Listen, if you’re facing foreclosure, I get it – it’s a tough situation. But you’ve got to keep your head up because there is hope, my friend. I know how overwhelming it can feel. But I’m here to walk you through this mess step-by-step so you know exactly what to expect. And more importantly, I want to share some tips on how you can potentially avoid foreclosure altogether.

What Is Foreclosure?

Okay, let’s start with the basics. A foreclosure is essentially the legal process that kicks in when you’ve stopped making your mortgage payments. Yep, that’s right – if you stop paying your lender, they have the right to take back your home and force its sale to recoup what you owe them. I know, it sounds harsh, but that’s just how it works when you have a mortgage. Technically, the bank owns your home until you’ve paid it off in full.

Here are some of the major consequences you could be dealing with if your home goes into foreclosure:

1) Losing your home and any equity you’ve built up in it (that’s the amount you actually own)

2) A nasty hit to your credit score, making it harder to borrow money or get approved for things like apartments in the future

3) Owing your lender even more money after the home is sold (called a deficiency balance) – talk about kicking you while you’re down, right?

How Many Missed Payments Triggers Foreclosure?

Most of the time, the foreclosure process doesn’t start until you’ve missed four consecutive mortgage payments – so around 120 days late on your payments. Now, one missed payment will likely result in some pesky late fees from your lender. But they’ll usually try to work with you before going straight to foreclosure, especially if you have a legitimate reason for falling behind like losing your job.

But listen up – if you just keep ghosting your lender and missing payment after payment without any communication, they’re going to get fed up real quick and could start foreclosure proceedings sooner rather than later. These lenders aren’t running a charity, you know?

For further insights into managing your finances and overcoming debt, consider reading my article: “Escape Debt Fast With the Debt Snowball Method.”

Click here to learn more and subscribe to the newsletter

The Nitty Gritty: How Foreclosure Actually Works

Okay, now for the not-so-fun part – the actual foreclosure process if it gets to that point. I’m not going to sugarcoat it, this part ain’t pretty. But you need to understand what you’re potentially up against, right?

The specifics can vary a bit based on your state and the type of foreclosure, but it generally goes down in five main stages:

1. You miss those mortgage payments

Maybe you lost your job, had a medical emergency, or just got slammed with too many bills. Whatever the reason, missing a few mortgage payments is often where this mess starts. The second you realize you might have trouble making a payment, call your lender immediately! They may be able to give you a temporary break or adjust your payment plan to help you get back on track.

2. The lender files a notice of default

Once you’re around four months behind, your lender will officially submit paperwork called a notice of default to the county. This basically says “Hey, this homeowner broke our agreement by not paying up.” They’ll send you a copy too – so don’t act surprised when you get it in the mail.

But don’t panic just yet! You’ll usually get a grace period of around three more months to get fully caught up on payments after this notice. So if you get that default notice, pick up the phone and work out a payment plan with your lender ASAP to stop this train before it leaves the station.

3. It enters the pre-foreclosure stage

If you weren’t able to catch up after that notice of default, your home now enters the pre-foreclosure stage. This is where things can start to get a little hairy – but you still have some options:

– Catch up on all those missed payments if you can find a way to come up with the cash

– Try to sell your home yourself through a regular listing

– Look into a “short sale” where you sell for less than what’s owed (but your lender has to approve this route)

– Or, as a last resort, sign over the deed to your lender to avoid full foreclosure

The key here is to take action – don’t just stick your head in the sand! Work with your lender and check all your possible options to try to stop this foreclosure train.

4. Your home goes to auction

If you weren’t able to sell or catch up at this point, your lender will take your home to auction. They’ll start the bidding at whatever balance you still owe on your mortgage. In some states, you may still be able to try buying back the home yourself if you can cover the total balance, fees, and interest – but that’s a long shot at this stage.

5. You face eviction

I’m not going to lie – this is the really crummy part. If the home doesn’t sell at auction, your lender will eventually be forced to evict you so they can get it off their hands. They’ll give you a set move-out date, but don’t wait until the last minute! Start lining up your next living situation ASAP.

Get your free “2024 Real Estate Market Outlook” now!

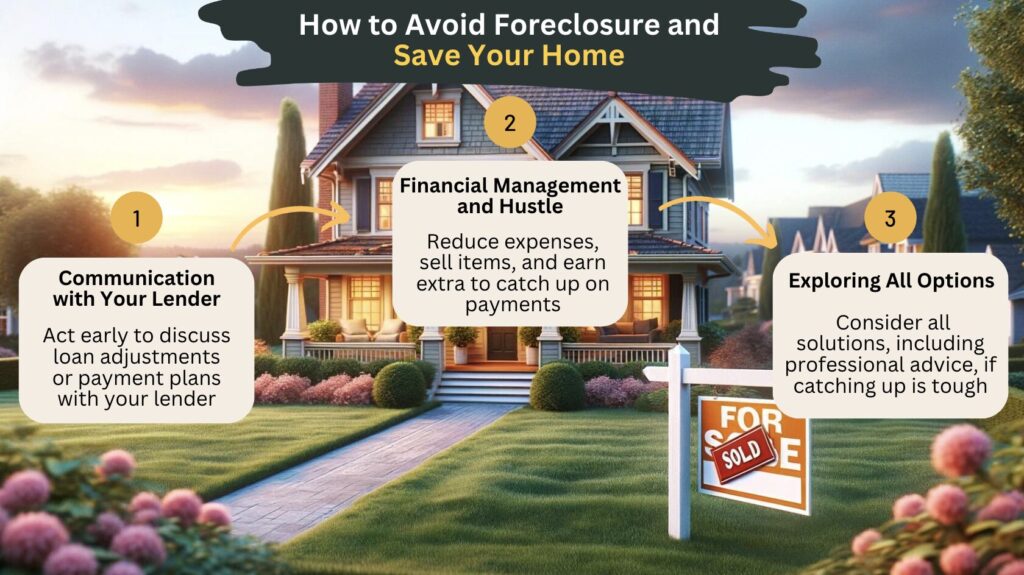

How to Avoid Foreclosure and Save Your Home

Look, I get how demoralizing and hopeless this whole foreclosure situation can feel when you’re in the thick of it. But you have to keep fighting, because there are actions you can take to potentially avoid losing your home!

Keep communicating with your lender. I can’t stress this enough – the second you think you might miss a payment, pick up the phone! Your lender may be able to adjust your loan terms, do a forbearance plan, or work out a new payment schedule to help you get back on track. But they can’t help if you don’t ask.

Do whatever it takes to get caught up. And I mean whatever it takes – get on a strict budget, cut every non-essential expense, sell off assets, pick up side gigs. Scrape together every cent so you can start chipping away at those missed payments. Your money mindset has to be “saving my home is priority #1” right now.

Explore all your options. If catching up just isn’t realistic, look into things like short sales, transferring the deed to your lender, or even bankruptcy – which can temporarily halt the foreclosure process in some cases. Talk to a real estate pro or financial advisor to understand all paths in front of you.

Conclusion

Look, I know this foreclosure nightmare is incredibly tough. The idea of losing your home – the place where you’ve made so many memories – is absolutely gut-wrenching. When you’re in the thick of it, it can feel hopeless like there’s no light at the end of the tunnel. Trust me, I’ve been there, and it’s brutal.

But you cannot give up. You have to keep fighting tooth and nail for your home. Lean on your friends and family for support during this stressful time. Don’t be afraid to ask for help – talk to financial advisors, housing counselors, anyone who can guide you. There are people and resources out there, you just have to seek them out.

More than anything, don’t just stick your head in the sand and wait for the worst to happen. Explore every single possible option and solution, even the ones that feel difficult or painful in the moment. Drastic times may call for drastic measures like taking on a second job, downsizing dramatically, or whatever it takes to start chipping away at those missed payments.

I know you’ve got this inner strength to push through. If you stay persistent, proactive, and positive, you can beat the odds and avoid foreclosure. It won’t be easy, but I’m rooting for you every step of the way. You’ve got this, my friend. Don’t ever stop fighting for your home.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.