Alright, let’s get real about one of the biggest decisions facing real estate investors – do you go for a fresh new construction property or put your money into something that’s already been around the block? It’s a doozy of a choice with pros and cons on both sides. But understand what makes each option unique and you’ll be in a much better position to pick the right investment for your strategy.

Look, I know you have worked hard to save up the money needed to invest in real estate. All of your sacrifices and discipline have paid off by allowing you to accumulate sufficient capital. However, it is now essential to ensure that you invest this hard-earned money wisely in order to generate strong returns that make those sacrifices worthwhile. That is why carefully considering the pros and cons of investing in new construction versus existing properties is so important.

What Is New Construction?

When we’re talking about new construction, we’re basically looking at homes so fresh and so clean that they haven’t even had a chance to gather dust yet. These puppies typically come straight from the builder or developer. Can’t get much newer than that! Though if custom-built is more your vibe, you can always team up with contractors and lenders to make your dream home a reality from the ground up.

But listen up – before dropping any cash on a new construction, you gotta do your homework. I mean really dig into that developer’s background – what kind of reputation do they have? How have their past projects held up over time in terms of value and quality? Don’t just take their word for it either. Chat with some of their previous buyers, comb through those online reviews, and really trust your gut instinct here.

The potential payoff with new construction? It can be huge if you play it right. You could be eligible for all sorts of sweet tax deductions and depreciation write-offs. Oh, and let’s not forget those delightfully low maintenance costs in those early years when everything is still sparkling new. That’s a major perk right there! Add in the fact that renters absolutely devour new properties and you may just have a recipe for success.

Click here to learn more and subscribe to the newsletter

New Construction Pros

Custom Build – Build it to precisely match what today’s market is craving = higher value and fatter rental profits

Lucrative Tax Deductions – Save big on taxes by deducting fixtures, finishings, and more

Immediate Equity Boost – Instant equity gains once it’s completed and that new value is certified

Adaptable Floorplan – Flexibility to create a layout with multiple units or room to expand later = more income streams

Turnkey Low Maintenance – New = low maintenance at least for the first few years

Desirable Modern Aesthetic – Shiny and modern = extremely appealing to those high-dollar tenants

Premium Tenant Magnet – Pristine shiny and modern appeal = extremely appealing to those high-dollar tenants

New Construction Cons

Prime Land Scarcity – Vacant lots in hot areas can be like gold – expensive and extremely limited. Snagging a prime piece of land may require an exhaustive search and deep pockets.

Obstructed Views – Other major developments going up around you could kill that nice view and property value. You’ll need to stay vigilant about any new construction plans that could impact your property’s appeal.

Inflated Construction Costs – High material and labor costs can make it pricier than just buying an existing property. Unexpected price surges during the build can quickly blow up your budget.

Bureaucratic Nightmares – Dealing with contractors, permits, and construction BS is a whole migraine. Navigating red tape and managing all the moving parts is a test of patience.

Zero Rental Income – You’re paying all those costs before earning a dime in rental income. Having a financial safety net is critical during this negative cash flow period.

Unpredictable Timelines – Unforeseen delays are always a risk – that move-in date may be pure fiction. Factors like weather, material shipments, and labor issues can derail schedules.

But maybe going the new construction route seems a bit too extra for you. If that’s the case, then let’s explore the other side of the coin – putting your money into an existing property that’s already got some history.

What Is An Existing Property?

When I say “existing properties” I’m talking about homes that have been around the block once or twice before. Could be an apartment complex, some funky townhouses, or your classic single-family digs. The key thing is some other lucky dog has already gone through all the headaches of getting it built from scratch.

One of the biggest draws of buying an existing place? You get to see exactly what you’re getting into well before signing on the dotted line. Make like a home inspector and visit that property at all hours to see how it operates and scope out any potential issues. With a new construction, you’re just kinda crossing your fingers until it’s done.

But of course, some of those design choices and fixtures are bound to be a little dated or just not your particular taste. So you gotta be willing to invest some cash into renovations if you want to get it freshened up and functioning perfectly for modern tenants. At least with an existing property, you know precisely what you’ll be working with from day one.

I know what you’re thinking – “vintage” and “old” just ain’t exactly selling points for some investors. But hear me out, because getting your hands on an established property has a ton of low-key advantages that are definitely worth considering:

Get your free “2024 Real Estate Market Outlook” now!

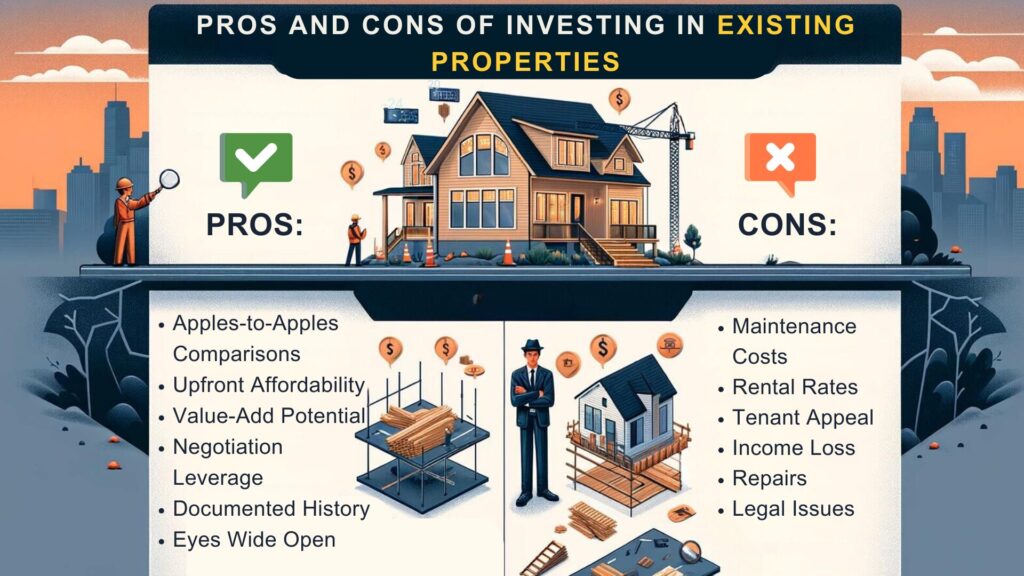

Existing Property Pros

Investing in existing properties isn’t all about navigating potential drawbacks; there are significant benefits to consider as well. These advantages provide a solid foundation for making informed, strategic investment decisions. Here’s a closer look at the perks of buying older properties:

Apples-to-Apples Comparisons – Apples-to-apples comparisons with similar properties is easy for accurate pricing. Having ample data on recently sold comparable homes takes the guesswork out of valuations.

Upfront Affordability – Typically way more affordable upfront compared to new construction. The lower entry price allows you to reserve more capital for renovations or other investments.

Value-Add Potential – Value-add plays are perfect with older properties – renovate and instantly increase those profits. Even moderate upgrades can significantly boost an aged property’s value.

Negotiation Leverage – Sellers are usually motivated so you’ve got one heck of a negotiating opportunity. Their urgency to sell can allow you to negotiate a better deal.

Documented History – Sales comps and historical data give you a clear preview of what you’re getting into. Knowing how the property has performed over time informs smarter investing.

Eyes Wide Open – No shameful surprises (in theory!) since you’ve seen the place inside and out. Being able to inspect the property thoroughly minimizes unexpected issues.

Existing Property Cons

Maintenance Costs: Be ready to set aside a decent chunk of cash for maintenance and those looming big-ticket repairs.

Rental Rates: Older properties just don’t generate those premium rental rates…at least not initially.

Tenant Appeal: Speaking of rentals, outdated properties are a harder sell to those tenants craving modern living.

Income Loss: You’ll likely lose some rental income whenever major renovations are happening.

Repairs: Age means stuff breaks – be prepared for unforeseen issues to keep popping up.

Legal Issues: Previous owners may have left you with code violations, liens, and other not-so-fun surprises.

Conclusion

In conclusion, the decision of whether to invest in a new construction property or an existing one requires carefully weighing the pros and cons of each option. New construction allows you to build exactly per current market demands, provides tax advantages, and typically has lower maintenance costs initially. However, it can be more expensive, locations may be limited, and there are additional construction headaches to deal with.

On the other hand, existing properties are generally more affordable upfront, allow you to clearly see what you’re buying, and provide opportunities to renovate and add value. The downsides are potentially higher maintenance costs, lower rent prices until renovated, and having to deal with the previous owner’s issues.

Ultimately, there is no one-size-fits-all answer – the ideal investment depends on your specific goals, budget, risk tolerance, and willingness to take on projects. Both new and existing properties can make wise investments when you do your due diligence, run the numbers carefully, and trust your instincts. The most important factor is selecting investment properties positioned to provide the returns and cash flow you need to achieve your real estate investment objectives, whether that property is brand new or already established.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.