For most people, their first residence is far from their perfect home. At first, it seems nice enough. But over time as your family grows, starter houses tend to feel cramped.

However, don’t resent your current shelter too much. While it has provided you and your family a safe roof over your heads, it has also set you up to own your dream house someday.

We’ll explain the process that can get you into the home you’ve always envisioned for your family—one you can genuinely afford!

But before we elaborate on those steps, let’s review the financial essentials you’ll need to address first to ensure your dream home is a blessing, not a burden.

What Are the Key Financial Prerequisites?

First things first–you must eliminate debt, implement a budget, and amass an emergency fund containing 3-6 months worth of expenses. Sound fundamental, right? If you haven’t finished these actions, you’re not prepared to upgrade to your dream home yet.

When you have a raging case of house fever, it can be tempting to prioritize paying off liabilities or stockpiling emergency savings. Especially when feeling strained by rising housing prices and interest rates.

But whether it’s your second or third residence, you should only invest in a home after covering the financial essentials we listed above. That’s when you’ll be equipped to embark on the journey toward owning your dream dwelling.

And that voyage starts with your home equity. What exactly is equity? Well, we’re pleased you asked…that escorts us to step one.

Step 1: Evaluate Your Home Equity

Home equity denotes your current residence’s value minus whatever sum remains on your mortgage.

In most situations, your home’s value inflates over time. Like other long-standing investments (such as retirement accounts), homes steadily appreciate in worth. There have been eras of ups and downs in the market, but real estate values have reliably ascended. As your home becomes more valuable, so does your equity through a process dubbed appreciation in real estate terminology.

Additional influences that boost your home’s equity include:

– Home improvements – Adding square footage, modernizing fixtures/appliances, or simply applying a fresh coat of paint can heighten your home’s value.

– Mortgage paydown – Accelerating debt elimination also constructs equity. The less you owe, the more equity you retain.

The quantity of equity you possess indicates how much money you’ll likely net after vending your house. You can harness those funds to make a sizable down payment and finance other expenses accompanying the home acquisition process.

So how do you gauge your home’s current value? You can obtain a ballpark estimate on real estate websites like Zillow or request a competitive market analysis from a trusted real estate agent. Or you can seek a professional appraisal.

Determining your home’s equity necessitates some math, but it’s basic arithmetic.

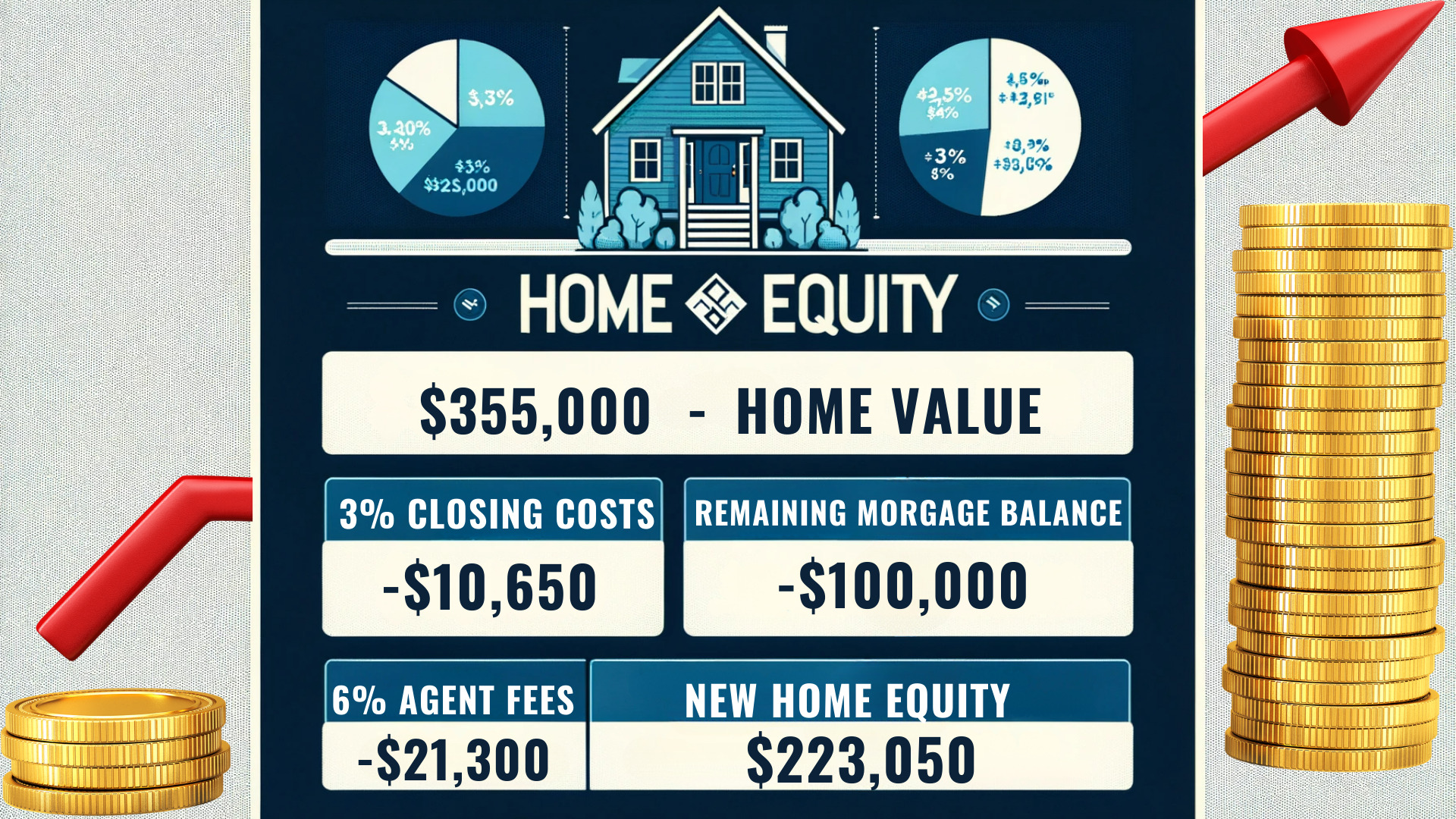

For example, presume your home’s present value is $355,000. When you sell it, you must pay 1-3% of the sale price for closing expenditures, another 6% in commissions for the agent, and any lingering mortgage balance.

That means you can expect to clear over $223,000 from the sale. That’s a great start on your dream home! And if you hold no mortgage debt, you pocket even more money to deploy as a down payment while covering other purchasing costs like repairs or moving.

Step 2: Construct Your Dream Home Budget

Once you compute your anticipated home sale proceeds, you can commence architecting a budget for your envisioned residence.

The formulation for owning your dream home (instead of it owning you) is to restrain your mortgage liability below 25% of your take-home income on a 15-year fixed-rate basis. You should also allot at least a 20% down payment to circumvent private mortgage insurance (PMI). Never accept a 30-year mortgage regardless of the lender’s promotion (they will try to push this). You would disburse a fortune in interest payments–money better allocated to constructing your wealth, not the bank’s coffers.

For example, if your take-home earnings are $4,800 monthly, your mortgage should not eclipse $1,200. By the way, that 25% amount should encompass other home expenses like homeowners association (HOA) dues, insurance premiums and property taxes too.

And remember to earmark funds for all the supplementary expenditures accompanying home acquisition–like moving bills and any upgrades or repairs. You don’t want those stealth costs to ambush you or drain your emergency fund.

Click here to learn more and subscribe to the newsletter

Step 3: Identify the Right Dream Home

Now reality sets in. After all your diligence accumulating equity (and computing lots of math–don’t forget that), you’re finally equipped to embark on the house hunt. Congratulations!

But don’t lose your focus. Remain attentive by creating a checklist of attributes that satisfy your budget, lifestyle and aspirations–and adhere to it during your exploration. Here are some ideas to commence brainstorming.

– Don’t compromise on location and layout. If you intend to occupy this home long-term, inconvenient access or an oddball floorplan are deal breakers. Seek a neighborhood and design supporting your lifestyle presently and for years ahead.

-Contemplate your family’s spatial necessities. While your budget governs your purchasing power, you’ll want adequate room for your family’s needs across different life stages.

– Assess school district reputations. Even if you don’t have children, nearby school quality could lift your property value. But if you have or plan to have kids, academic options probably already rank high among your priorities.

– Identify appreciation potential. Are property values ascending locally? Is business development accelerating? These clues can foreshadow whether your dream home will morph into a valuable investment.

– Tally the costs. Fancy features like spa bathrooms are splendid but ensure primary elements take precedence over luxuries. And remember, upgrades swell purchase expenses.

Step 4: Remain Choosey and Patient

We realize you’re anxious to occupy your new palace, but resist the temptation to settle in your urgency. Don’t overpay for a subpar dwelling merely because you’re weary of house hunting.

The key is enlisting an astute real estate guide who comprehends your budget and refuses to surrender to “good enough.” They’re as committed to your vision as you are and will support you through twists and turns until mission accomplished.

In addition, you can institute a couple supplementary safeguards to prepare for immediate action when the right listing manifests:

– Attain pre-approval for a 15-year fixed mortgage. Prequalified borrowers are catnip for sellers–especially amid multiple offers. And since your documentation is queued up, you’ll sprint straight to closing post-offer.

– Propose earnest money with your bid. Earnest money demonstrates sincere intentions to purchase via a deposit normally averaging 1-2% of the sale figure applied to your down payment or closing expenditures. Even if the arrangement dissolves, you usually recoup most of it.

Now you might be recognizing the preparation still ahead before you’re poised to quest for your dream domain. Or you may be realizing your diligence is about to bear fruit! In any case, if you pursue this methodology, you’ll discover the home you’ve forever fantasized about without a purchase you’ll come to regret.

Get your free “2024 Real Estate Market Outlook” now!

Step 5: Make a Competitive Offer

You found it! Your dream home is on the market. Now it’s time to make an offer.

In many housing markets, good properties attract multiple bidders. Don’t get scared off. Stay confident that your preparation will carry you through.

Lean on your real estate guide to formulate an appealing package:

– Price – Offer competitively but avoid overbidding your budget just to “win.” Your agent can suggest strategic figures aligned to market trends.

– Terms – Detail any special requests like leasebacks to the seller along with proposed closing timeframe.

– Earnest deposit – Reaffirm your sincere intentions by offering 1-3% of purchase price.

– Preapproval letter – Display rock-solid proof of financing readiness from your lender.

– Love letter – Share why this particular home resonates and how you plan to nurture it. Sellers appreciate knowing their beloved abode is going to a good home.

With a compelling bid assembled, stay poised through negotiations by:

– Seeking smart compromises if sellers request revised terms

– Refusing to abandon bottom-line budgetary limits or financing contingencies

– Trusting your agent’s wisdom regarding competitive dynamics

Step 6: Final Walkthrough & Closing

Congratulations, your offer was approved! But don’t fully exhale just yet.

As closing day approaches, schedule a final walkthrough to confirm the property’s status aligns with contractual stipulations. If you find defects like damaged walls or non-operational appliances, document thoroughly and submit to legal counsel right away. They can advise on the best next steps per purchase terms.

Barring any hitches, closing day arrives! This marathon’s pinnacle combines signing paperwork with payment processing. Once finished, celebrate with the keys to your castle!

Enjoy nesting with pride by gifting your first home the same love and care that transformed it from daydream to reality. May it shelter your family for years while blessings multiply within its walls.

The fulfillment of owning your dream home awaits those willing to strategically strive through budgeting, patience and faith. Now go create lasting memories in those sacred spaces you’ve imagine.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.