If you’re looking to become debt-free once and for all, the debt snowball method may be the solution you need. This powerful debt reduction strategy can help you pay off debt faster than you ever thought possible.

How the Debt Snowball Method Works

The debt snowball, sometimes called the debt avalanche, is all about attacking your debts in a specific order – from smallest balance to largest – so you can pick up momentum and motivation as you knock out each one.

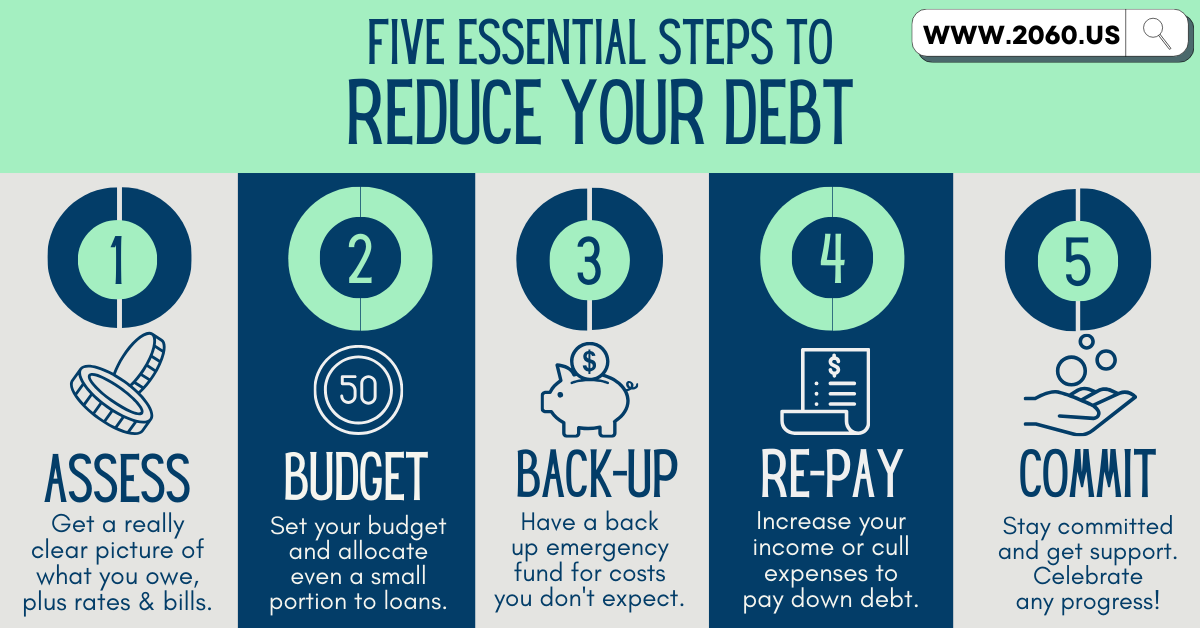

Here’s a quick rundown of the step-by-step process:

Step 1: List Debts Smallest to Largest

Make a list of all your debts from the smallest outstanding balance to the largest. Do this regardless of interest rate. The idea here is to line up some quick “wins” attacking smaller debts first to build confidence.

Step 2: Pay Minimums on All Debts Except the Smallest

Continue making minimum payments on all debts as required, except the one at the very top of your list (the smallest balance). That one will get special treatment.

Step 3: Apply Extra Money to Smallest Debt

Throw every extra dollar you can possibly find at that smallest debt while still making minimums on the others. Get intense about cutting expenses temporarily if needed to apply as much money against that first debt as possible.

Step 4: Repeat Until Debt Free

Once the first (and smallest) debt is eliminated completely, take that payment amount and apply it to the next smallest debt. Repeat the process – minimum payments plus all available extra money attacking one debt at a time – until you are 100% debt free!

Click here to learn more and subscribe to the newsletter

Why the Debt Snowball Works

The debt snowball method is so effective because it utilizes both math and psychology to create an approach you can stick to. It recognizes that getting out of debt is just as much (if not more) about changing your financial behaviors and beliefs as it is about raw numbers.

When you attack your debts starting with the smallest balances first, you set yourself up for those quick “wins” knocking out debts one by one. This builds confidence and momentum to keep charging forward. With each debt you eliminate entirely, you’ll have more money freed up each month to throw at the next target.

Over time, it creates a snowball effect, rolling faster and faster towards becoming 100% debt-free. The sense of progress is a powerful motivator to help you stick to the plan.

The Science Behind Small Wins

Research has shown that achieving smaller, reachable goals consistently is key to staying motivated over the long haul. The debt snowball taps into this by lining up those sure-thing early victories.

As you experience accomplishment after accomplishment clearing debts, belief in your ability to get out of debt grows. You start taking bolder and bolder actions to make it happen. In this way, success builds upon success until escaping debt becomes inevitable!

What About Interest Rates?

Some financial experts argue that the mathematically optimal way to pay off debt is by focusing on interest rates rather than balances. This strategy is known as the debt avalanche method.

The logic is that eliminating high interest rate debts first will save you the most money in interest payments over time. However, this approach also has downsides:

Lack of Early Wins

Paying off debts strictly by interest rate often means tackling larger, long-term debts like student loans and mortgages first. This means you likely won’t have any debts completely paid off for quite some time.

Without those quick initial wins from eliminating debts, it can be harder to stay motivated. Meanwhile, smaller credit card and consumer debts linger untouched draining your finances with interest for longer.

Higher Chance of Backsliding

Because progress seems slower prioritizing by interest rate, there is greater temptation to backslide into old bad habits. If you lose motivation, you may stop applying extra payments and fall behind altogether.

The debt snowball helps avoid this fate by building self-confidence through targeted early wins. You develop positive momentum making each debt that much easier to knock out. This energy makes you unstoppable on your journey to become debt-free!

Get your free “2024 Real Estate Market Outlook” now!

A Debt Snowball Example

Seeing a practical example can help demonstrate the power of the debt snowball method. Let’s walk through a hypothetical scenario with four debts:

$500 – Medical Bill—$50 payment

$2,500 – Credit Card Debt— $63 payment

$7,000 – Car Loan— $135 payment

$10,000 – Student Loan— $96 payment

Using the debt snowball system, we would:

Step 1: List Smallest to Largest

$500 Medical Bill

$2,500 Credit Card

$7,000 Car Loan

$10,000 Student Loan

Step 2: Pay Minimums on All Except Medical Bill

Minimum payments would continue on the credit card, auto loan, and student loan while putting as much money as possible towards the medical bill.

Step 3: Attack Debts One by One

Once the medical bill is paid off entirely, roll that money into paying off the credit card balance. Then the auto loan, and finally the student loan. Like a snowball rolling downhill, the payment amount grows with each debt eliminated!

Let’s say there is an extra $500 per month available to put towards debts above the minimum payments. In this case, the medical bill would be gone in Month 1.

The credit card balance would be paid by Month 5, the auto loan by Month 14. And with consistency, even the student loan could be paid off just 2 years after starting!

The debt snowball creates rapid momentum, helping you become debt-free faster than you may think possible!

The Debt Snowball is The Best Approach

When it comes to paying off debt quickly and efficiently, the debt snowball method is hands-down the most effective strategy for most people. Even with the mathematical benefit of focusing on high-interest debt first, the behavioral and psychological boost of the debt snowball makes it easier to stick to.

And often, success comes down to simply taking action consistently over time.

Changing Financial Behaviors

At its core, getting out of debt requires changing financial habits and attitudes. The debt snowball builds positive momentum by showing you are capable of making progress towards your goal.

As you repeat the simple process of eliminating one small debt after another, it reprograms the way you think about debt payoff. Before you know it, you start acting like a person who was meant to be debt-free!

Staying Motivated For the Long Haul

Paying off significant debt takes most people months if not years of dedication. With so much time between the start and the debt-free finish line, it takes serious motivation not to backslide into old ways.

The debt snowball includes built-in milestones that reinforce your willingness to stay the course. Tiny wins add up to unbelievable progress when you stick to the plan!

So if quick wins and steady momentum sound good to you, give the debt snowball a try. It could be exactly what you need to escape debt forever!

Take Control of Your Debt

If debt feels like it has a grip on your finances and is holding you back from living the life you want, it may be time to take action. The debt snowball method provides a straightforward way to take back control.

By listing out all debts smallest to largest and attacking them one by one with focused intensity, you can leverage momentum and motivation to become debt-free faster than you thought possible.

The satisfaction of eliminating debt after debt frees up more and more of your hard-earned money to use toward other financial goals or just enjoying life.

Rather than feeling ashamed or overwhelmed by debt, take pride in the fact that you are facing the issue head on. Use the debt snowball to prove to yourself that you can accomplish amazing financial feats through consistency and discipline.

The path to financial freedom starts by taking that first step towards better money habits. Implementing the debt snowball puts you on the fast track to escape debt forever!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.