As we are going into a 3rd month of the global pandemic we wanted to offer some statistics and thoughts on what has been happening in the world of multifamily. Below are a few of our observations concerning the performance of multifamily as an asset class during COVID-19 crisis, current market activity and what the future holds.

How to Get Started in Multifamily Real Estate Business

Long story short, multifamily is proving itself, at least for now, as a very resilient asset class yet again. In the end of March, multifamily operators across the country were bracing for the worst and expecting painfully high delinquencies in April. Based on the many conversations that were had at the time, the expectation was that Class C properties could have delinquency rates as high as 40-50% (high exposure to service sector jobs, very low/non-existent savings and moral hazard resulting from many states halting evictions), Class B was expected to show 25-30% delinquency rate. Instead, things turned out way better than that. Most Class B properties collected 97%+ of the rents billed (in many cases 100%), Class C – depending on the location and other factors – mostly 85%-95%. See the National Multifamily Housing Council’s chart on April rent collections:

May collections are similarly strong and better than April. Delinquencies are indeed materially higher (on a relative, not absolute basis), but not nearly as bad as market participants anticipated. Other trends we see:

- Lower turnover as less people are moving during COVID-19

- Many operators have no rent increases on lease renewals (location dependent)

- Negative rent growth on new leases for many operators – location and property-Class dependent. Some data points from public REITs on April rent growth: Camden: -2.5%, MAA: -3.3%, Equity Residential: -4%, Nexpoint: -1.65%

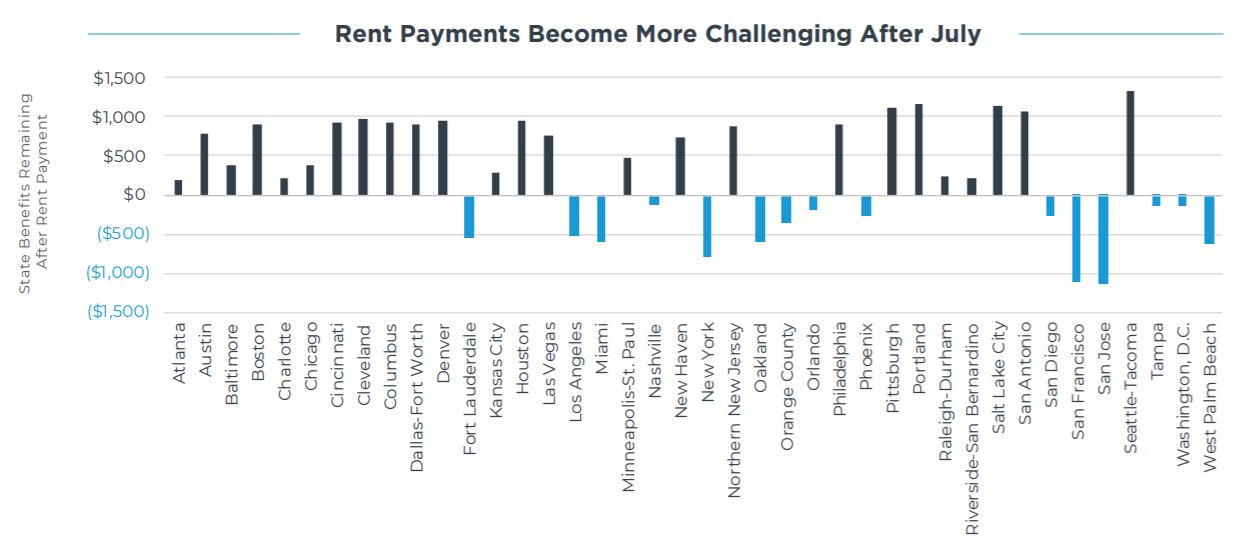

So far so good – the situation has not become a complete meltdown as many feared. However, is this sustainable? Rent collections have been strong, in large part, due to state and government programs providing unemployment benefits. Under the CARES act, those receiving state unemployment benefits are entitled to $600 per week in expanded unemployment compensation through July 31st. But what happens once federal benefits stop at the end of July? Below is the chart for 40 major metros showing how much in state benefits will be remaining per tenant, after rent payment, once (and if) $600 federal benefits stop (and you can click here for the link to the source):

Tenants’ ability to pay rent will change materially after July. Will federal benefits be extended? Will we see a sharp drop in collections in August/September? It is too early to tell. But if I personally had to bet, I would bet on continued government support. Politically, it is too risky to pull the plug too early.

Market Activity

Based on our observations and frequent conversations with commercial brokers, the transaction activity is currently on hold. In person property tours are not yet possible in many locations. There is very little inventory on the market. The sellers are being advised to wait till more clarity exists on the operational front and they haven’t yet adjusted their pricing expectation. As such, there is a significant bid-ask spread currently since many multifamily buyers still have capital and willingness to deploy it but initially were looking for substantial discounts of 20-30% to pre-COVID-19 prices. Those few deals that we do see have listing prices that don’t reflect any discount at all. Sellers that might be forced to sell – most likely those with bridge loans maturing next year – are not there yet either.The vast majority of multifamily owners are still cash flow positive and are unlikely to become forced sellers unless they face near-term maturities.

On the financing side, getting credit is a bit more challenging today, with Fannie and Freddie requiring lower LTVs (hence, higher downpayments from equity investors) and higher debt service escrow requirements of 6-18 months, which results in higher upfront investment by the multifamily buyers and hence also affects valuations.

In term of capitalization rates, there have not been a lot of transactions and data points to look to, however I would not be shocked if after the dust settles, the cap rates are same or lower. Why? Cap rates are a function of interest rates and risk premiums. Interest rates today are lower than pre-COVID-19 and as for risk premiums, multifamily is still one of the most resilient property types, the most predictable property types, provides inflation hedge and looks attractive on a risk/reward basis vs stocks and bonds.

Our Thoughts

My own thinking is that the smartest thing to do right now is to wait, watch and observe. I am a proponent of “active waiting” – staying on top of the market, regularly speaking with brokers and lenders, watching market trends and continuing to underwrite deals that meet our initial investment criteria – and making offers if those make sense. In terms of pricing expectations, we don’t expect an Armageddon scenario and 30% discounts. While not immune to the recession, Multifamily so far has proven to be rather resilient and on a relative basis still compares quite favorably to the paper assets. Still, it seems to us that due to lower NOIs and more challenging credit terms, some price adjustment is likely to take place by the end of the year, once market participants have more data to digest and adjust to new reality. I would be happy with 5-10% discounts on the assets in strong markets.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.