Do you ever feel like no matter how hard you try with your finances, you just can’t get ahead? Between inflation, recessions, and life’s curveballs, it can be frustrating to feel like your money efforts aren’t amounting to much. But without laying out financial goals, it’s easy for your money to spin in circles without clear direction.

If you want to truly make progress, it’s essential to map out financial goals. Don’t panic! I’ll guide you through identifying your money targets and the route to reach them. You’ve got this!

Defining a Financial Objective

A financial goal is any monetary plan you set, whether short-term (like saving $1,000) or long-term (purchasing a home or saving for retirement). Setting life goals is wise, but financial goals mean dedicating savings and spending to support your dreams.

Money can be either a source of overwhelm or excitement when goal planning, depending on your relationship with it. With endless options, you can’t do everything at once. So let’s talk about approaching goals in an order that sets you up for lifelong financial health. But first, let’s get in the right mindset.

6 Steps to Financial Goal-Setting

Influences like your motivations, values, upbringing, and money habits impact how you set financial goals. Mapping goals requires self-reflection and intention, so make time to daydream about what you want out of life. Once your monetary wish list is set, break goals into doable steps:

– Make Your Goal Specific. Vague goals like “get better with money” or “someday upgrade my car” are hard to achieve because they lack clarity. Narrow it down. Define the area to tackle, like debt, and the specifics, like the repayment amount.

– Make Your Goal Measurable. Got debt payoff as your goal? Set an exact target amount to gauge success.

Although complete debt freedom should be the end goal, smaller milestones keep motivation high. If you have $30,000 total debt, first focus on the smallest debt, like a $15,000 student loan. Tracking progress toward a clear target matters.

– Give Yourself a Deadline. Goals without deadlines are easily put off. Set a challenging but doable timeframe to accomplish them.

Going back to the $15,000 student loan example – when do you want to pay it off? If one year, you need to pay $1,250 monthly. Find the sweet spot between possible and pushing yourself.

Short-term financial goals can be tackled in under 5 years. Long-term monetary aims, like retirement, may take 5+ years. Some examples:

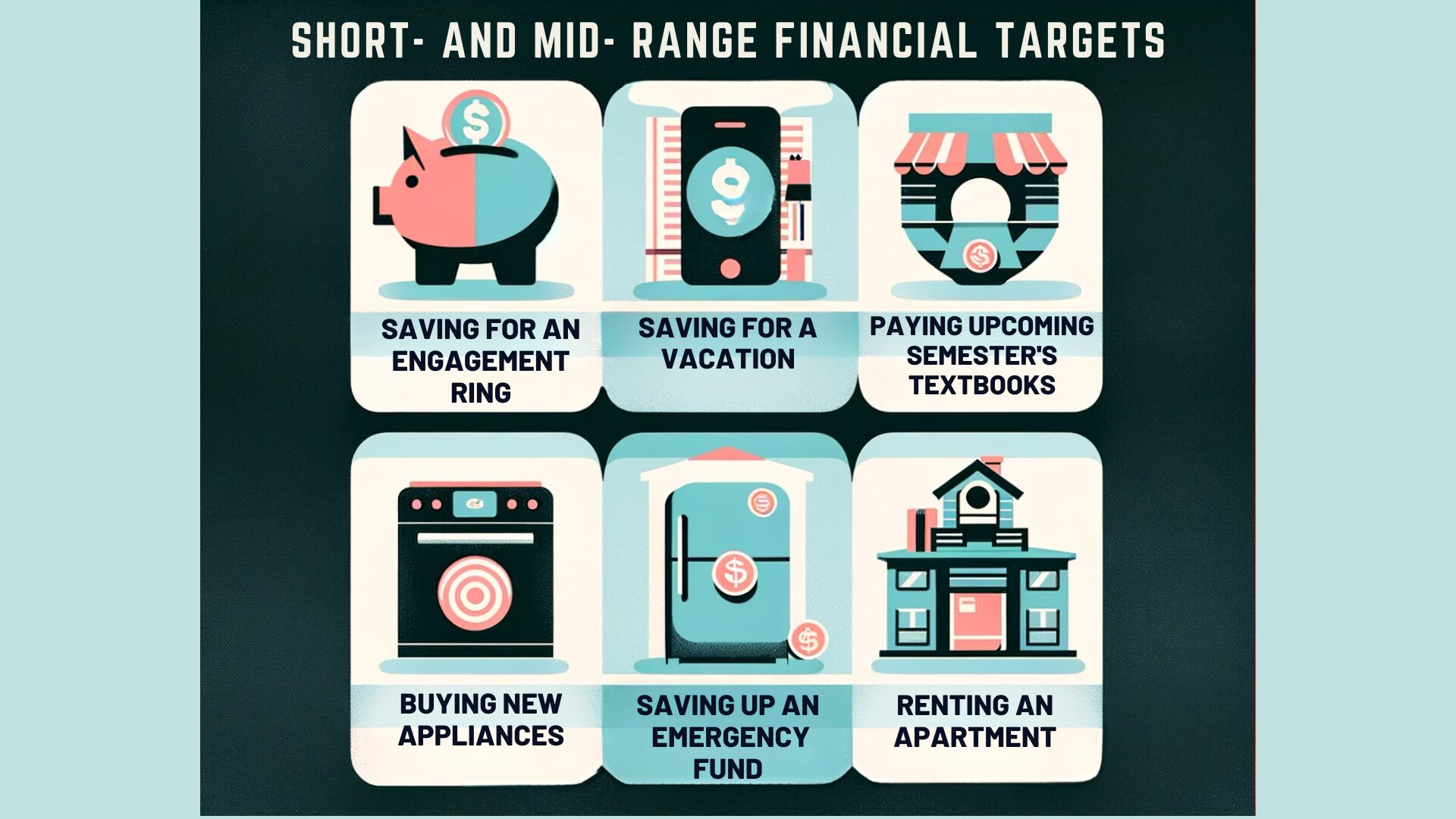

Short- and Mid-Range Financial Targets:

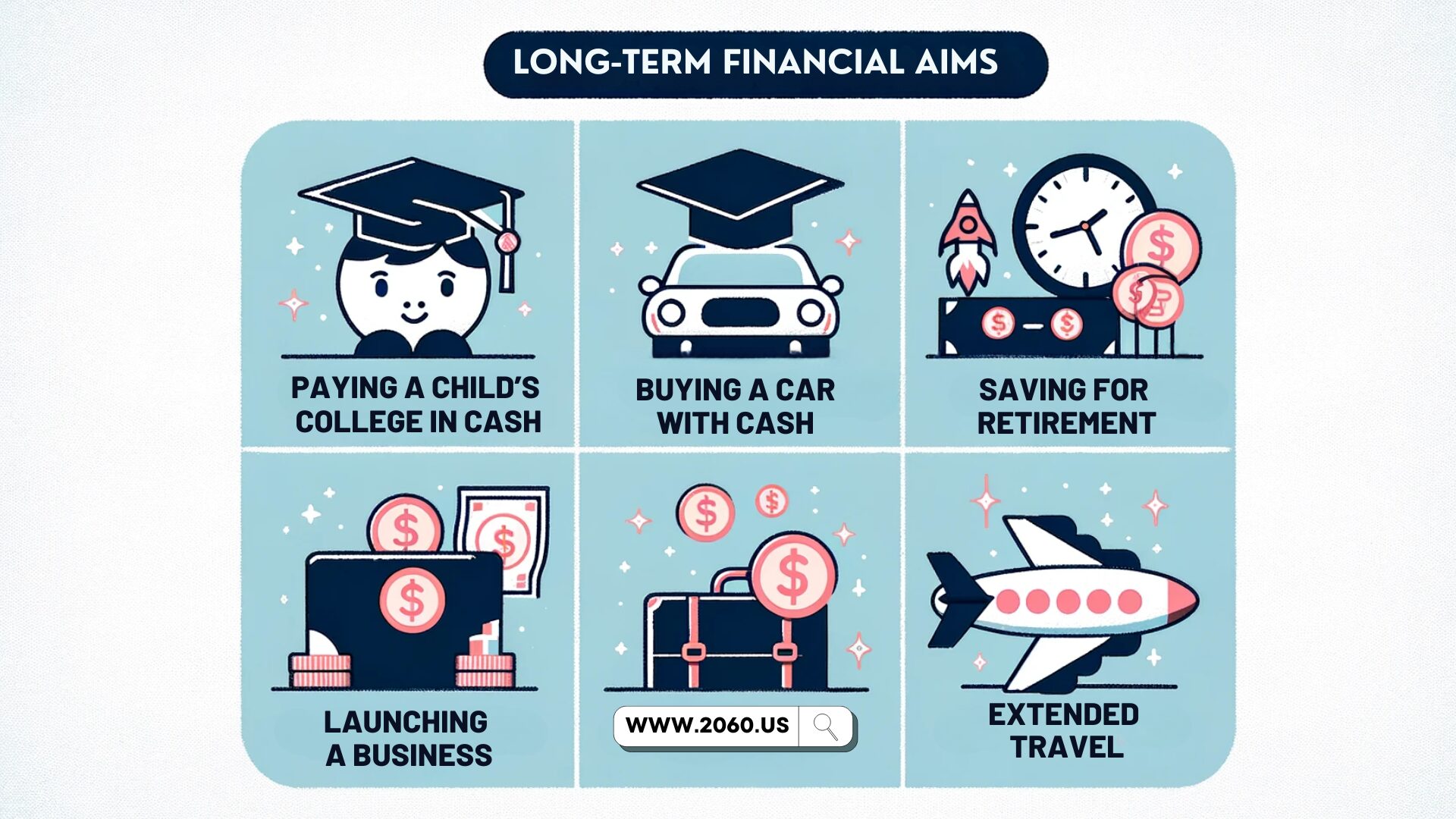

Long-term Financial Aims:

– Make Sure They’re Your Goals. Comparing yourself financially helps no one. Make choices right for you, not just because friends renovate kitchens or influencers take dream trips. Define why you’ve chosen your aims.

– Write Your Goal Down. Studies show writing down goals boosts achievement. Jot them down! Put reminders on your mirror or phone to stay on track.

– Get a Goal Buddy. Sharing your journey with others – a spouse, friend, or community – brings motivation through accountability and cheers.

Click here to learn more and subscribe to the newsletter

5 Financial Goal Examples

With endless money advice, knowing where to start can be confusing. That’s why I recommend the Baby Steps money plan. It guides you to save, pay debt, and build wealth in a proven order.

Unsure where to start? Here are some common financial goals and tips:

– Create and Follow a Budget. Budgeting allows control of your finances and progress toward targets. It’s a spending plan aligning income and expenses, telling dollars where to go instead of wondering where they went. Budgeting brings confidence through intentional money moves toward aims.

– Build an Emergency. Fund When surprise expenses like car repairs or medical bills strike, an emergency fund prevents debt. Start with $1,000, tackle debt, then save 3-6 months’ expenses. With a full emergency fund, you’re prepared for life’s curveballs.

– Eliminate Debt. Debt holds you back financially, stopping progress. Attack it fully – realize that money going to lenders can’t build your future.

– Save for Your Dream Retirement. Envision your ideal future, perhaps in 5-30 years. Pack up grandkids for annual Disney trips? Tour a new state with your spouse each quarter? Stay home reading? Take up painting or world cuisine classes?

No matter your retired dreams, investing 15% of income now makes them possible. With zero debt, all those freed-up payments can build that retirement instead!

– Reduce Spending, Increase Saving. Vague “spend less, save more” goals need specifics to succeed. Changes like budgeting, deal hunting, couponing, earning more income and saying no (even to yourself) allow lifestyle shifts toward saving. Meal planning is hugely impactful – food is most Americans’ top overspend.

Get your free “2024 Real Estate Market Outlook” now!

Why Financial Goals Matter

Goals bring future focus to money decisions. You see how daily choices compound into overall financial health.

Without aims, buying breakfast out daily seems harmless. But let’s assess the true cost. Spending $25 per workweek on lattes is $100 monthly. What else could that money do?

Investing $100 monthly for 5 years could grow to over $8,000 thanks to compound growth – think, that’s a whole college semester drinked away.

Fifteen years of $100 monthly investments could yield over $45,000.

Thirty years? Over $280,000. I like coffee, but not that much!

Making small sacrifices now sets up financial security later. Daily money habits absolutely impact your future.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.