Let’s be real – wealth doesn’t simply materialize out of thin air. Building true prosperity requires the same grit, patience, and nurturing care as cultivating a flourishing garden. In this comprehensive guide, we’ll explore the parallels between botanical growth and financial growth, planting the seeds for you to blossom into a wise investor and steward of your assets.

Unlocking the Best Version of Yourself Through Investing

Investing starts small, like planting a tiny seed, and with a bit of care and patience, it can grow into something big and rewarding. It’s all about taking those first small steps, staying patient, and being consistent with your efforts, just like keeping a garden. This whole process is not just about making money; it’s a journey that teaches you discipline and helps you grow into your best self.

Investing: The Seed of Financial Greatness

All gardens sprout from tiny seeds full of potential, and your investment journey begins in much the same way – with that first modest contribution to a retirement account, that initial stock purchase, or those stray dollars stashed away. It’s from these unassuming origins that wealth has the opportunity to blossom if you stay dedicated to feeding and caring for that seedling of an investment.

During the Great Depression, a farmer started a little vegetable garden. From a few scrawny seedlings, he persistently cultivated and reinvested his harvests until that humble patch transformed into a verdant half-acre oasis that helped sustain his community for years. Whether nurturing plants or finances, the core principles remain the same: Start small, be diligent, and watch those compound gains flourish beyond your wildest dreams.

The Principles of Wise Investment

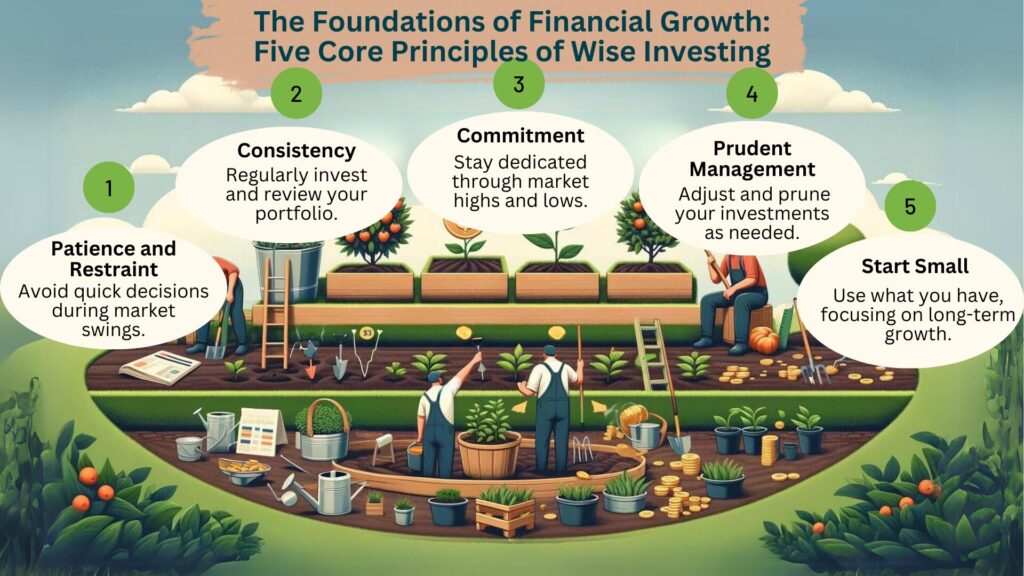

Much like an experienced gardener, the wise investor adheres to foundational tenets that have been proven to bear fruit many times over. First and foremost, practice patience and restraint. Ruining young seedlings by overwatering or tampering is the surest way to stunt their growth before they’ve even taken root. Investments demand a similar light touch – no rash decisions or panicked reactions to temporary market fluctuations.

Consistency and commitment are also paramount. A gardener doesn’t neglect their plot for weeks at a time, so why treat your investments with any less attentiveness? Make it a routine to monitor your portfolio’s progress, feed it with fresh contributions when possible, and proactively prune away any dead weight holding you back. Finally, start with what you have and let growth unfurl naturally through diligent nurturing over time. Seeds of wealth require immense patience to fully blossom.

Strategies for Nurturing Your Financial Portfolio

When it comes to growing your financial portfolio, think of it as tending to a diverse garden. Just like a smart gardener mixes up the plants to avoid disaster from a single pest or disease, smart investing means spreading your money across different types of investments. This approach, along with managing risks like the unexpected market downturns, helps ensure your money grows steadily over time, even when the financial climate gets tough.

Diversification: The Key to a Resilient Garden

Imagine a gardener planting only one type of crop – it would be utter madness! An unexpected blight or infestation could decimate their entire life’s work in one felled swoop. The savvy green thumb knows that biodiversity is key to any vegetable plot’s longevity and prosperity. The same philosophy extends to your financial portfolio – prudent investors know to spread assets across a variety of sectors, securities, and asset classes.

Sure, a portfolio heavily skewed toward tech stocks might have paid off during the late 90s dot-com boom, but what happens when the market inevitably shifts? A more judicious approach is to cultivate a lush blend of domestic and international equities, bonds, real estate, commodities or whatever asset mix aligns with your personal vision and risk tolerance. By nurturing this vibrant diversity upfront, you’ll be far better insulated against any one economy’s volatile growing season.

Click here to learn more and subscribe to the newsletter

Risk Management: Weathering Financial Storms

Even the most painstakingly cultivated garden carries inherent risks from droughts, infestations, freak frosts, and other unforeseeable forces of nature. That’s precisely why savvy gardeners take proactive measures like installing irrigation systems, curating hardy resilient crops, and erecting protective enclosures. Your investment advisory strategy should be no different – systematically planning for worst-case scenarios before they occur.

For example, seasoned investors are judicious about rebalancing their portfolio’s risk exposure as their life situation and retirement timeline evolves. They develop robust emergency funds capable of sustaining periods of famine. They investigate defensive tactics like hedging or options strategies to neutralize downside exposure. This pragmatic brand of stewardship ensures your financial garden can withstand any market climates and continue thriving for generations.

The Long-term Growth Perspective

Investing isn’t just about putting money into stocks or bonds; it’s equally about investing in yourself. By improving your skills, knowledge, and overall well-being, you’re planting seeds for future financial success and personal fulfillment. Just as a gardener learns more from getting their hands dirty than just reading about it, real growth comes from actively working on yourself. And just like in gardening, the key to a fruitful investment, whether it’s in assets or in yourself, is patience and persistence. Rushing for quick gains often leads to failure, but steady, consistent efforts lead to lasting wealth and satisfaction.

Investing in Yourself: The Ultimate Asset

Of course, probably the wisest form of investment is the fertilizer you provide your own personal growth. Too often we conceptualize our assets as being solely monetary when our knowledge, skills, and well-being are just as vital to compounding our wealth over time. That timeless axiom of being “green-thumbed” – it doesn’t emerge from reading horticulture books, but from a devotion to consistently tending your own garden through years of hands-on experience.

In precisely the same way, making that conscious choice to upskill yourself through classes, certifications, building side income streams – these are profound ways of enriching the soil from which tomorrow’s prosperity blooms. Investments in your mind, body, and spirit yield infinite dividends, both pecuniary and philosophical. Nurture these most precious assets and very quickly you’ll find opportunities for abundance flowering from every direction.

Get your free “2024 Real Estate Market Outlook” now!

Patience and Persistence: The Fruits of Long-term Investment

For all the agricultural metaphors, the most critical parallel between gardening and investing is the pivotal role that patience plays. Simply put, rushed growth is unsustainable and hardy returns take dedicated years to cultivate. We’ve all seen the fool’s errand of those desperate to get-rich-quick or obsessed with chasing faddish earnings – that path is a surefire way to wither on the vine before you ever ripen into true wealth.

No, the wisest investors recognize compounding interest as the eighth wonder of the modern world. By methodically sowing the seeds of their portfolio through calculated contributions year over year, prudent hands stay the course while their investments germinate into a harvest worth reaping come retirement season. It’s never about shortcuts or slashing corners but holding unwavering focus on your end goals through consistent, persistent care over the ultra long-haul. That basic brand of disciplined patience birthed every self-made fortune in history – your prosperity will be no exception.

Conclusion

True wealth means so much more than amassing vast monetary riches – it represents living each day abundantly as the fullest version of yourself. This transformative guide has illuminated how the ancient art of gardening encapsulates that same eternal pursuit of prosperity and self-actualization through perpetual nurturing.

So embrace your role as a financial green thumb. Stay dedicated to tilling the fertile soil of your own talents and insights. Carefully research before sowing any new investment seed. Feed your crop patience and wisdom while relentlessly pruning away vice and temptation. And above all else, trust that your diligent commitment to growth, even during famine’s harsh seasons, will one day culminate in a bountiful harvest of abundance beyond measure.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.