The decision to buy a home is one that is ever-present, but 2025 is an incredibly interesting period in real estate. With changing mortgage rates and inventories in motion, buyers must exercise careful consideration in choosing an option. There are those who say entering the market at current times is a sound decision, but caution is advised for others. In this article, we will explore factors at play in homeownership in 2025 and whether entering at present is a sound move for you.

The Current Status of the Real Estate Sector

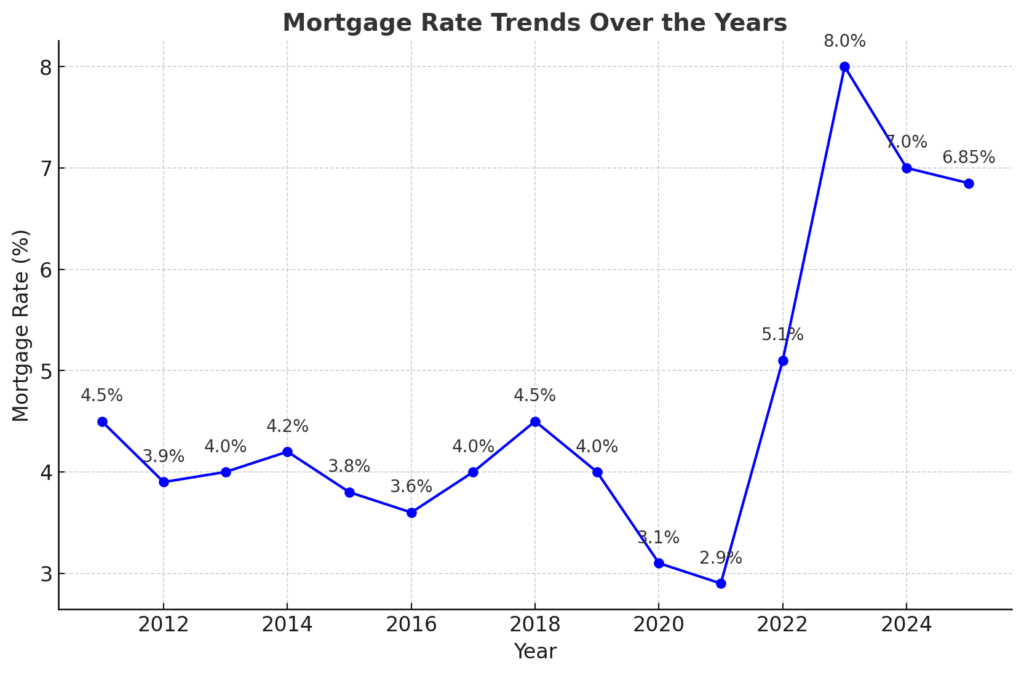

Over the decade, mortgage rates have seen rapid fluctuations. Rates between 2011 and early 2022 averaged under 5%, and homeownership became relatively cheap for most homeowners. Rates soared over 8% in October 2023, having a deep impact on lending price. As of early 2025, mortgage rates have steadied at 6.85%, a level over 2022 but less extreme recently

Many homebuyers waited for significant rate drops when the Federal Reserve reduced interest in late 2024, but the marketplace hasn’t been predictable. Rates will most likely drop moderately in 2025, but one cannot procrastinate forever, for price and demand will have an impact, too. CoreLogic foresees a mild price gain of 2.3% through September 2025, representing steady but not dominating growth.

Click here to learn more and subscribe to the newsletter

Should You Buy a House in 2025?

Experts agree that the answer to this question depends on personal financial readiness rather than market speculation. Below, we examine reasons why purchasing a home this year could be a smart move—as well as reasons why waiting might be more prudent.

Reasons to Buy a Home in 2025

Increased Inventory & Reduced Competition – Home availability in most regions rose, minimizing bidding contests and smoothing out prices, and making terms easier to negotiate.

Potential for Decline in Interest Rates – Rates will not fall to 2022 lows, but most view a moderation in the latter part of 2025 to assuage concerns regarding affordability.

Long-Term Cost Certainty – Unlike with renting, and its concomitant annual price inflation, homeownership fixes monthly payments, protecting them from inflation.

Motivated Sellers – Some sellers, having waited out the high-rate period, can re-enter the marketplace, offering more alternatives and deeper discounts for buyers.

A real estate broker affirms that financial preparedness is key: “If one possesses a strong down payment, secure income, and a healthy level of debt, buying a property can mean long-term financial security.”

Reasons to Wait Before Buying

Affordability Challenges – Despite increased inventories, high payments for mortgages and rising homeowners’ insurance costs can make homeownership fiscally burdensome for part of buyers.

Market Uncertainty – Unexpected fluctuations in mortgage rates or housing prices can cause buying too early to result in overpayment or a state of negative equity.

Alternative Investment Solutions – In a high-interest environment, in specific cases, leasing and investing in alternative assets can potentially yield a larger financial return compared to buying a property.

Potential for a Rate Decline – There is no guarantee, but waiting until later in 2025 could mean securing a bettershaped mortgage in case rates drop even lower.

Real estate developer advises: “I’m waiting in anticipation of fall 2025 when rates will drop even lower. The greatest risk is buying and then having the market drop afterwards.”

Comparing Homeownership with Rental in 2025

While homeownership can mean security and future wealth accretion, leasing can mean freedom of movement—one important consideration for career changers and financial unpredictability. In regions with persistent high housing values even during times of fluctuating rates, leasing can even be a smarter move.

However, if 2025 continues to witness price appreciations, buying will become a smarter financial decision in the long run future. Prospective buyers will then have to pit calculated mortgage payments (including property taxes, insurance, and maintenance) with rentals in the surrounding location in deciding whether to buy a property.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

The Best Way for Prospective Customers

Whether you choose an early 2025 purchase or a delayed 2025 purchase, preparation is paramount. Observe these steps in order to maximize your chance for a good bargain:

Improve Your Credit Rating – Higher credit scores mean more favorable mortgage terms.

Save for a Higher Down Payment – Saving for a down payment can make payments smaller and save private mortgage insurance (PMI) payments.

Get Pre-Approved – Having an awareness of your lending capacity simplifies your new home search and positions you as a powerful, competitive buyer.

Research Local Markets – Trends in your region will vary, therefore use your region specifically, not national statistics

Conclusion

Making the Best Decision for Your Context Deciding whether to buy a home in 2025 will rely on individual financial readiness, current marketplace locally, and long-term goals. Affordability will remain a dominant concern, even with trends in a less tumultuous housing marketplace in contrast with years past. Consumers who become economically prepared and inform themselves will stand the best opportunity for a sound decision. Buying in 2025, in any case, will depend on homeownership aligning with your overall financial security and life goals.

*This article is based on publicly available sources and is intended for informational purposes only. We do not claim ownership of the content used and encourage readers to refer to the original materials from their respective authors.

Follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

* Disclaimer: The content provided on this website is intended for educational and informational purposes only and does not constitute investment, financial, or tax advice. We strongly recommend that you consult with qualified professionals before making any financial decisions. Past performance of investments is not indicative of future results. The information presented here is not a solicitation or offer to buy or sell any securities or investments. Our firm may have conflicts of interest, and we do not guarantee the accuracy or timeliness of the content provided. Investing involves risks, and you should carefully consider your financial situation and consult with a financial advisor.