Did you know that over 50% of commercial real estate is bought by private investors? I didn’t. I thought it was all institutions. Turns out – this is not the case! Who are those “private investors”?

It could be either high net worth individuals (a.k.a. “very rich people” and their family offices) or syndicators (people who pull investors’ money together to buy real estate deals; min investment is often $50K). Syndicators’ backgrounds vary; I met investors that came from all walks of life – doctors, lawyers, engineers, pilots, fire fighters, accountants, psychologists, management consultants, marketing professionals, you name it. Finally, former finance people (me!) even though I am surprised why more bankers and hedge fund/private equity professionals don’t go into real estate – their skill set is directly transferable and real estate is one of the easiest businesses to start.

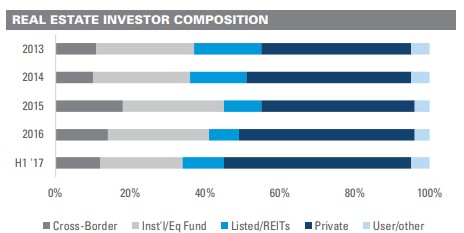

Below is the chart from a Viewpoint report published by Integra Realty Resources (https://www.irr.com/reports/IRR%20Viewpoint%202018.pdf):

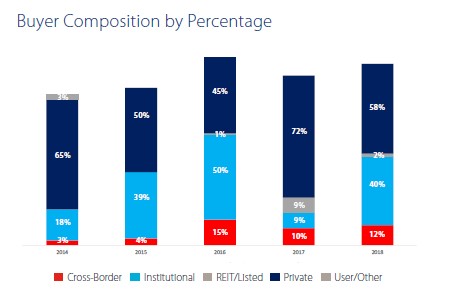

As you can see, private investors comprised more than 50% of the group in 1H2017. Another piece of data comes from the recent Avison Young Multifamily report for Triangle area (Raleigh/Durham/Chapel Hill in NC):

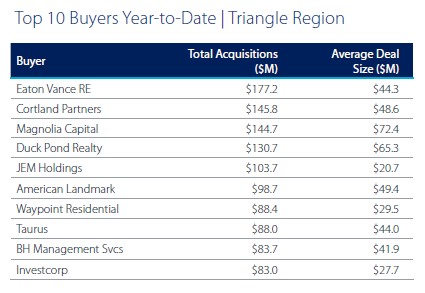

Again, similar trend here – private investors are the dominating group by volume. Top 10 investors, however, are mostly institutional – let’s look at the chart below:

My educated guess is that the institutional money mostly chases Class A assets and the percentage of private investors in only Class B/C value-add multifamily assets would be even higher. Also, institutional investors go for larger deals. From our conversations with commercial real estate brokers for example, large properties – over 200 units and over $20mm in value typically attract ~30 LOIs (“LOI” stands for “Letter of Intent” – in plain English, a first indicative, non-binding bid a buyer will submit) per deal, while smaller deals – below 150 units let’s say – typically generate lower number of bids, typically 10-15 per deal. Those number seem to work for larger and popular markets (Sunsail Capital is currently focuses on Atlanta and North Carolina markets).

How could be buying commercial real estate seemingly so easy for non-institutional folks? Well….let’s look at the financing for example. Turns out it is actually easier to get a loan for a 100 unit apartment complex than for a single family house! Any multifamily property with five or more units is considered “commercial” and as such, lenders do not look to the personal credit of the borrower but they do their own underwriting on the property itself and look to the strength of generated cash flow to decide how much they are willing to lend on it. And as of today, lenders are still all over each other to lend on multifamily deals – https://www.nreionline.com/multifamily/lenders-continue-fight-market-share-multifamily-deals.

What about equity for the down payment? Not that hard to find either. People just LOVE multifamily real estate (I certainly do!) and cannot get enough of it. And rightly so: you can get cash flow, equity build up (your tenants are effectively paying off your mortgage), price appreciation and enormous tax advantages.

To conclude, the challenge it today’s market is not finding the capital – either debt or equity – but rather finding a deal where the numbers make sense.

As always – please reach out if you have any questions/want to talk real estate or simply to say hi!

Julia

* This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.

Are you interested in learning more about multifamily real estate investing? Our team of experienced professionals is here to help. Whether you’re looking for advice on conducting market research or need assistance in identifying the best investment opportunities, we have the knowledge and expertise to guide you through the process. Subscribe to our YouTube channel to access informative videos and expert discussions on multifamily real estate investing. Follow us on Instagram for inspiring visuals and exclusive content. Additionally, explore our comprehensive course on Udemy for detailed insights and strategies in multifamily real estate investing, designed to help you succeed. Check out our new customized ChatGPTs: Real Estate Investing Coach and Real Estate.

Ready to elevate your real estate investment journey? Contact us now to schedule a consultation and take the first step towards achieving your financial goals in the real estate and land development industry.