In a recent Op-Ed article that appeared in the WSJ, the authors Arthur Laffer and Stephen Moore offer an interesting perspective on the potential impact of Trump tax bill’s cap on the deduction of state and local tax on the migration patters across the US. If what they are saying does in fact materialize, it could potentially be very beneficial for many multifamily markets.

According to the excerpt below, the authors expect New York and California residents to leave those states in droves:

“Now that the SALT subsidy is gone, how bad will it get for high-tax blue states? Very bad. We estimate, based on the historical relationship between tax rates and migration patterns, that both California and New York will lose on net about 800,000 residents over the next three years—roughly twice the number that left from 2014-16. Our calculations suggest that Connecticut, New Jersey and Minnesota combined will hemorrhage another roughly 500,000 people in the same period.”

The full article could be found here: https://www.wsj.com/articles/so-long-california-sayonara-new-york-1524611900

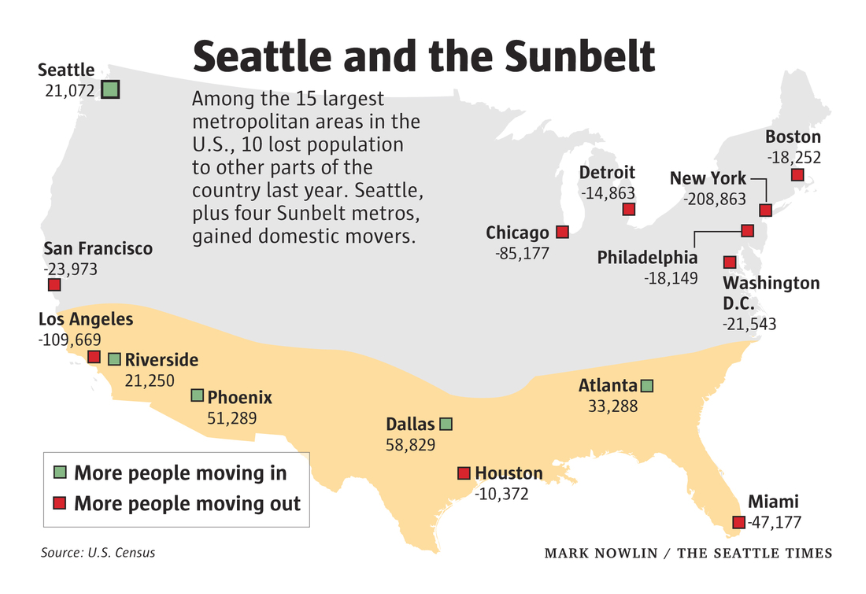

Another recent article in The Seattle Times https://www.seattletimes.com/seattle-news/data/seattle-just-one-of-5-big-metros-last-year-that-had-more-people-move-here-than-leave-census-data-show/ also talks about how people have been moving to the Sunbelt states (and now Seattle too) for years from New York, Los Angeles, Chicago and other large metros.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.