When it comes to saving for retirement, you’re the master of your own financial ship—the burden is on you to properly set aside enough money to sail smoothly into your golden years. And if you’ve been following the trusted advice, that means stashing away 15% of your income each year into tax-advantaged accounts like 401(k)s and IRAs.

But let’s say you’re raking in the really big bucks—we’re talking CEO or other high-income earner territory. In that case, maxing out those retirement accounts is great, but it won’t get you anywhere close to that 15% target given your sizeable income. You’ve got a good “problem” on your hands.

So does that mean you’re stuck just pumping money into those tax-favored plans and calling it a day? Not a chance! There are plenty of additional investment vehicles you can utilize to keep putting your hard-earned cash to work. But before we get to those, let’s hit the pause button for a second.

Building up a retirement fund is a key step in a proven financial strategy that outlines a path to creating and maintaining wealth. This step comes after clearing non-mortgage debt and establishing a solid emergency fund. Those who adhere to this plan might achieve a net worth in the millions after roughly two decades.

This strategy works regardless of whether you have a modest income or a high salary. Considering this, here are five effective investment options for high-earners:

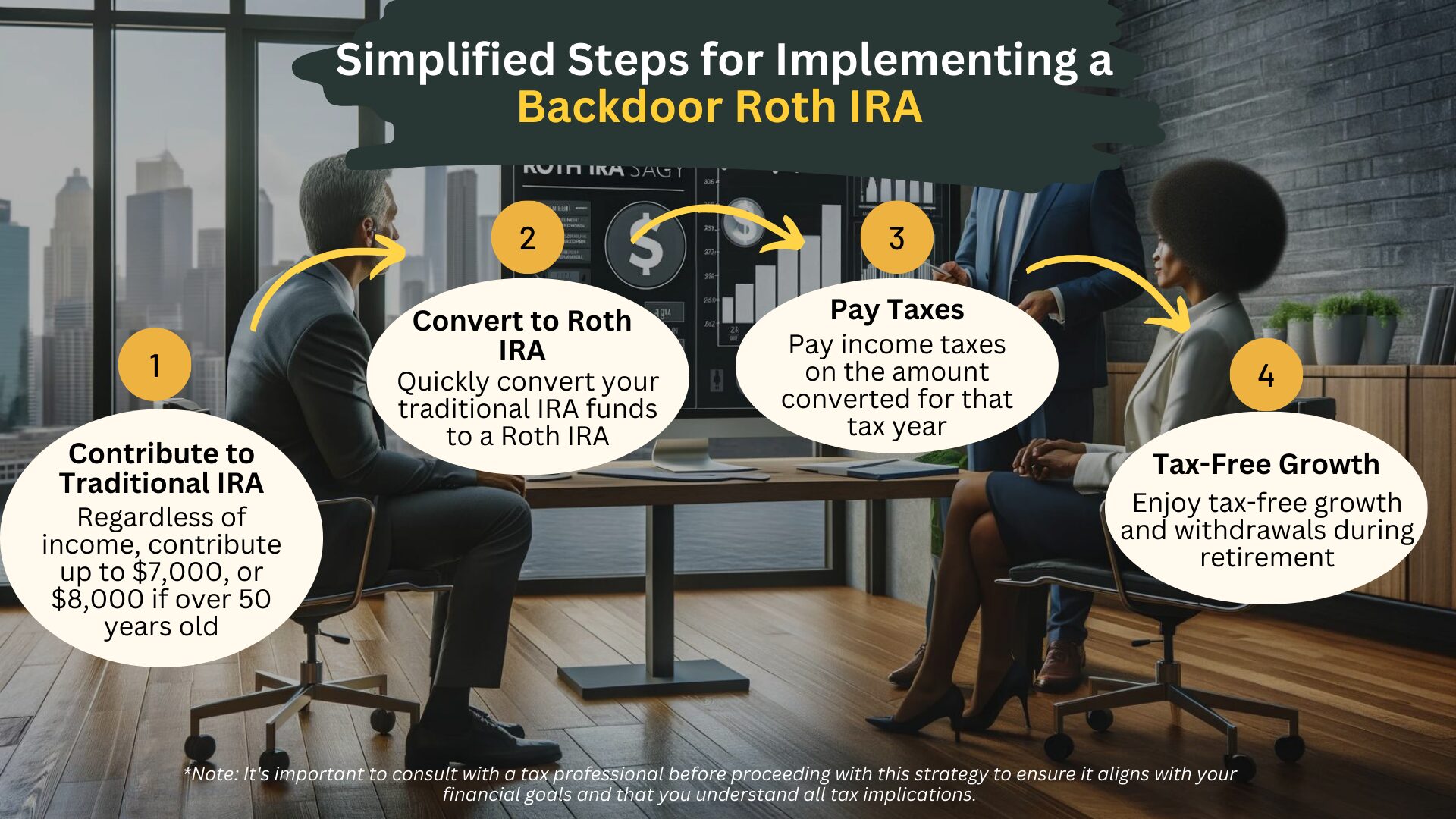

1. Backdoor Roth IRA

This strategy allows you to bypass the income limits on contributing to a Roth IRA (for 2024, that’s $161,000 for individuals and $240,000 for couples). Here’s how it works: First, you put money into a traditional IRA (up to $7,000 or $8,000 if over 50). Then, shortly after, you convert that traditional IRA into a Roth IRA.

The catch? You’ll have to pay taxes upfront on the converted amount. But from that point forward, your money can grow 100% tax-free. Come retirement, you can withdraw funds without owing Uncle Sam a single cent! You can also convert existing IRAs like SEPs or SIMPLEs, but be ready for a potential whopper of a tax bill.

As with any major money move, make sure to run this by a tax pro first. But when executed properly, the backdoor Roth is a fantastic way for high-earners to bypass income limits and score awesome tax-free growth.

Pros of Investing in a Backdoor Roth IRA:

– No income restrictions – everyone can take advantage of this strategy

– Tax-free growth and withdrawals in retirement

– Ability to contribute and convert funds annually

Cons of Investing in a Backdoor Roth IRA:

– Income taxes due on contributions and conversions

– Relatively low annual contribution limits

– Potential for higher taxes if converting in a high income year

2. Health Savings Account

If you’ve got a high-deductible healthcare plan, you can triple-dip into tax savings with a Health Savings Account (HSA). In the short term, an HSA allows you to squirrel away pre-tax dollars to cover any out-of-pocket medical costs that may pop up. Your contributions go in tax-free and can be withdrawn tax-free as long as they’re used for qualified healthcare expenses.

But here’s where it gets really juicy: The HSA can also be turbocharged as a long-term investment account for healthcare costs down the road. Once you’ve built up a reasonable balance (typically $1,000 to $2,000), you can invest the rest for tax-free growth potential—just like you would in an IRA.

With medical costs for retirees now averaging over $300,000 per couple, being able to access those invested HSA funds tax-free in retirement is huge. Spend it on healthcare and it’s all tax-free money. Take distributions for non-medical reasons after 65 and you’ll owe income tax, similar to a traditional IRA. But either way, being able to invest long-term for upcoming medical bills is wildly advantageous.

The only catch? Those pesky annual contribution limits. For 2024, you can sock away up to $4,150 if single or $8,300 for families. Not too shabby!

Pros of Investing in an HSA:

– Triple tax advantage: pre-tax contributions, tax-free growth, tax-free withdrawals for qualified expenses

– Build up funds to cover future medical costs in retirement

– No RMDs, you withdraw on your own schedule

– Invest for growth just like a traditional IRA

Cons of Investing in an HSA:

– Cannot contribute once enrolled in Medicare

– Relatively low annual contribution limits

– Still need to budget for other retirement expenses beyond healthcare

Click here to learn more and subscribe to the newsletter

3. After-Tax 401(k) Contributions

Here’s an under-the-radar strategy that can help supercharge your 401(k): After maxing out your $23,000 pre-tax contribution limit (or $30,500 if over 50), some employers allow you to then make additional after-tax contributions. For 2024, the total cap on contributions is $69,000 ($76,500 if over 50) including any employer match.

Let’s say you max out that pre-tax $23,000, and your employer kicks in a $5,000 match—that’s $28,000 right there. You could then contribute up to an additional $41,000 in after-tax money to your 401(k). Down the road, you can transfer those after-tax dollars directly into a Roth IRA, where they’ll continue growing tax-free from that point on.

It’s not the simplest strategy, but the ability to automatically funnel extra money into a tax-advantaged account each paycheck can be a huge wealth-builder over time. Just make sure to prioritize maxing out all other retirement accounts first before looking into after-tax 401(k) contributions.

Pros of After-Tax 401(k) Contributions:

– Automated payroll deductions make saving easy

– Invest in the same funds as your tax-deferred 401(k) money

– Keep all retirement savings centralized in one account

Cons of After-Tax 401(k) Contributions:

– No upfront tax deduction on those additional contributions

– Still subject to annual limits on total 401(k) contributions

Get your free “2024 Real Estate Market Outlook” now!

4. Brokerage Accounts

Alright, say you’ve maxed out every other retirement account under the sun and you’ve still got surplus money to invest—where to put it? Enter the good ol’ brokerage account (also called a taxable investment account).

With one of these babies, you can invest in basically any type of security out there—stocks, bonds, mutual funds, ETFs, you name it. And unlike with retirement accounts, you won’t face any annual contribution limits or income restrictions. The drawback is that you’ll owe taxes annually on investment income like dividends, interest, and realized capital gains. But letting excess cash just sit in a bank account earning 0.01% interest is arguably an even bigger wealth killer.

The flexibility of a brokerage account also can’t be beaten. There are no early withdrawal penalties or required minimum distributions to worry about. You can pull money out whenever you need it without the IRS smacking you with fees. For high-earners who may want to retire early or have unpredictable income streams, that flexibility is golden.

Pros of Investing in a Brokerage Account:

– No annual contribution limits

– Complete investment flexibility with any stocks, funds, etc.

– No RMDs or early withdrawal penalties

– Build diversified taxable portfolio alongside retirement funds

Cons of Investing in a Brokerage Account:

– Owe annual taxes on investment income and gains

– Assets not protected from creditors like in retirement accounts

– Miss out on upfront tax deductions from retirement contributions

5. Real Estate

For those with the risk tolerance and real estate bug, income-producing properties like residential or commercial rentals can be an amazing source of ongoing monthly cashflow…when executed properly. With time and positive leverage, the right properties can significantly appreciate in value as well.

Similarly, investing in land in up-and-coming areas can be a smart long-term wealth-builder. But let’s be crystal clear: real estate investing is far from passive. Being a landlord is basically a second job filled with maintenance headaches, problem tenants, and months of vacant properties. You’d better have a genuine passion for real estate before going this route.

There’s also no getting around the upfront investment and carrying costs. You should only buy properties with 100% cash—no mortgages. And don’t forget to factor in additional expenses like insurance on top of routine maintenance and repairs. When you run the numbers, the real estate profits may not seem so lucrative after all.

The bottom line is that real estate done right has the potential to be wildly profitable, but it’s far from a turnkey investment for generating passive income. Know what you’re getting yourself into before taking the plunge!

Pros of Investing in Real Estate:

– Tried-and-true investment for income and appreciation

– Diversify your portfolio away from just stocks/bonds

– Leverage and cash flow potential

Cons of Investing in Real Estate:

– Time consuming, actively managing properties

– Vacant periods with no rental income

– Values can fluctuate based on location factors

– Need sizable upfront capital for cash purchases

Conclusion

No matter how high your income climbs, the key to building lasting wealth is putting your money to work through smart, diverse investments. As a high-earner, you have the remarkable opportunity to supercharge your growth by taking full advantage of tax-advantaged accounts and strategies that most can only dream about.

From the backdoor Roth IRA to Health Savings Accounts, after-tax 401(k) contributions and regular brokerage accounts, there’s no shortage of powerful vehicles to complement your traditional retirement funds. For those willing to take on more hands-on work, real estate investing offers an avenue for potential cash flow and appreciation as well.

The right approach, as always, begins with the fundamentals – being debt-free, having cash reserves, and prioritizing maximum contributions to tax-advantaged plans before exploring other options. From there, carefully evaluate each opportunity through the lens of your specific financial situation, risk tolerance, and overall wealth-building strategy.

Because at the end of the day, no matter how you accumulated your wealth, achieving true financial freedom requires diligent planning and a commitment to making your money work as hard as you did to earn it in the first place. Make the most of the investment options available, and your high income can be leveraged into an empire of lasting wealth.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.