Warren Buffett, the Oracle of Omaha, is not just a name but an institution in the world of finance. With his knack for smart investments and financial prudence, he has become a role model for many aspiring investors. However, Buffett doesn’t just talk about how to get rich; he also offers cautionary advice on what not to do if you want to secure your financial future.

Amidst a culture that often romanticizes the “American Dream,” many find themselves trapped in what can only be described as the “American Nightmare” — a cycle of financial instability and poor financial decisions. This article aims to shed light on Buffett’s sage advice for avoiding the pitfalls that can lead to financial ruin.

The Stark Reality of the “American Nightmare” Through the Lens of Warren Buffett

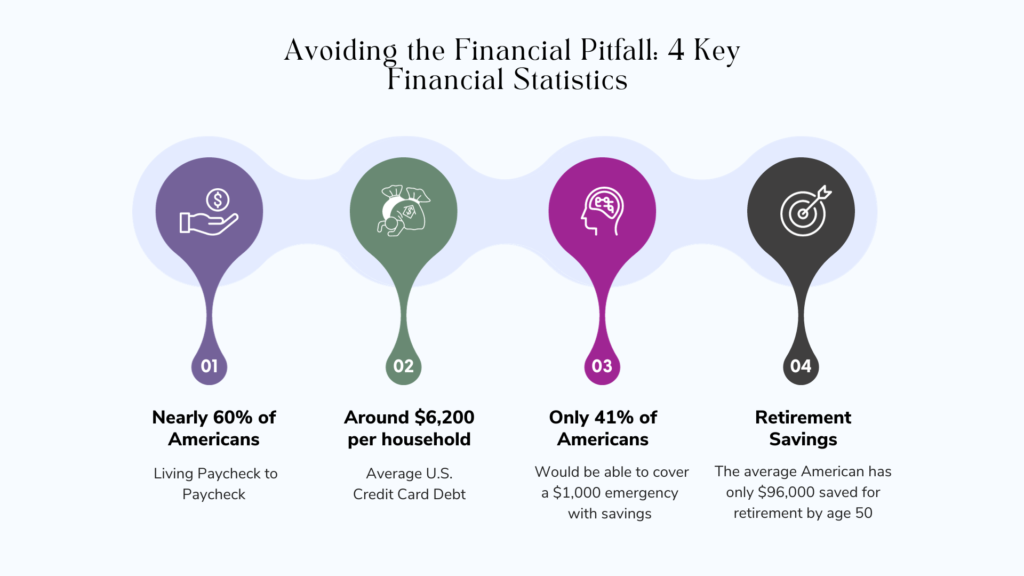

The “American Dream” is a term often romanticized, painting a picture of financial success attainable by anyone willing to work hard. Yet, the reality is far from this ideal for a significant number of Americans. According to recent data, nearly 60% of Americans are living paycheck to paycheck. This isn’t just a matter of numbers. It represents millions of people struggling to make ends meet, unable to save for emergencies, let alone invest for the future. This grim scenario is what we refer to as the “American Nightmare.”

Warren Buffett, who has navigated the turbulent waters of the financial world with unparalleled success, has often spoken about this distressing reality. He notes that many people, despite their best efforts, find themselves ensnared in a cycle of financial instability due to poor financial habits and attitudes. Buffett emphasizes that this situation is not merely unfortunate but also avoidable. He argues that many fall into the “American Nightmare” not necessarily because of a lack of effort, but often due to a lack of financial education and poor financial decision-making.

Buffett’s observations serve as a sobering reminder that the “American Nightmare” is not a myth but a harsh reality for many. And it’s not just about those who are financially imprudent; it’s also about individuals who work hard but lack the financial literacy to navigate the complexities of modern economics. His insights indicate that this nightmare scenario is not an inevitable fate but a situation that can be corrected through better financial habits, education, and decision-making.

Click here to learn more and subscribe to the newsletter

Heeding Warren Buffett’s Wisdom on Financial Missteps to Avoid

Warren Buffett’s financial counsel is not limited to investment strategies. He also provides valuable insights into the habits and attitudes that can set one back financially. Let’s delve into some of the key points:

Avoiding Financial Education: One of the foremost pieces of advice from Buffett is the emphasis on financial literacy. Ignorance is not bliss when it comes to managing your money. A lack of understanding of basic financial principles can lead to poor investment choices and crippling debt.

Short-Term Thinking: Buffett is known for his long-term investment strategies, and this principle can be applied more broadly to personal finance. A focus on immediate gratification can lead to reckless spending and a lack of savings. As Buffett suggests, think of your financial decisions as long-term investments in your life.

Living Beyond Your Means: This is one of the most straightforward yet most ignored pieces of financial advice. Buffett, despite his immense wealth, is known for his frugal lifestyle. The key takeaway is to live a lifestyle that your income supports, not one that your credit cards can temporarily afford.

Ignoring the Power of Compound Interest: Buffett often stresses the incredible power of compound interest, both for investments and debts. Ignoring this principle can mean missed opportunities for growth or accumulating unnecessary debts.

Lack of Diversification: Putting all your eggs in one basket is never a good idea, and Buffett is a strong advocate for diversification. Lack of diversification can expose you to unnecessary risks and potential financial ruin.

While these points may seem like common sense, they are often easier said than done. The key is not just to know these principles but to live by them.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

Actionable Steps to Turn Your Financial Life Around

While understanding what not to do is crucial, taking actionable steps to improve your financial situation is equally important. Based on Buffett’s advice, here are some practical tips:

Educate Yourself: Take the time to read financial books, attend workshops, or even take online courses. The more you know, the better your decisions will be.

Plan for the Long-Term: Whether it’s saving, investing, or spending, always have a long-term perspective. Set up an emergency fund, contribute to your retirement account, and don’t shy away from long-term investments that have a history of good returns. Consider long-term investments like real estate or bonds, which can provide a stable income over time.

Budget Wisely: Keep track of your income and expenses. Make a budget that allows you to live within your means and stick to it. If possible, automate your savings and bill payments to avoid the temptation of overspending. Set Financial Goals, whether it’s saving for a vacation or buying a home, having goals can guide your budgeting decisions.

Harnessing the power of compound interest: It is a vital aspect of financial planning. Starting to invest early can significantly boost your financial growth, as it allows your money more time to compound and grow. However, it’s important to remember that compound interest can also work against you, especially when it comes to high-interest debts. If these debts are not promptly addressed, they can multiply exponentially, causing financial strain.

Diversification: It is another cornerstone of sound financial management. Rather than putting all your resources into a single investment, it’s wise to spread the risk across different asset classes such as stocks, bonds, and real estate. Furthermore, financial markets are not static; they are subject to fluctuations and changes. As such, it’s important to periodically review your investment portfolio and make necessary adjustments to align with your financial goals and market conditions.

Conclusion

Warren Buffett’s financial wisdom goes beyond mere investment tips. It serves as a comprehensive guide for anyone aspiring to escape the clutches of the “American Nightmare” and move closer to the “American Dream.” By avoiding pitfalls like neglecting financial education, thinking short-term, and living beyond one’s means, we can take significant steps toward financial security and freedom.

It’s not enough to simply admire Buffett’s success or aspire to similar financial heights. The real takeaway is to actively implement his advice into our daily lives. After all, financial well-being is not a destination but a journey, requiring consistent good habits and wise decisions.

Remember, the “American Dream” isn’t an exclusive club reserved for a select few. It’s a realistic goal that’s attainable through prudent planning and sound financial habits. As Buffett himself has demonstrated, the path to financial freedom isn’t necessarily glamorous or exciting. It’s paved with discipline, long-term planning, and a keen understanding of the principles of money management.

So take action today. Educate yourself, plan for the long term, and live within your means. Your future self will thank you.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.