Real estate investing often gets portrayed as this super active pursuit – constantly dealing with tenant problems and maintenance issues. But there’s actually a whole other approach to real estate investing that’s much more passive and hands-off.

It’s called passive real estate investing. That’s when you own investment properties, but pay others to manage them for you. You become a silent partner, while a property management company handles all the day-to-day stuff.

As an experienced investor who has diversified into over 40 assets, I wanted to write this beginner’s guide to explain passive real estate investing. My goal is to explain the basics so you can decide if passive real estate investing is a good fit for your portfolio or not.

What Exactly is Passive Real Estate Investing?

With passive real estate investing, you own properties – whether residential rentals, commercial buildings, retail space, etc. But you aren’t the one dealing with tenants, collecting rent checks, or handling repairs.

Instead, you hire a professional property management company to take care of all that for you. Their responsibilities typically include:

Finding qualified tenants and signing lease agreements – Marketing rentals, screening applicants, and having new tenants sign rental agreements.

Performing background/credit checks – Running credit and criminal background checks on applicants to verify finances and history.

Collecting monthly rent payments – Sending monthly invoices, collecting rent checks/payments, and following up on late payments.

Conducting repairs and maintenance – Scheduling regular maintenance, addressing repair requests, and hiring contractors as needed.

Responding to tenant complaints – Being available to address noise complaints, disputes between tenants, lease violations, etc.

Staying on top of move-ins and move-outs – Inspecting units, refunding deposits, and preparing vacant units to be rented again.

So in essence, the property manager handles all direct interaction with tenants. They deal with the headaches of owning rental properties so you don’t have to.

Your involvement is much more passive as the behind-the-scenes investor. You may weigh in on high-level decisions from time to time. But for the most part, you sit back and collect rental income without having to deal with the properties yourself.

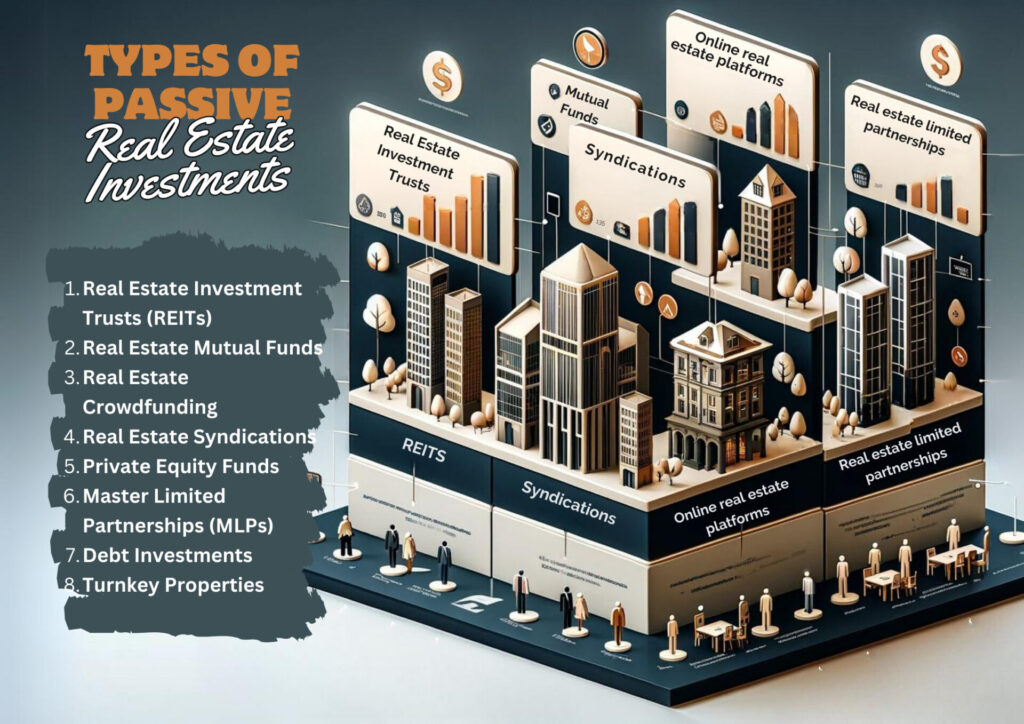

Some examples of passive real estate investments include:

Turnkey Rental Properties – A company purchases a property, updates/renovates it, finds a tenant, and manages it on your behalf. You own the property but they handle everything.

Real Estate Investment Trusts (REITs) – These are companies that own and manage residential or commercial real estate. You can buy shares of a REIT to earn rental income without having to purchase physical buildings yourself.

Real Estate Crowdfunding – Platforms that let you pool funds with other investors to provide financing for real estate projects. You earn passive income in return for your investment.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

No matter what specific model you choose, the benefit is earning money through real estate without having to deal with midnight plumbing emergencies or screening tenant applications yourself.

Why Consider Passive Real Estate Investing?

There are some compelling reasons why passive real estate investing has become an increasingly popular way for everyday investors to earn rental income:

Generates Consistent Cash Flow

The appeal of rental properties is the steady cash flow they can provide in the form of rent payments from tenants. Investing passively allows you to earn this rental income without having to manage tenants directly.

Requires Minimal Hands-On Work

With a property manager handling all the day-to-day responsibilities, passive real estate investing requires very little daily effort on your part. The properties operate smoothly in the background without you needing to get involved.

Potential for Appreciation

Real estate prices historically trend upwards over longer periods of time. So passive rental properties may grow in value over the many years that you own them – especially once the mortgage is paid off.

Diversification for Your Portfolio

Adding passive real estate investments diversifies your holdings away from just stocks and bonds. This diversification across asset classes can help reduce your overall investment risk.

Use Leverage to Your Advantage

Passive investors can often finance a large portion of a property purchase through a mortgage loan. This allows you to buy a larger real estate asset using leverage. If the property appreciates substantially, your returns are boosted even more.

Professionals Handle the Work

Experienced property managers are skilled at marketing to prospective tenants, validating applications, and renewing lease agreements. This high level of professional management can give passive investors better results.

Tax Advantages

Passive rental income may qualify for tax advantages not available from other investments, like the 20% qualified business income deduction. Consult a tax professional to understand how this could benefit you.

Some Potential Drawbacks to Consider

Although passive real estate investing comes with some great perks, it’s important to also weigh a few of the downsides:

It requires significant capital upfront – Buying rental properties involves a lot of cash, even if you secure financing. The barriers to entry are higher than with other passive income strategies.

Less control over your investment – You’ll need to rely heavily on your property manager vs. being directly in charge yourself.

Possibility of vacancies – Even good property managers may sometimes struggle to find tenants immediately, which can reduce your income.

Chance of mismanagement – No matter how thoroughly you vet, there’s risk of winding up with an incompetent property manager who causes you headaches.

Lack of tax benefits – Active rental investors enjoy more tax write-offs. As a passive investor, deductions are limited so consult a tax pro.

Low liquidity – Selling properties to cash out your investment takes time, versus liquid assets like stocks/bonds.

No investment is perfect, so weigh the pros and cons before jumping in. But many investors feel the benefits make passive real estate worth considering.

Click here to learn more and subscribe to the newsletter

Tips for Getting Started with Passive Real Estate

Intrigued by the idea of passive real estate investing? Here are some tips if you want to get started:

Research Different Passive Models

Get very clear on the options – from turnkey rentals to REITs and real estate crowdfunding. Study the pros/cons of each so you understand what you’re getting into.

Crunch the Numbers

Run detailed calculations to estimate returns based on potential rents in your market. Factor in expenses like the property management fee, taxes, insurance, vacancies, and repairs. See if the income outweighs the costs.

Thoroughly Vet the Property Manager

If going with a turnkey rental, vet several property management companies in-depth before choosing one. Ask lots of questions and verify they have strong reviews and proven experience.

Start Small if New to Real Estate

If you’re new to real estate investing in general, try buying just one passive rental property at first. Give yourself 6-12 months to understand the ropes before expanding.

Choose a Reputable Company for REITs or Crowdfunding

If investing in a REIT or real estate crowdfunding, pick an established company with a strong track record and transparent operations. Assess their past performance.

Diversify Your Investments

Use passive real estate as just one component of a broader investment portfolio. Diversification helps reduce overall risk rather than putting all your eggs in one basket.

Ready to Explore Passive Real Estate Investing?

Passive real estate investing allows everyday investors to earn rental income without having to deal with the day-to-day headaches of being an active landlord. It provides an opportunity to diversify and tap into appreciated real estate values.

That said, it has higher barriers to entry than many investments and involves putting your trust in a property manager. Do your research to find an optimal balance between risk management and returns for your individual goals.

With rigorous analysis of potential properties or companies, and a solid long-term financial plan, passive real estate investing can provide outstanding hands-off returns. Just know it takes work upfront to set things up smoothly.

If you invest wisely and stay the course, passive real estate can continue producing income through multiple market cycles as part of a balanced portfolio. So if you think this hands-off approach to real estate investing could be right for you, hopefully this beginner’s guide provides a great starting point!

Let me know if you have any other passive real estate questions. I’m always happy to chat more!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.