Warren Buffett is undoubtedly the greatest investor of our time, with a current net worth of over $100 billion. However, when he first got started in his early 20s, Buffett had to work hard to make money and achieve his first $100k just like anyone else.

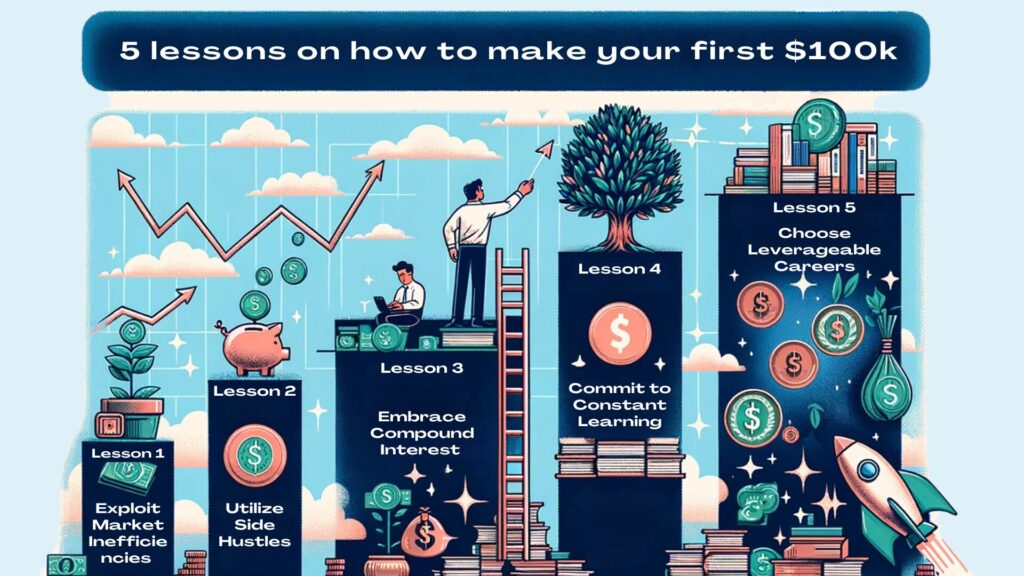

By studying Buffett’s proven strategies to go from $0 to $100,000, we can extract key lessons to help shortcut our own path to making serious money. While not every technique may apply directly in today’s world decades later, the core principles are timeless. I analyzed Buffett’s proven methods for making money when he was just starting out his investing career. Here are 5 key lessons to learn from how Warren Buffett made his first $100k:

Lesson 1. Seek Out Inefficient Markets

In his early years, Buffett focused on small, overlooked investment opportunities. Unlike his current portfolio of large companies, young Buffett capitalized on inefficient markets – areas where investments are not fully recognized by most investors.

Buffett understood that not all markets efficiently price assets based on their intrinsic value. By thoroughly researching companies, he could identify undervalued investments that would yield substantial returns over time. This required developing financial analysis skills and thinking independently from the crowd.

For example, Buffett analyzed a public tender offer related to Rockwood & Co., a shuttered chocolate maker. He recognized that the offer price was lower than the value of Rockwood’s cocoa bean inventory assets. So he accumulated shares and profited by exchanging them for cocoa beans, which he immediately sold at the higher market price.

Deals like this demonstrated Buffett’s ability to spot pricing anomalies in neglected companies. While these small wins may not seem significant, they set the foundation for the billions he would ultimately make in underappreciated large companies.

Key Takeaway: Be relentless in searching for undervalued or obscure assets and chances to buy low/sell high.

Lesson 2. Compound Interest and Time Are Wealth Accelerants

While clever market plays were helpful, Buffett understood early on that compound interest would be the real game changer in building long-term personal fortune. The more money you have saved and invested, the faster it grows since interest starts earning interest itself.

This meant maximizing saving money as early as possible, not spraying it on status symbols to impress others. Buffett was happy to live frugally in order to plow savings into investments. By relentlessly minimizing “lifestyle inflation”, his net worth compounding soared.

To demonstrate why being disciplined about saving and investing money early on makes such a staggering difference in the long run, here is a comparison: Say “John” is able to save $5k a year and invests it starting at age 25 earning a 6% annual return. After 40 years at retirement age 65, John would have $1.3 million saved up. Very nice!

“Sarah” is able to save $25k per year, perhaps by earning more income from a successful business venture and staying frugal. She also starts at 25, invests for 40 years, and earns the same 6% annual return.

Incredibly, Sarah ends up with over $6.5 million dollars at retirement age from consistent disciplined saving and compound growth.

This shows why mastering the fundamentals of budgets, saving rates, and investing habits does more for building long term wealth than chasing quick stock market wins. Consistency and time in the market rule all.

Key Takeaway: Master delaying gratification today so your future self is exponentially better off financially.

Click here to learn more and subscribe to the newsletter

Lesson 3. Multiple Income Streams Are Vital

Another way Buffett accelerated his path to $100k was by running various side businesses outside of his investing day job. He did everything from selling magazine subscriptions door-to-door to running a pinball machine operation.

Why work so hard with a day job already? Two reasons:

1. These side hustles provided further capital he could invest to compound returns.

2. The business skills learned from those ventures were invaluable themselves.

Having multiple cash flow sources working in parallel is like financial rocket fuel. You likely can’t become a billionaire solely by doing side gigs, but generating even just an extra few thousand dollars a year that can be invested makes a massive difference over decades thanks to compound growth.

Key Takeaway: Start income side-hustles to supercharge your savings capacity and business experience.

Lesson 4. Being a “Learning Machine” Makes You a Master of Money

While buying shares and commodities provided quick wins, Buffett knew investing and business mastery takes a lifetime of nonstop learning. He believes in consuming as much knowledge as possible across disciplines.

Why read so extensively when he was already making good money early on? Because Buffett realized that:

1. The more you know, the higher quality investment decisions and business judgments you can make.

2. Knowledge builds the skill to keep making money through future market shifts and economic changes.

3. If you keep learning faster than competitors, you will ultimately beat them through better mastery of craft.

Key Takeaway: Be a relentless learning machine – building knowledge builds better money-making capacity.

Get your free “2024 Real Estate Market Outlook” now!

Lesson 5. Choose Careers with Leveraged Income Potential

Buffett lost his desire to ever do manual labor jobs again after youthful struggles working in his grandfather’s grocery store. He realized early that both his interests and temperament were far more suited to knowledge work roles.

So he deliberately positioned himself in occupations like financial analysis roles where pay could heavily scale beyond pure hourly work if he kept sharpening abilities. Being good at playing the market made more money than just selling more hours of manual effort.

Key Takeaway: Seek careers where skilled practitioners can make exponentially more income than linear time workers.

The markets may change, but these core principles Buffett mastered to go from $0 to $100k endure. Model the methods, absorb the mindsets, and build the knowledge foundations today to set yourself up for financial greatness in the long run.

Conclusion: Build Your Fortune on Timeless Principles

Achieving long-term financial success requires mastering core principles that stand the test of time. While market conditions and technology shifts, human nature does not.

By modeling the proven money-making fundamentals demonstrated by Warren Buffett to make his first $100k, you set yourself up to bypass common pitfalls and build sustainable wealth.

Stay relentless in seeking arbitrage situations and overlooked assets before the masses discover them. Maintain an obsession for spotting market inefficiencies and asymmetries.

Leverage real estate’s compounding nature. Property can serve as a springboard asset to bootstrap your financial foundation. Let rental income fuel further smart expansion, while sweat equity and economies of scale multiply returns. Maximize compound interest by maximizing savings rates. The more you can delay lifestyle inflation to plow money into investments, the faster your returns accelerate.

Use side hustles to boost capital and business skills in parallel. Additional income allows you to juice savings, while business experience compounds knowledge.

Commit to constant learning across diverse disciplines. The more you know, analyze, and skill-build, the better your decisions and ability to adapt over time.

Target careers with leveraged economics to maximize your highest abilities. Focus on paths aligned to your strengths where skilled practitioners can significantly outearn linear time workers.

Build your fortune on this foundation of timeless principles, rather than chasing evasive short-term tricks. The long-term compounding will speak for itself.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.