Alright, let’s get real here, folks. Investing in real estate can be an exhilarating ride filled with potential cash cows, but let’s be honest – it is not a walk in the park either. As a fresh-faced newbie in the game, you’re probably raring to go and dreaming of those rental income checks rolling in. But pump the brakes there, my friends! Before you dive headfirst into the deep end, you gotta know the common pitfalls that can sink your investment dreams faster than you can say “foreclosure.” In this blog post, I’m laying out the top five mistakes that rookie investors often make, and sharing some solid tips straight from the trenches on how to avoid them.

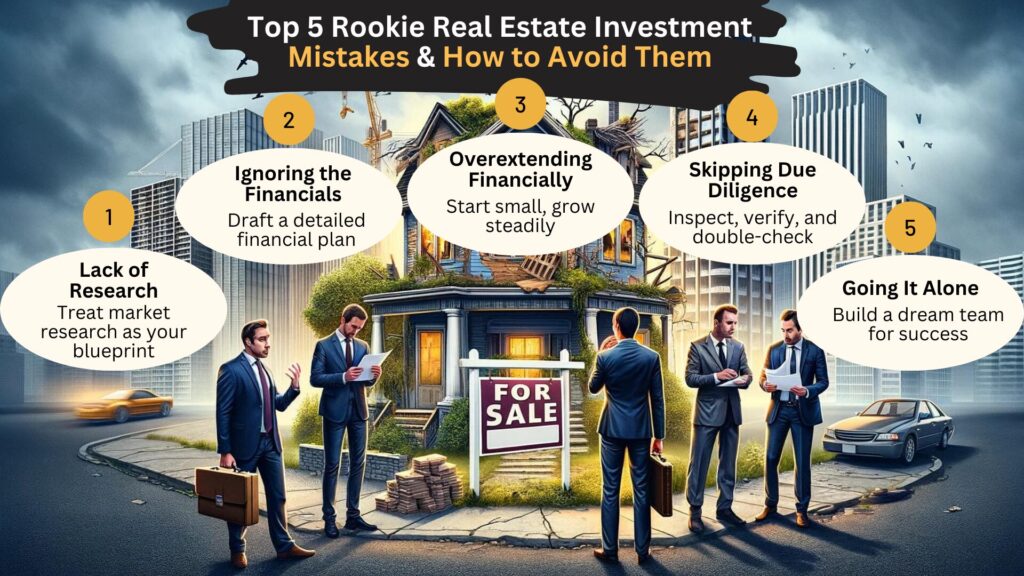

Mistake #1: Failing to Conduct Thorough Research

One of the biggest rookie blunders is not doing your homework properly. Look, real estate investing isn’t about getting lucky – it’s about doing your due diligence and knowing the market inside and out. If you don’t take the time to really understand the location, property values, rental rates, and demographic trends, you could end up with a lemon on your hands that’ll drain your pockets faster than a sieve. Trust me, I’ve seen it happen, and it’s not pretty.

How to Avoid This Mistake

Before you even think about signing on the dotted line, you gotta treat researching the local real estate market like it’s a full-time job. Study those property values, rental rates, and demographic trends like you’re prepping for the biggest exam of your life. Get cozy with the zoning regulations, tax laws, and potential risks in the area until you can practically recite them in your sleep.

Don’t be afraid to pick the brains of experienced investors who’ve been around the block, attend seminars and workshops, and scour every online resource you can find. Knowledge is power in this game, my friends, and it could mean the difference between scoring a sweet deal and ending up with a money pit.

Click here to learn more and subscribe to the newsletter

Mistake #2: Failing to Understand the Financials

Another rookie mistake that’ll have you scratching your head in confusion? Not fully understanding the financial side of things. Too many newbies overlook expenses like maintenance, repairs, property management fees, and vacancy rates – and let me tell you, those suckers can put a serious dent in your profits if you’re not prepared.

How to Avoid This Mistake

You gotta treat that financial plan like it’s the Holy Grail of your investment strategy. Create a bulletproof budget that factors in every potential cost, from mortgage payments and insurance to those pesky property taxes and ongoing maintenance (because let’s face it, properties don’t maintain themselves). And don’t even think about ignoring those vacancy rates – empty units can be a real cash flow killer if you’re not prepared.

Get a solid understanding of cash flow and how it relates to your investment property, because that’s the lifeblood of this whole operation. If you’re feeling a little lost in the numbers game, don’t be afraid to bring in reinforcements – a good financial advisor or experienced investor who’s been there, done that can be worth their weight in gold.

Mistake #3: Biting Off More Than You Can Chew

Overextending yourself financially is a surefire way to end up in hot water, my friends. As a new investor, you might be tempted to take on more properties than you can realistically handle, either because you’re feeling overconfident or you’ve got dreams of building an empire overnight. But trust me, that’s a recipe for disaster that’ll have you drowning in debt and stress faster than you can say “foreclosure.”

How to Avoid This Mistake

The name of the game here is starting small and building your portfolio brick by brick, like you’re constructing the foundation for a skyscraper. Invest within your means and avoid taking on too much debt like the plague – remember, real estate investing is a marathon, not a sprint.

If you’re not sure how much you can realistically handle, don’t be afraid to seek out some professional advice from experienced investors or financial advisors. They’ll help you stay grounded and focused on a manageable investment plan that won’t leave you house-poor and living in one of your rental units (and not in a good way).

Get your free “2024 Real Estate Market Outlook” now!

Mistake #4: Neglecting Due Diligence

Skimping on due diligence is a rookie mistake that’ll have you kicking yourself later, my friends. Due diligence means thoroughly inspecting and evaluating a property before you make that purchase – and failing to do so can land you with a whole host of hidden issues, from structural problems to legal nightmares that’ll drain your resources faster than a leaky faucet.

How to Avoid This Mistake

When it comes to due diligence, you gotta treat it like it’s your full-time job. Get those professional inspections done by reputable companies, and review every single legal document with a fine-toothed comb. Verify the property’s history and condition like a seasoned detective, leaving no stone unturned. Don’t even think about cutting corners on this crucial step, because it could end up saving you from costly repairs, legal battles, or inheriting someone else’s problem property that’ll make your investment dreams a living nightmare.

Mistake #5: Going It Alone

Real estate investing ain’t a solo gig, my friends. Trying to handle every aspect of the process by yourself is a surefire way to end up overwhelmed, burned out, and making costly mistakes that could put a serious dent in your investment dreams. Trust me, you don’t want to find yourself spinning plates and scrambling to keep everything afloat while your investments come crashing down around you.

How to Avoid This Mistake

You gotta assemble your own personal dream team of professionals to support you every step of the way. I’m talking about a knowledgeable real estate agent who knows the market like the back of their hand, a property manager with a proven track record who can handle the day-to-day grind, a skilled contractor or handyman to keep your properties in top shape, a trusted accountant to keep your finances in order, and a qualified attorney to protect your legal interests.

Don’t skimp on building this solid team, because having the right people in your corner can make all the difference when the going gets tough. Leverage their expertise to navigate the complexities of real estate investing and make informed decisions that’ll keep your investment dreams alive and kicking.

Conclusion

In conclusion, investing in real estate is no cakewalk, but avoiding these common rookie mistakes can truly set you up for success. Remember to always do your due diligence, crunch the numbers thoroughly, build a solid team of professionals, and never overextend yourself financially.

Real estate investing is a marathon, not a sprint, so take it slow and steady. With patience, the right mindset, and a commitment to continuous learning, you can navigate the pitfalls and build a profitable portfolio that generates long-term wealth.

At the end of the day, real estate investing is all about making smart, informed decisions every step of the way. So trust the process, lean on your team of experts, and don’t be afraid to learn from your mistakes. The road to real estate riches may have its bumps, but by avoiding these top five blunders, you’ll be well on your way to realizing your investment dreams.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.