Owning a home is a serious investment, and for many, keeping their mortgage payments is their greatest concern. But accidents can happen, and you can find yourself faced with financial struggles. If you find yourself unable to pay your mortgage payments, you can find yourself wondering: what happens when you don’t pay? While stopping payments can sound like the temporary solution, the consequences can be far-reaching, including damaging your credit, your financial future, and even your ability to stay in your home. Having knowledge about the potential consequences and available options can help you make the best decision.

The Rising Problem of Mortgage Delinquencies

In 2024, delinquencies increased sharply, particularly for the nation’s veterans, the military, and first-time buyers. According to data from Intercontinental Exchange, around 2.2 million mortgages were delinquent or under active foreclosure by the year’s close.

The report also revealed the struggles encountered by the Federal Housing Administration (FHA) loans, generally held by the first-time buyers, where the delinquencies rose by 74 basis points (0.74%) for them. In the similar fashion, the delinquencies for the VA loans also rose by 80 basis points (0.8%) for them. These movements indicate the added financial strain, potentially carrying wider economic implications for the year 2025.

What Happens If Miss a Mortgage Payment

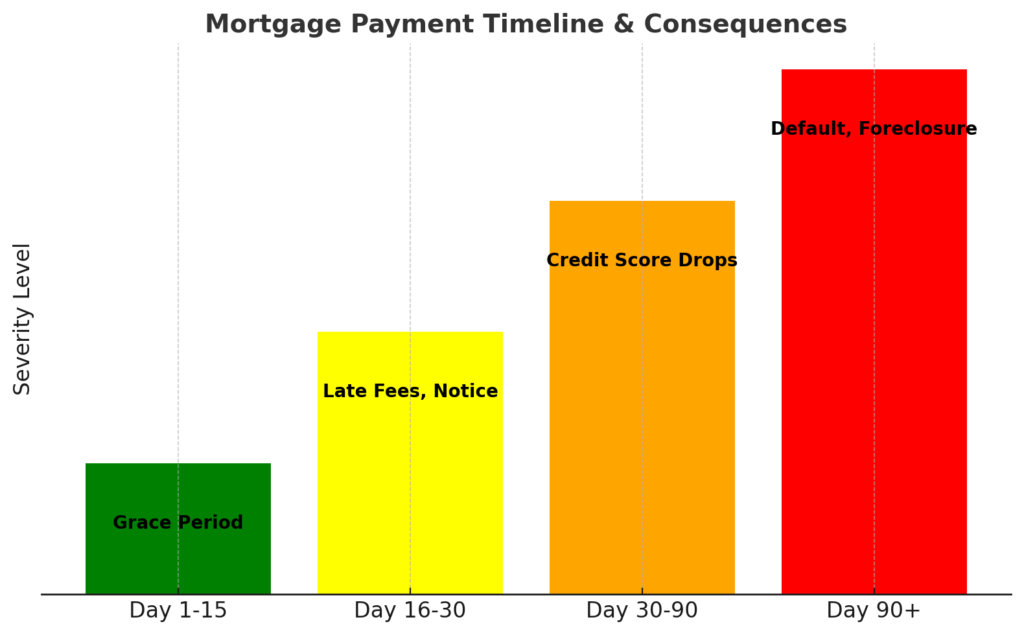

When you miss your mortgage payment, the penalties begin reasonably small but grow very quickly unless the matter is taken care of. This is the timeline for what typically happens:

Day 1-15: Most payments are due by the first day of the month. Most creditors provide a grace period (through the 15th day) prior to assessing penalties for being overdue.

Day 16-30: Late penalties and charges commence. Besides this, you will also receive a formal letter from your lender informing you about the overdue amount.

Day 30-90: If you default on the payment, the lender can report this delinquency to the bureaus, negatively affecting your credit score. Multiple delinquencies will make your credit rating fall even lower.

Day 90+: If you fail to make payments, the loan will default, and the foreclosure process will initiate. This can lead to the filing of suits and eventually the loss of your property.

Click here to learn more and subscribe to the newsletter

How Does Skipping Mortgage Payments Impact Your Credit?

Your credit score is one of the very beginning things you will damage when you default on your mortgage. Miss payments on your mortgage and the bureaus will report them after 30 days’ worth of non-payment, causing your credit score to immediately dip. The larger the non-payment period, the worse the damage. Bankruptcy or foreclosure will stick around for seven years, keeping you from being able to secure loans for the future or even rent property.

The effect of defaulting on a mortgage is much like defaulting on other significant loans, including car loans and personal loans. Yet, since the mortgage is secured by your house, the penalties can be worse, resulting not only in monetary loss but also displacement.

How Long Before Foreclosure Happens?

Foreclosure laws also vary from one state to the next, but the lender will typically initiate the process after six months’ non-payment. In the meantime, the lender will make some efforts towards reaching you for potential resolutions, but when nothing is attained, the lender can initiate the repossession of the house. This can take the form of several months up to one year, dependent upon the regulations provided by the state and the processes adopted by the courts.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

What Are My Options If I’m Having Trouble Paying My Mortgage?

If you’re under financial duress, the solution is not to ignore the situation. Talking things over with your lender can reveal multiple avenues for avoiding foreclosure and limiting the impact on your credit. These are some common resolutions:

If You Want To Stay In Your Home

Forbearance: Your lender may allow you to postpone or reduce payments for some short period of time. This is useful for short-term financial crises.

Loan Modification: Negotiate the terms of your mortgage, including the lengthening the terms of the loan or the reduction of the interest rate, to make payments easier.

Repayment Plan: If you fall behind but your financial situation will improve, the lender can allow you to pay the shortfall through reduced, affordable payments over time.

If You Need To Leave Your Home

Deed-in-Lieu of Foreclosure: You surrender your property voluntarily to the lender for partial or complete cancellation of the debt.

Short Sale: If your house is worth less than the balance you owe, you can sell your property for less than the balance owed, avoiding the lender from doing a full foreclosure.

Conclusion: Take Action Before It’s Too Late

Stopping mortgage payments may seem like the last resort when things turn tough financially, but the consequences can be devastating over the long run. Besides harming your credit and your financial security, halting payments also puts your home under risk. If you happen to find yourself here, you need to immediately contact your lender. Forbearance, loan modification, or repayment plans can enable you to hold onto your house and your financial future. Taking proactive steps can enable you to work through financial adversity and sidestep long-term damages.

*This article is based on publicly available sources and is intended for informational purposes only. We do not claim ownership of the content used and encourage readers to refer to the original materials from their respective authors.

Follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

* Disclaimer: The content provided on this website is intended for educational and informational purposes only and does not constitute investment, financial, or tax advice. We strongly recommend that you consult with qualified professionals before making any financial decisions. Past performance of investments is not indicative of future results. The information presented here is not a solicitation or offer to buy or sell any securities or investments. Our firm may have conflicts of interest, and we do not guarantee the accuracy or timeliness of the content provided. Investing involves risks, and you should carefully consider your financial situation and consult with a financial advisor.