In the competitive world of multifamily real estate investing, the role of effective property management cannot be overstated. It’s not just about maintaining properties; it’s about strategically enhancing their value. This comprehensive guide delves into the various aspects of property management and how they impact the value of real estate investments.

The Impact of Professional Property Management on Asset Value Growth

Effective property management goes beyond basic maintenance. It’s an essential component in ensuring the growth of your real estate asset’s value. Professional property managers bring expertise in various areas including tenant relations, financial management, and regulatory compliance, all of which contribute to the overall value of your property.

Key Strategies for Property Value Enhancement in Multifamily Investments:

Regular Maintenance and Upgrades: Ensuring the property is not only maintained but also periodically upgraded plays a crucial role in value enhancement.

Tenant Satisfaction: Happy tenants lead to lower turnover rates and higher occupancy rates, which are critical factors in a property’s valuation.

Efficient Operations: Implementing cost-effective operational strategies reduces expenses and increases the net operating income, a key determinant of property value.

Table 1: Impact of Property Management on Real Estate Value

| Factor | Impact on Value |

|---|---|

| Maintenance and Upgrades | Direct Increase |

| Tenant Satisfaction | Indirect Increase |

| Operational Efficiency | Direct Increase |

Benefits of Efficient Property Management in Multifamily Housing

The multifaceted benefits of efficient property management extend well beyond the upkeep of the physical property. It encompasses financial acumen, market understanding, and a strategic approach to tenant relations.

How Good Management Practices Affect Real Estate Investment Returns

Good management practices directly correlate with the financial performance of your real estate investment. This includes optimal rent setting, efficient budgeting, and effective cost management, all contributing to higher investment returns. Effective property management also involves understanding and adapting to market dynamics, which helps in setting competitive rents while ensuring profitability. Proactive asset management, including regular property assessments and timely enhancements, keeps the property appealing to current and prospective tenants.

The Interplay Between Tenant Satisfaction and Real Estate Valuation

A satisfied tenant is more likely to renew their lease, reducing vacancy rates and ensuring a steady stream of rental income. The stability and predictability of income are vital for the valuation of multifamily properties. Furthermore, high tenant satisfaction leads to positive word-of-mouth, enhancing the property’s reputation and attractiveness in the market. Satisfied tenants are also more likely to accept reasonable rent increases, contributing to a steady growth in revenue.

List of Practices for Enhancing Tenant Satisfaction:

-

Quick Response to Maintenance Requests

-

Regular communication and updates

-

Providing amenities that match tenant needs

-

Ensuring a safe and secure living environment

This holistic approach to property management not only benefits tenants but also aligns with the financial goals of property owners, creating a win-win scenario for both parties.

Click here to learn more and subscribe to the newsletter

Operational Excellence in Property Management and Its Effect on Rental Yields

Operational efficiency in property management is a key factor in maximizing rental yields. This encompasses everything from cost-effective property maintenance to streamlined administrative processes. By reducing operational costs, the savings can be passed onto tenants in the form of competitive rents, or reinvested into the property to further enhance its value. Operational excellence not only means performing tasks more efficiently but also involves smart decision-making that positively impacts the bottom line.

Improving Financial Performance of Managed Real Estate Assets

Efficient financial management is central to the success of any real estate investment. This includes meticulous budgeting, effective cost control, and strategic reinvestment. By focusing on these areas, property managers can significantly improve the financial performance of real estate assets. Adopting a data-driven approach to financial management allows property managers to make informed decisions, forecast future trends, and adapt to market changes more effectively. This proactive stance ensures that the property remains profitable and competitive in the market.

Cost-Effective Maintenance Strategies for Long-Term Value Preservation:

Preventive Maintenance: Regular checks and upkeep to prevent major repairs. This approach not only saves money in the long run but also ensures that the property remains in top condition, enhancing tenant satisfaction and property value.

Vendor Relationships: Building strong relationships with suppliers and contractors for better pricing. By negotiating favorable terms and ensuring quality service, property managers can significantly reduce maintenance costs.

Energy Efficiency: Implementing energy-efficient practices to reduce utility costs. This not only lowers operational expenses but also appeals to environmentally conscious tenants, potentially increasing the property’s marketability.

Technology Integration: Utilizing modern technology for property management tasks can streamline operations, reduce manual errors, and save time. For example, using property management software for tasks like rent collection, lease management, and maintenance requests can significantly enhance operational efficiency.

These operational strategies contribute to a more efficient, cost-effective management approach, which is essential in today’s competitive real estate market. By focusing on operational excellence, property managers can ensure their properties not only meet but exceed the expectations of both tenants and investors.

Get your free “2024 Real Estate Market Outlook” now!

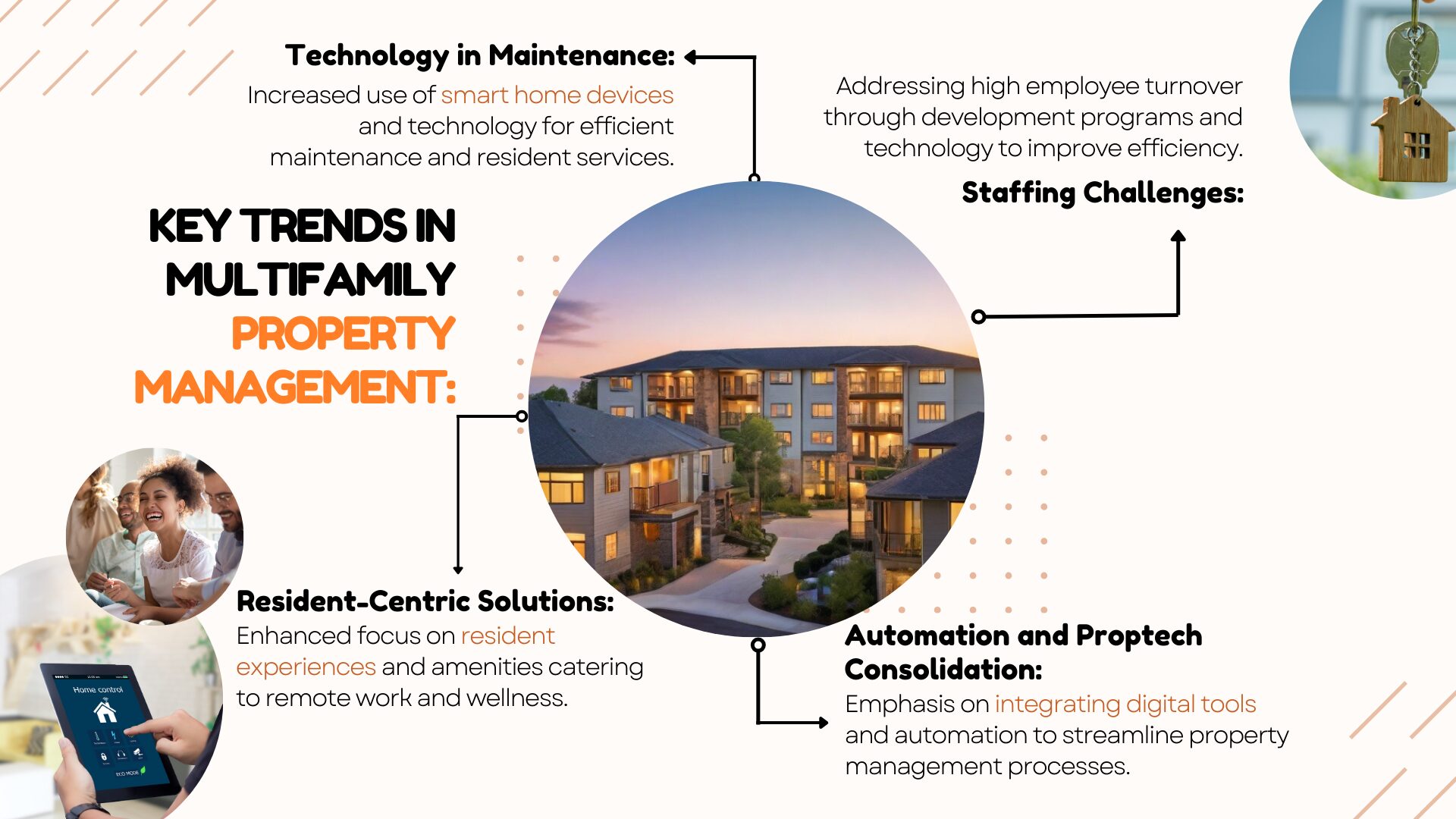

The Future of Multifamily Property Management: Trends and Predictions

The landscape of property management is in a constant state of evolution, with new trends and technologies emerging at a rapid pace. For property managers, staying ahead of these trends is not just beneficial; it’s crucial for maximizing the value of their investments.

Sustainability: A Necessity, Not a Buzzword

Sustainability has transitioned from being a mere buzzword to an absolute necessity in property management. Implementing sustainable practices is no longer an option; it’s a fundamental requirement. Not only do sustainable initiatives reduce the environmental impact of multifamily properties, but they also have a direct impact on their marketability and, consequently, their value.

Property managers are increasingly incorporating sustainable features into their properties, such as energy-efficient lighting, eco-friendly building materials, and waste reduction programs. These initiatives not only appeal to environmentally conscious tenants but also result in lower operational costs. Reduced utility expenses and the potential for government incentives for eco-friendly practices contribute to higher net operating income, a key driver of property value.

Leveraging Technology for Enhanced Property Management Efficiency

In the digital age, the use of technology in property management has become indispensable. Property managers are leveraging a wide range of technological solutions to enhance operational efficiency and, in turn, boost property value.

From automated tenant communication systems that streamline requests and notifications to advanced property management software that centralizes essential tasks, technology plays a pivotal role. Tenant portals allow renters to pay rent online, submit maintenance requests, and access important documents with ease. Property managers benefit from reduced administrative workloads, improved communication with tenants, and the ability to track and analyze property performance in real-time.

Moreover, the integration of smart home technology is gaining momentum in multifamily properties. Smart locks, thermostats, and security systems enhance security and convenience for tenants while offering property managers remote control and monitoring capabilities. This not only increases tenant satisfaction but also adds to the property’s perceived value.

Predictive analytics and data-driven decision-making are also on the horizon for property management. These technologies enable property managers to anticipate maintenance needs, optimize rental pricing based on market trends, and make informed investment decisions. By proactively addressing issues and maximizing rental income, property managers can boost property value over time.

Conclusion

In conclusion, effective multifamily property management is essential for boosting property value. By focusing on tenant satisfaction, operational efficiency, and proactive maintenance, investors can optimize their financial returns and ensure the long-term success of their real estate assets. Embracing sustainability practices and leveraging technology trends will be instrumental in staying ahead in the competitive world of real estate investing.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.