The country is adjusting to the news that Donald Trump is heading back to the White House, and Washington, D.C.’s commercial real estate scene is bracing for a rollercoaster of change. While most of the attention remains on national policies and political shifts, the impact on the local real estate market is becoming impossible to overlook.

But for a city so inextricably linked with federal operations, the Trump administration’s priorities will prove hugely influential over the commercial landscape of the District. From workforce policies to architectural mandates, the next four years could be shaping up to be a sea change for landlords, tenants, and investors alike.

Federal Workforce Plans: Biggest Question Mark

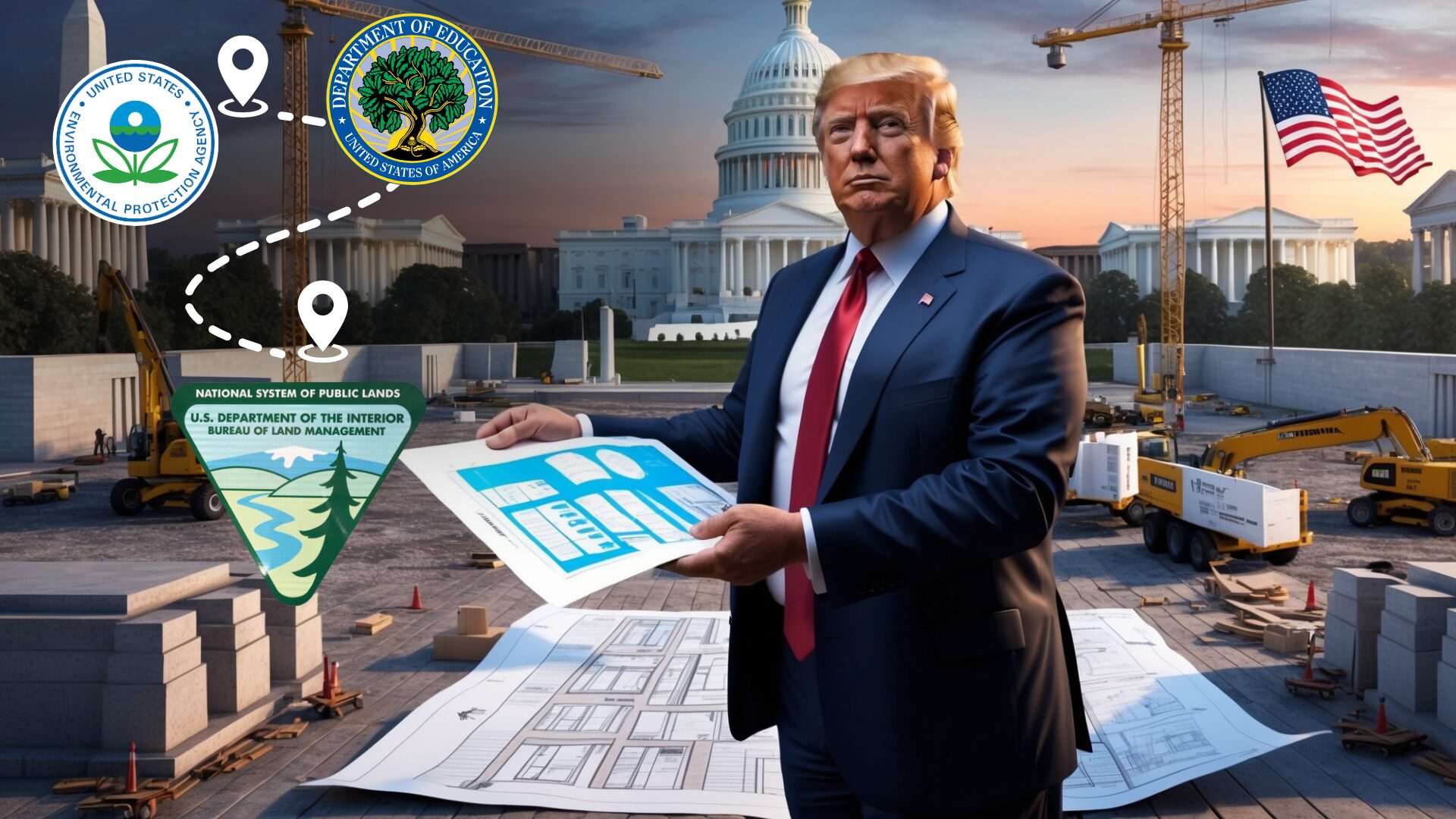

But the centerpiece of the uncertainty is what Trump will do with the federal workforce: His first term saw the relocation of agencies like the Bureau of Land Management from D.C., and speculation abounds that he could further press that button on decentralization. If Trump were able to move more federal agencies into other states, the impact on local landlords would be immense: fewer agencies in the District means fewer tenants, which means less leverage in demand for office space.

But deeper cuts are potentially looming even larger. Trump previously has floated reducing dramatically, or even eliminating, agencies such as the Environmental Protection Agency and the Department of Education. Such a move would have ripples beyond empty offices into the local real estate market, as fewer federal workers would be living, shopping and dining in the city.

The Push for In-Person Work: A Double-Edged Sword

On the other hand, Trump’s adherence to forcing workers into the office could be a saving grace for commercial landlords. If federal workers have to go to the office five days per week, demand for the office space might flatten or even rise. This might give life to the surrounding businesses that depend on foot traffic from those office workers: cafes, dry cleaners, and local shops.

Yet, any such gains from a return-to-office policy might be offset by an overall contraction in the size of the federal workforce. Fuller offices would help landlords regain some of the revenue lost when so many employees started working remotely during the pandemic. But the broader hit to the economy by fewer federal employees would make this more of a delicate balancing act.

Click here to learn more and subscribe to the newsletter

Architectural Mandates and Local Governance: What Else Is at Stake?

Beyond workforce dynamics, Trump’s influence could extend to other corners of D.C. real estate: during his first term, he issued an executive order promoting classical architecture for federal buildings-a move that was attacked and defended with equal passion. While the Biden administration rescinded that order, Trump’s return to the city might bring it-again-along with him, shaping future federal building projects in the District.

And then, of course, there’s Trump’s prior expressed interest in trying to take a more active hand over local government in the Capital City. A move like that would probably reduce the mayor and city council to secondary status as well – well that could make local decision-making on zoning, development and other real estate issues increasingly knotty.

What does that mean for investors?

Trump’s second term means a mix of clarity and uncertainty for real estate investors. On one hand, knowing who leads the White House does give some predictability. On the other hand, depending on their breadth and scope, specific policies he enacts may help or hurt the local market.

This could be a risk with big workforce cuts, but a push to in-person work and strong economic activity in some areas could balance out. A case on either side will mean investors still have to remain flexible and move with the changes that come.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

A Roller Coaster Ahead for D.C. Real Estate

In the short term, the next four years are shaping up for one heck of a ride in Washington, D.C.’s real estate market. Whether growth or setbacks characterize Trump’s policies for the local economy depends on how his respective plans for the federal work force, office spaces, and local governance actually shake out. For the time being, District landlords, businesses and investors will need to remain highly attentive and stay tuned for an environment that could shift significantly under Trump. While some changes may open new doors, others could create significant hurdles for D.C.’s real estate market.

*This article is based on publicly available sources and is intended for informational purposes only. We do not claim ownership of the content used and encourage readers to refer to the original materials from their respective authors.

Follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

* Disclaimer: The content provided on this website is intended for educational and informational purposes only and does not constitute investment, financial, or tax advice. We strongly recommend that you consult with qualified professionals before making any financial decisions. Past performance of investments is not indicative of future results. The information presented here is not a solicitation or offer to buy or sell any securities or investments. Our firm may have conflicts of interest, and we do not guarantee the accuracy or timeliness of the content provided. Investing involves risks, and you should carefully consider your financial situation and consult with a financial advisor.