In 2024, real estate investment offers exciting growth opportunities. This article introduces six key strategies to help you succeed in the real estate market. We cover everything from rental properties to new online platforms, ensuring there’s something for every type of investor. Whether you’re starting out or looking to expand your portfolio, these strategies are designed to guide you toward smart, profitable decisions in real estate.

We’ll explore how to navigate the complexities of the market, adapt to changing economic conditions, and capitalize on emerging trends. Additionally, we provide insights into managing risks and maximizing returns, equipping you with the knowledge to make well-informed investment choices. Join us as we uncover the potential of real estate investment in 2024 and beyond.

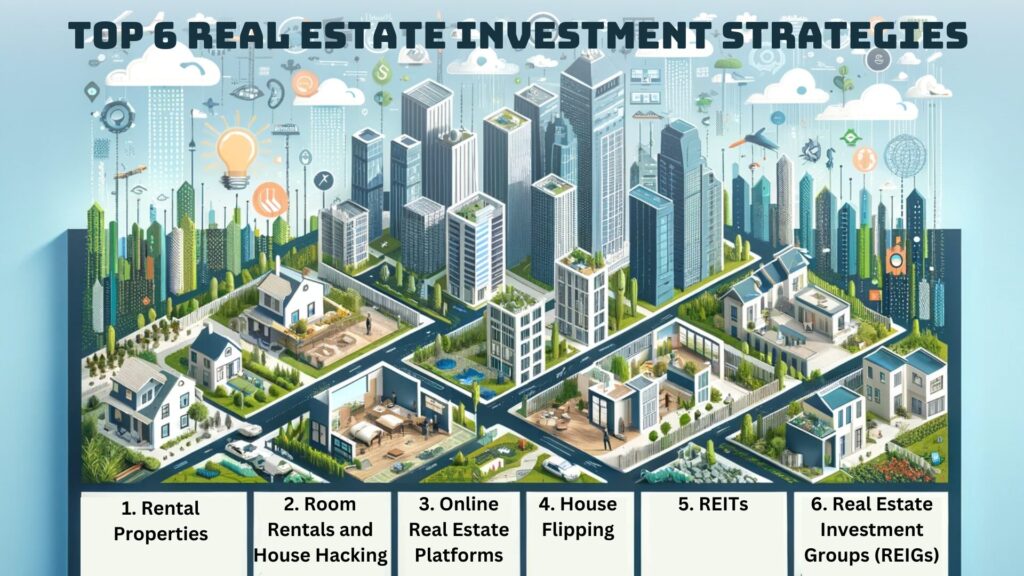

Diverse Real Estate Investment Avenues

Real estate investing offers a wide range of opportunities beyond the initial purchase of a home. It encompasses various strategies from owning rental properties to flipping houses, investing in Real Estate Investment Trusts (REITs), and exploring online real estate platforms. Here’s an expanded look at six strategies to diversify your real estate investment portfolio:

1. Rental Properties

Investing in rental properties is a traditional approach. You buy a property and rent it out for either short-term or long-term. This can provide a steady income and potential tax advantages on expenses such as maintenance, insurance, and mortgage interest. However, the initial investment can be substantial. Challenges might include managing tenants and upkeep. Despite these issues, rental properties can be a solid source of ongoing income and may increase in value over time.

2. Room Rentals and House Hacking

This strategy involves renting out part of your residence, such as a spare room or a basement, a concept known as house hacking. It’s a practical and lower-cost entry into real estate investment. By renting out a section of your primary residence, you can significantly offset your living expenses. Scaling this up to a multi-unit property allows for more rental income. The flexibility in choosing tenants, from long-term leases to short-term vacation rentals through platforms like Airbnb, makes this an attractive option for new investors.

3. Online Real Estate Platforms

Online platforms have opened new doors in real estate investment, allowing individuals to participate in larger projects with smaller capital commitments. These platforms facilitate collective investments in various real estate projects, offering potentially higher returns than traditional investments. However, they also carry a higher risk and typically offer less liquidity than more conventional real estate investments.

Click here to learn more and subscribe to the newsletter

4. House Flipping

House flipping is a more hands-on investment strategy. It involves purchasing underpriced properties, renovating them, and selling for a profit. Success in flipping hinges on finding the right property, having the capital for purchase and renovation, and efficiently managing the renovation process. While it can be highly profitable, it’s also a significant undertaking that requires market knowledge, financial skills, and the ability to manage a renovation project.

5. REITs

Real Estate Investment Trusts (REITs) are companies that own, manage, or finance income-producing real estate. Investing in a REIT allows you to be part of real estate ventures without direct involvement in property management. They are typically more liquid than physical real estate and are required to pay out a large portion of their profits as dividends, making them an attractive option for income-seeking investors.

6. Real Estate Investment Groups (REIGs)

REIGs are groups of investors pooling their resources to invest in real estate properties. They offer a collective approach to property investment, often with professional management handling the day-to-day operations of the properties. While they provide a way to invest in real estate without the responsibilities of direct management, they come with membership costs and the risks associated with collective investment decisions.

Each of these strategies offers a different approach to real estate investment, allowing investors to find a method that best suits their financial goals, risk tolerance, and level of desired involvement.

Time Stamp: The Potential of Real Estate Investing

Real estate investing offers several benefits but also comes with unique challenges. It’s important to choose the right strategy based on your goals, risk tolerance, and investment timeline.

Benefits

Steady Cash Flow: Rental income can provide a regular and stable income.

Value Appreciation: Properties generally increase in value over time.

Tax Advantages: Deductions on mortgage interest, property tax, and other expenses.

Leverage Opportunities: Using financing to amplify potential returns.

Challenges

Limited Liquidity: Converting property to cash quickly can be difficult.

High Initial Costs: Significant investment required for down payments and maintenance.

Time-Consuming Management: Managing tenants and property maintenance requires time and effort.

Making the Right Choice

Align with Goals: Consider whether you’re seeking long-term appreciation or immediate income.

Risk Tolerance: Understand the risks involved, especially with leverage.

Investment Horizon: Real estate is typically a longer-term commitment.

Seek Advice: Professional guidance can be invaluable in navigating the complexities of real estate investment.

Real estate can be a lucrative investment, but it’s essential to approach it with a clear understanding of both its advantages and demands.

Get your free “2024 Real Estate Market Outlook” now!

Frequently Asked Questions (FAQs)

How Much Can Real Estate Investors Earn?

Earnings in real estate vary widely. For instance, Donald Bren amassed a $15.5 billion fortune in commercial real estate. Average earnings can be around 6% to 11% for equity REITs. Real estate investor salaries vary based on location, investment type, and other factors, with the average salary around $139,851 per year.

Pros and Cons of Real Estate Investing?

Real estate offers benefits like diversification, passive income, appreciation, and tax advantages. Drawbacks include time commitment, variable property values, and potential liquidity issues. Each investment type comes with its own set of risks and rewards, requiring careful consideration.

Top Tax Benefits of Real Estate Investing?

Tax benefits vary by investment type. Rental properties offer numerous deductions, including mortgage interest, property taxes, and maintenance costs. House flipping tax treatment depends on your status as an investor or dealer, and other investments have different tax implications. Consulting a tax specialist is advisable to optimize benefits.

Conclusion

In 2024, the realm of real estate investment is rich with opportunities for both new and experienced investors. Our exploration of six diverse strategies, ranging from rental properties to innovative online platforms, underscores the potential for significant growth and financial success in this dynamic market.

Real estate investing, while offering considerable rewards like steady income and property appreciation, also requires careful navigation of its complexities and challenges. It’s crucial for investors to align their choices with personal goals, risk tolerance, and market conditions.

The key to success in this evolving landscape is informed decision-making and strategic planning. Whether you’re looking to generate immediate income or invest for long-term appreciation, understanding and adapting to the market is essential.

As we look ahead, the prospects of real estate investment continue to shine. With the right strategies and a keen understanding of the market, real estate can become a valuable part of your investment journey, offering sustainable returns well into the future.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.