Buying land is looking like an increasingly wise investment in 2023. Learn how population growth, inflation resistance, rural appeal, passive income potential and low prices after 2022’s cooldown make land an ideal asset amid economic uncertainty. I discuss why land endures, factors like mineral rights and zoning, and strategies to maximize returns.

Land has always been one of the most solid investments a person can make. In today’s uncertain times, the stability and security of land is more appealing than ever. As we move into 2023, there are several compelling reasons why buying land is looking like an increasingly smart investment strategy. Over the years, I have diligently diversified my investment portfolio, venturing into more than 40 assets across a range of classes. From multifamily properties to land development. I have explored various markets and regions, ensuring a well-rounded approach to risk management. This wealth of experience is why, in this article, I will share invaluable insights about land development and why it is a good investment.

The Enduring Value of Land

Land is the ultimate tangible asset. It’s a physical space that you can live on, grow crops on, and build structures on. Unlike speculative investments like stocks or bonds, the inherent worth of a piece of land endures. As Mark Twain famously said: “Buy land, they’re not making it anymore.”

Of course, the land market does experience booms and busts. But overall, well-selected parcels tend to steadily increase in value over decades. There’s something deeply reassuring about investing in a tangible asset you can see and touch, especially in an increasingly virtual world.

Population Growth Drives Up Land Prices

One of the key factors determining land value is population growth. As the global population increases, demand for land rises while supply remains fixed. This dynamic invariably pushes land prices upward over time.

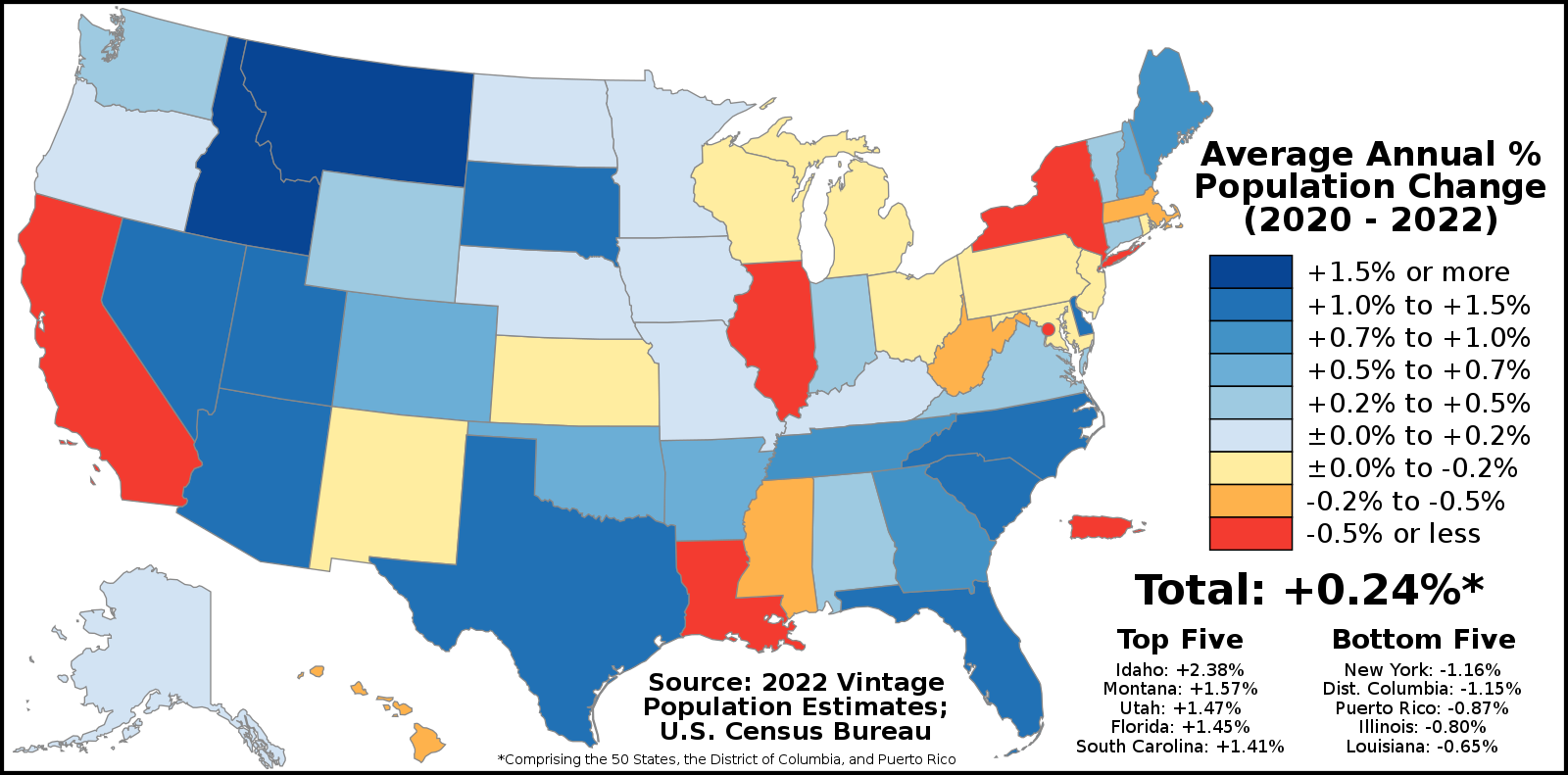

Source: Wikimedia, The average annual resident population growth rate of each U.S. state

According to United Nations projections, the world population is expected to reach 9.7 billion by 2050. As more people compete for a limited amount of land, values are likely to continue appreciating – especially in and around major cities.

For investors, this presents an opportunity to capitalize on rising land prices over the long-term. Purchasing land in strategic locations near expanding urban centers can deliver even stronger returns.

Land as a Hedge Against Inflation

With inflation in 2022 reaching its highest level in 40 years, many investors are looking for assets that will hold their value.

Historically, land has proved an excellent inflation hedge. As the cost of living rises, the underlying value of land tends to increase accordingly. The tangible nature of land also provides security amid economic uncertainty.

In an inflationary environment, money parked in cash or bonds loses purchasing power. But tangible assets like land generally keep pace with or even outperform the inflation rate.

The Appeal of Rural Properties

While land in or near cities offers obvious value, rural properties have their own unique appeal. The COVID-19 pandemic triggered a surge of interest in rural living as people sought more space and seclusion.

Owning rural land can provide a peaceful retreat from urban life. Acreage in pastoral settings offers privacy, self-sufficiency, and recreation. Interests like gardening, raising animals, hiking, and camping are all easily accommodated.

Rural land prices are also often significantly lower than urban prices per acre. For buyers willing to live further afield, substantial rural acreage can be purchased for the cost of a modest house in many metro areas.

Try your personal AI-powered Real Estate Advisor completely for free

Using Land for Passive Income

In addition to capital appreciation over time, land ownership also provides opportunities to generate passive income. Depending on the features and location of your property, potential options can include:

Leasing land to farmers for crops or livestock: If your land has fertile soil and water access, you may be able to lease acreage to nearby farmers to plant crops or graze animals. Rental rates vary widely based on local market conditions and land quality, but generally range from $30 – $200 per acre annually.

Leasing land for solar/wind energy equipment: With the growth in renewable energy, leasing open land to solar/wind companies has become quite lucrative. You can earn anywhere from $30 – $100 per acre annually for signing over access rights so they can install and operate solar panels or wind turbines.

Leasing hunting/fishing rights: Allowing recreational hunting and fishing on your land can provide steady income via per-day/week licensing fees. Popular species like deer, elk, bass and trout in high-demand areas can command top dollar during peak seasons.

Harvesting timber: If your land has mature trees suitable for timber harvesting, you may be able to periodically harvest and sell the timber for income. The amount varies widely based on timber quality and market conditions. Slow-growth hardwoods may sell for $2,000 – $5,000 per acre.

Auctioning land leases for oil/gas/mineral rights: Do you own the mineral rights underneath your land? Leasing the land to oil/gas/mining companies for extraction can yield substantial passive income. Bonus bids and royalty rates range wildly based on location and resource potential.

Cell phone tower leasing: Telecom companies are often looking for elevated, clear plots of land to install cell phone towers. Depending on tower height and location, annual leasing fees can reach $30,000 per tower or more.

Parking RV/boat storage: If accessible and secure, your land could be used for RV, boat and other vehicle storage. This can provide steady seasonal income from people who pay for storage spots on your property.

Owning land opens up many possibilities to earn regular income in diverse ways. Even an extra few hundred dollars a month goes a long way toward covering your property expenses and taxes. And over time, this passive income can significantly boost your overall return on investment. The key is matching your land’s unique characteristics with the optimal income sources.

Customizing Your Property

One of the best aspects of owning land is the freedom to customize it for your needs. Do you dream of raising chickens or growing an orchard? Prefer privacy and seclusion? Want space for kids to play and explore?

When you buy land, it becomes a blank canvas to create your own personal sanctuary. The home, gardens, amenities and features are all yours to design.

For some, owning land facilitates dreams of living off-grid. With enough acreage, you can build an energy-efficient home, install solar panels, keep bees, grow food, and enjoy total self-sufficiency.

Key Factors When Buying Land

Location: Properties near expanding cities generally see the strongest appreciation, but rural settings have their own appeal. Study area growth projections and consider your lifestyle goals.

Acreage: Larger parcels (10+ acres) offer more privacy and recreational options, while smaller lots (1-2 acres) usually have lower prices. Carefully consider how much land you need.

Accessibility: Ensure the property has acceptable road access and connections to utilities like electricity, water and septic systems.

Terrain: Take topography, drainage, vegetation and soils into account. These factors impact construction costs and agricultural use.

Mineral rights: Do you own the rights to any valuable subsurface resources like oil, gas or minerals? If not, consider how this could impact property value.

Zoning/regulations: What uses are permitted? Can you build structures, farm commercially, keep livestock, etc? Contact your local planning office to understand regulations.

In a turbulent economic environment, land stands tall as a rock-solid asset. For investors with a steady hand and long time horizon, buying land in 2023 may prove to be a strategy that stands the test of time. The old saying rings truer than ever – they aren’t making any more of it.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.