Alright, listen up folks – purchasing raw land is no walk in the park. It’s a whole different ball game compared to buying a residential property where you can simply back out if something doesn’t check out during that short inspection period. Nope, when you close on a land purchase, you’re in it for the long haul – potential problems, pitfalls, and all.

That’s why doing your due diligence upfront is absolutely crucial for land deals, folks. You’ve gotta roll up those sleeves and get elbow-deep in research before taking the plunge. Cutting corners on the front end is just asking for trouble down the road. Proper investigation is your saving grace, shielding you from making a catastrophic, wallet-busting mistake that could leave you stuck with a total lemon of a property.

So, what exactly should this all-important due diligence process entail when you’re scoping out that prime piece of land, you ask? Grab a seat and a fresh brew, because we’re about to dive into the nitty-gritty details.

Protecting Interests Through Contract Provisions

First thing’s first, you’ve gotta make sure that purchase contract works in your favor by giving you ample time to conduct thorough due diligence, folks. Don’t let those sellers try to back you into an unrealistically tight closing deadline. Trying to cram all that research into a shortened timeline is just begging for crucial red flags to slip through the cracks, trust me.

I’m talking about aiming for terms that afford you at least 30-60 days to comb through that property with a fine-tooth comb, every nook and cranny. Sure, sellers might push back on offering an extended diligence period, but you’ve gotta stand your ground on this one, folks. That extra 2-4 weeks could end up saving you tens or even hundreds of thousands of hard-earned dollars by avoiding a botched deal. It’s worth it, believe me.

Oh, and make sure the contract stipulates timely delivery of all relevant property documentation from the seller, too. We’re talking title reports, surveys, easements, leases, tax and assessment history, appraisals – anything and everything that can provide useful background on exactly what you’re purchasing.

Don’t just take the seller’s attorney’s word for it, either, folks. With vacant land, ownership interests can get murkier than a backwoods swamp, especially if that property has been passed down through the generations like an old family heirloom. You want to confirm, beyond a shadow of a doubt, that you have a crystal clear picture of who actually has a legitimate claim to the land you’re buying.

Click here to learn more and subscribe to the newsletter

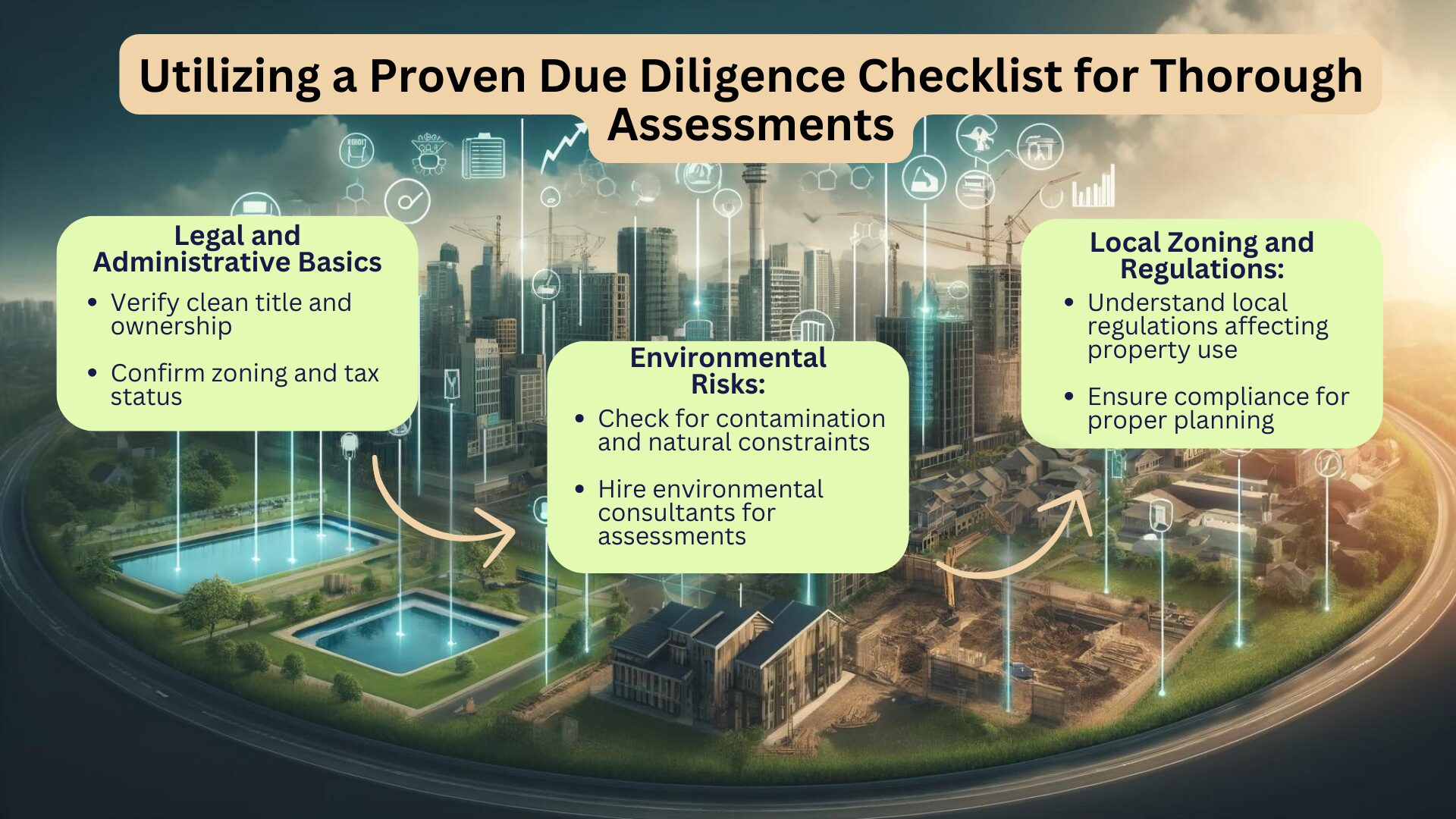

Utilizing a Proven Due Diligence Checklist for Thorough Assessments

Listen, due diligence for land gets complex in a hurry, folks. I’m talking Russian-novel levels of complexity real quick. Working without a comprehensive, all-encompassing checklist is just asking for oversights and mistakes to slip through the cracks. You absolutely, positively need one to make sure you methodically cover all your bases, every single time – no exceptions.

Covering the Legal and Administrative Basics

Start by running through the basic legal and administrative due diligence to confirm the property checks out on paper, nice and clean. Verify clean title, ownership interests, proper zoning classification, tax status, and all those nitty-gritty details. It might not be the most glamorous work in the world, but trust me folks, it’s exceedingly necessary groundwork.

Assessing Environmental Risks and Natural Constraints

From there, you’ve gotta look at potential environmental risks with a magnifying glass, folks. I’m not just talking obvious contamination risks, either – although that’s definitely part of it if the property has any history of commercial or industrial use. Past activities like gas stations, chemical storage or waste dumping can leave behind impacts that’ll come back to bite you if you’re not careful.

No, you’ve also gotta be aware of the natural features of the land itself that could throw a wrench in your plans, stuff like wetlands, flood zones, or endangered species habitats. Those kinds of elements can seriously dictate what you’re legally allowed to do on that site, so you’ve gotta tread very, very carefully and bring in the big gun environmental consultants to assess every potential issue.

Speaking of legal limitations, you’d better believe local zoning codes and development regulations are gonna have an enormous influence over what you can and can’t do on that property, folks…

Evaluate Development Feasibility

Once you’ve got a solid grasp on what you legally can and can’t do on that property, it’s time to dive deep into the numbers, folks. You’ve gotta crunch ’em to determine if your conceptual plans for that land investment or development actually pencil out in reality, or if you’re just chasing pipe dreams.

I’m talking carefully considering every little detail that could make or break your project’s success: access roads, utility availability, topography and grade, total buildable area, target market conditions, traffic impacts, proximity to amenities – you name it. Be mentally prepared to pivot your plans, too, because the realities on the ground often force changes as you learn more about the property’s constraints and limitations. Flexibility is absolutely key in this game, folks.

If you’re new to land development, do yourself a favor and lean on some experienced consultants or developers to provide that all-important feasibility expertise, too. Their insights could just save you from costly mistakes and poor judgments. Few investments provide a higher ROI than expert guidance from folks who’ve been there and done that.

And at the end of the day, let’s be real – it all comes down to profits, doesn’t it folks? You’ve gotta run the numbers to ensure the financials actually work and make economic sense for pursuing that investment or development project. Build out detailed projections analyzing anticipated revenues, construction costs, professional fees, carrying costs, entitlement expenses, and every other monetary factor that’ll determine whether you turn a profit or take a loss.

Be conservative with those projections, too. This is no time for pie-in-the-sky best case scenarios, folks. You’ve gotta crunch the numbers with a critical eye and keep laser-focused on the bottom line. If the deal doesn’t make sound financial sense, no amount of dream-selling from brokers should convince you to pull the trigger. Trust your diligence, not their hype.

Get your free “2024 Real Estate Market Outlook” now!

Conclusion

The bottom line here is that mistakes with land can carry incredible costs, folks – I’m talking potentially losing your shirt and then some on a bad investment or development deal. That’s why having an experienced real estate consultant in your corner is an absolute must, even if it means dishing out some cash upfront for their expertise.

Listen, land deals have more nuance and hair-pulling complexity than a Scottish reel, folks. Don’t kid yourselves into thinking you can DIY the due diligence process, especially if you’re new to working with vacant land sites and all their intricacies. Let the seasoned pros handle that heavy lifting and provide the in-the-trenches insights you need to make smart, profitable business decisions with confidence.

In this game, paying a few thousand bucks for quality consulting from the right guide can deliver an ROI higher than the stratosphere compared to going it alone – trust me on this one, folks.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.