Investing your hard-earned money can seem like an intimidating mountain to climb. With countless options and strategies to choose from, how do you even begin?

Luckily, personal finance guru Dave Ramsey has boiled down the investing process into 5 straightforward steps anyone can follow. By sticking to this clear roadmap, you can get your investment plan up and running in no time.

Step 1: Clearly Define Your Investing Goals

The first and most critical step is to get very clear on why you are investing in the first place. Really take some time to think deeply about what your ideal retirement looks like. What does your dream lifestyle entail?

Sit down with your spouse or a close friend or family member and discuss the activities, travel, and passions you want to pursue in your golden years. Envision your perfect day in detail. Outline the contributions and impact you want to continue making.

Getting super clear on your aspirations gives you a compelling reason to stick to your investing strategy even when times get rocky. Your big “why” will keep you locked in for the long haul.

Along with defining your vision, take the time to determine exactly how much money you’ll need to fund this retirement. Meet with a financial advisor and have them run projections, or use one of many free online retirement calculators.

Having a clear target number allows you to come up with a game plan to reach your goal. It quantifies how much you need to invest and save. Defining your destination makes the journey far easier.

Many people gloss over this step and just start investing haphazardly without a purpose. Don’t make that critical mistake. Your savings motivation will be much higher when you connect it to a retirement vision that gets you fired up.

Step 2: Invest 15% of Your Gross Annual Income for Retirement

Once you become debt-free (except for your mortgage) and build up an emergency fund with 3-6 months of living expenses, it’s time to start directing a significant chunk of your income toward retirement investments.

Financial experts nearly universally recommend striving to invest 15% of your gross pay toward retirement savings. This percentage provides the best balance between building your nest egg rapidly while still leaving room in your budget for other important savings goals.

You may be wondering—why 15% exactly? It comes down to retirement preparedness versus other competing priorities like saving for college or paying off your home early.

While all these goals are admirable, retirement has to come first. Various studies show 15% is the minimum to be on track for a comfortable retirement. Investing any less leaves you at risk of significant shortfalls in your later years.

Now that you know your target percentage, the next step is deciding where exactly to invest that 15% of your income. Here is Dave Ramsey’s recommended simple strategy:

– Invest enough in your employer’s 401(k) to earn any full company matching contribution. This is free money you don’t want to leave on the table!

– Next, maximize your annual contributions to a Roth IRA, which provides tax-free growth. If married, contribute fully for your spouse as well.

– If you haven’t yet reached 15% of your gross pay after maxing out 401(k) match and Roth IRAs, increase your 401(k) contributions further to reach your desired savings rate.

By following this proven investment order of operations, thousands of everyday millionaires have built up seven figure nest eggs to last them through retirement. With discipline and time, you can achieve similar outstanding results.

Click here to learn more and subscribe to the newsletter

Step 3: Construct a Balanced Portfolio with Stock Mutual Funds

Once you know how much to invest, the next step is deciding exactly how to invest your hard-earned dollars. It’s easy to become overwhelmed by the sheer amount of investment options available in your 401(k), IRA, or standard investment account.

Stocks, bonds, mutual funds, ETFs, target date funds – where should you even begin? The universe of choices can quickly start to feel endless.

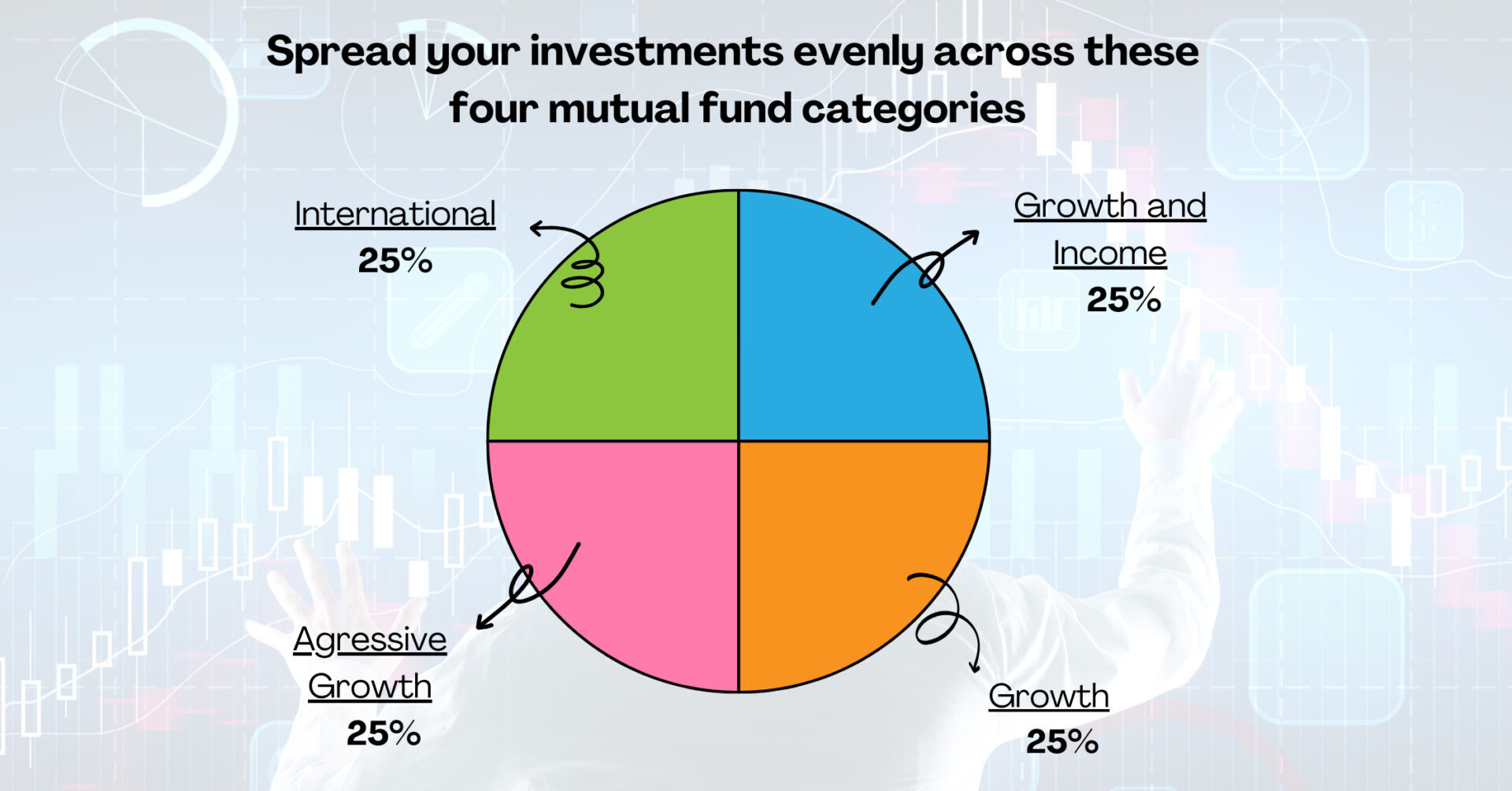

To simplify your decision, build a balanced mutual fund portfolio using Dave Ramsey’s easy 4-fund framework:

Growth Funds – Invest a percentage in mutual funds focused on growth stocks with strong prospects for capital appreciation.

Growth and Income Funds – Balance growth with mutual funds also providing steady dividend income.

Aggressive Growth Funds – Allocate a smaller portion to higher risk/higher potential reward aggressive growth funds.

International Funds – Invest a percentage in funds focused on international stocks to diversify globally.

Spreading your investments across these four fund types helps minimize risk by diversifying your holdings. You limit exposure to any single company or sector.

This balanced mutual fund approach allows you to participate in stock market returns over decades while avoiding unnecessary risk concentration. Don’t put all your eggs in one basket.

If you feel confused navigating the specific fund choices in your 401(k) or IRA, enlist the help of a financial advisor or investment professional. Their expertise can prove invaluable in helping you construct the right fund mix based on your risk tolerance and time horizon.

Step 4: Cultivate a Long-Term, Patient Mindset

Once your investments are set up, it’s crucial to maintain a long-term perspective. The stock market will fluctuate up and down over months and years. It’s easy to overreact and change course when you see big swings.

But investing for retirement is a lifelong marathon, not a spring. Short-term market gyrations are expected and should not cause you to jump ship on your strategy or asset allocation.

Time and compound growth are two of your biggest assets when investing. The earlier you start investing, the more powerful their effects become.

For illustration, let’s say you begin investing $800 monthly in balanced stock mutual funds starting at age 35. If those funds earn the historic long-term average annual return of around 10%, your portfolio could easily grow to over $2 million by age 65.

That’s the incredible power of compound growth over time! Of that $2 million nest egg, less than $300,000 came directly from your pocket. The rest is money your money made.

Legendary investor Warren Buffett famously said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” When it comes to investing, time planted is what allows money to grow.

As demonstrated by the bestselling book The National Study of Millionaires, patience and persistence are the keys ultra-wealthy investors use to build fortunes. Millionaires stay invested through bull and bear markets, trusting their long-term strategies.

Follow their example and tune out short-term market swings. Avoid reactionary moves like cashing out during downturns. Stay focused on controlling the controllables. With time as your ally, you can achieve inspiring results.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

Step 5: Enlist an Experienced Investment Advisor

You don’t have to figure out investing on your own. In fact, seeking guidance from the start prevents costly missteps. On your journey to investment success, partner with an experienced financial advisor.

A knowledgeable investment professional can answer your questions, recommend appropriate investments for your goals, and keep you disciplined when markets get rocky.

Look for an advisor willing to provide counsel over the long haul, not just earn a quick commission. Find someone invested in your life goals who can offer perspective during turbulent times that test your patience and discipline.

If you don’t already have an investment pro in your corner, ask trusted friends and family for referrals. Look for an advisor with extensive experience successfully guiding clients toward their retirement dreams.

With the right advisor helping craft your investment strategy, you can feel confident you’re on the right path. An expert guiding hand can prevent derailment on your journey to financial freedom.

Start Investing in Your Future Today

By following these 5 simple steps, you now have a clear map to investment success.

First, define your investing goals so you have a compelling reason to see it through. Next, invest 15% of income in tax-advantaged retirement accounts. Construct a balanced, diversified portfolio. Maintain a patient, long-term mindset. And finally, enlist an experienced financial advisor to help guide your journey.

While no investing journey is without twists and turns, this roadmap will serve you well in reaching your desired destination. Stay the course through ups and downs, keep your eye on the horizon, and before you know it, you’ll be achieving your financial goals.

The time is now. Your investing future begins today. Follow these steps and embark on your exciting journey toward financial freedom!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.