Robert Kiyosaki, author of the bestselling personal finance book Rich Dad Poor Dad, has made it his life’s mission to educate people on the importance of financial education. Through his books, games, and other resources, he shares valuable insights on how everyday people can build wealth and get rich.

In this article, I will highlight four key lessons from Robert Kiyosaki that can help put you on the path to financial freedom.

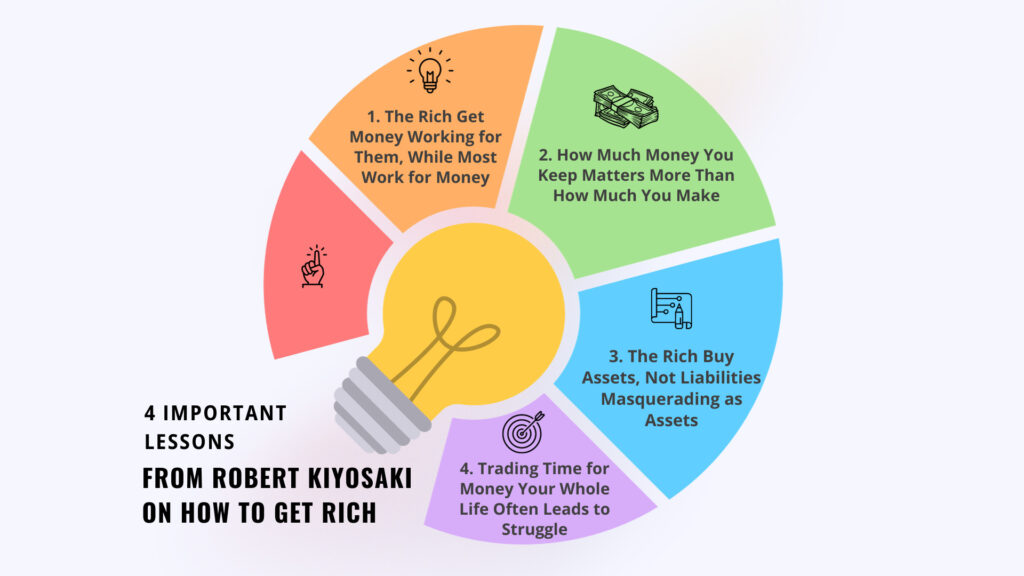

1. The Rich Get Money Working for Them, While Most Work for Money

This idea has become a cliché, so many now dismiss it as a myth. But it’s absolutely real. Ask regular folks how they earn money, and it always comes back to jobs. That’s logical early in life when you have no assets or sellable skills. A job provides that first income stream you need.

However, the rich realize quickly that jobs won’t make them wealthy long-term. To get truly rich, you need to become the employer, not the employee. You hire others to work for you. Most of us stay stuck in the job phase lifelong. We believe jobs are the only income source, trapping us there.

The rich learn business ownership young. Running a business is about leveraging resources and people to earn way more than you could by selling your labor for a wage.

As a business owner, you can focus on your highest-potential skills. Hire employees or contractors to do the other work generating income. You shift from front-line worker to overseeing the business. As the business grows more profitable, you invest some profits to compound your income.

Click here to learn more and subscribe to the newsletter

2. How Much Money You Keep Matters More Than How Much You Make

One of the biggest differences between the rich and others is emphasizing savings. For most folks, spending is the top budget priority. Saving just gets the leftovers. For example, say your monthly net income is $5,000. After expenses and some fun purchases, you save $250.

That’s only 5% of your net income saved. For many households, unexpected costs eat up even that little bit. Others give up on saving completely since the amount seems insignificant.

With the rich, especially self-made millionaires, it’s very different. Financial experts may recommend saving 10-15% of income regularly. But the aspiring rich often save 30%, 40%, even 50% or more of their earnings. No question, saving at that level requires living well below your means. But it’s temporary, since savings and investments compound over time.

Let’s use that $5,000 monthly income example again. But this person saves and invests 50% of it, or $2,500 monthly. Assuming average annual returns favoring stocks, they would have over $1,276,000 in just 20 years.

In other words, they become a millionaire in 20 years. And that’s not even factoring in potential income and savings increases over time. This shows why how much you keep makes more difference in the long-run than how much you earn.

3. The Rich Buy Assets, Not Liabilities Masquerading as Assets

A big myth about rich folks is they all inherited their money. But believing that is totally self-defeating. Look at any self-made millionaire, and they likely spent years acquiring income-producing assets.

This flies in the face of what many believe, bought into consumer culture and advertising. They “invest” in possessions seen as assets. The home is probably the best example. Most think of it as their biggest asset, devoting too much income to buying and maintaining it. But a house isn’t an income-generating asset. It actually costs money to keep. It only becomes an investment if you sell it for cash to reinvest.

Worse, most middle-class homes carry heavy financing. Understandable at first purchase, but many strip equity through second mortgages and home equity lines when equity builds. Others serially refinance, taking cash out every few years. While home value rises, so does debt.

Other non-income “assets” are cars, recreational gear, furniture, entertainment items, and vacation homes. Feel good to own, but produces no income.

Typical rich-people assets are stocks, bonds, investment funds, rental real estate, REITs, and businesses. All can generate steady income, appreciation, or both. Over time, income asset growth results in higher income. Eventually, the income may fully replace having to work.

Get your free guide “Passive Real Estate Investing For Busy Professionals”

4. Trading Time for Money Your Whole Life Often Leads to Struggle

This isn’t knocking long careers working for others. But it spotlights how staying an employee often means a lifetime financial struggle. The core limitation as an employee is always trading time for money. With only so much time to give your employer, your income is capped.

But more basically, you earn less than you produce. If your work brings in $50 an hour for your company, you may only earn $25 per hour. It must be that way for your employer to profit from your labor.

There are also income limits for any job, regardless of performance. Say your field pays $50k-$75k. Even if you’re a top performer, you’ll likely never exceed $75k.

Contrast that with selling your skills independently, either business-to-business or to the public. You could easily earn $50 an hour or more. As you grow your skills and capacity, your rate can rise to $75, $100 per hour, or higher.

Self-employment has no income ceiling. The more you earn, the more you can save and invest to gain true wealth.

And with self-employment, you can take your business anywhere. So you’re free to pursue more profitable, challenging directions and even add multiple income streams.

Self-employment also enables retirement plans, like SEP IRAs and Solo 401(k)s, allowing much larger tax-deferred savings than typical employer plans.

For example, with a Solo 401(k) you can save $19,500 as the employee, plus 25% of net business income, up to $56,000. Imagine accumulating even a 7-figure balance in 15-20 years, just from the huge tax deductions. Not only does self-employment remove income ceilings, but it enables faster asset building than being an employee.

Getting Rich Requires Big Money Mindset Shifts

These lessons aren’t meant to make you feel hopeless if you’ve been handling money like most people. They’re to provide insight into how the rich get rich. It takes major behavioral changes. However embracing them as new financial habits can totally transform your money situation for the better.

Even if you can’t save/invest 50% of your income, set a reasonable goal like 20-30%. It will take longer to reach your aims, but you’ll get there. The key is, if you want meaningful financial improvement, you need more substantial money mindset shifts.

The rich have already made these mental shifts. You can become one of them by doing what they do.

Applying These Lessons to Real Estate Investing

The principles from Rich Dad Poor Dad translate very well to building wealth through real estate. Here’s how:

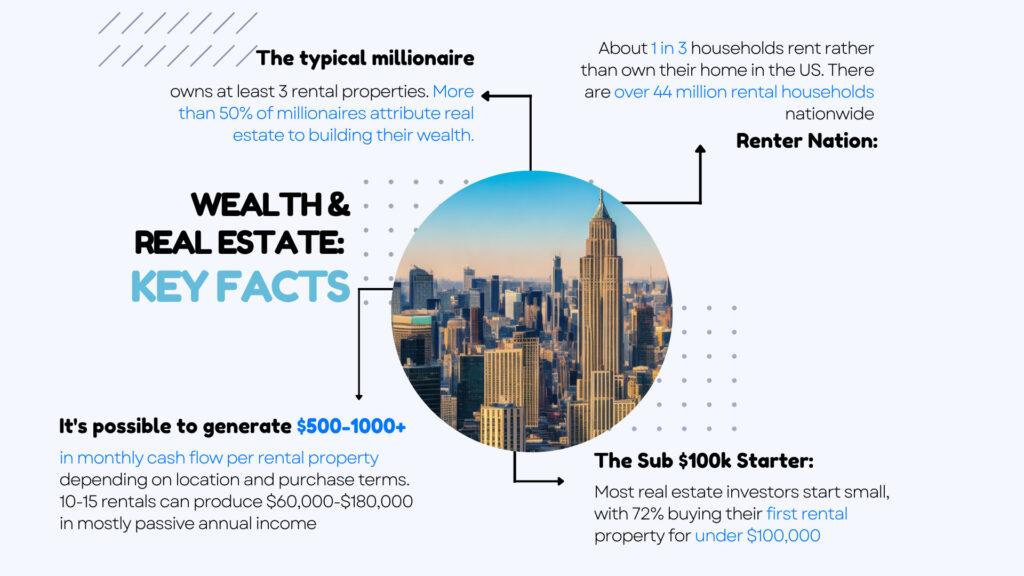

Rentals allow real estate to work for you. You earn a steady rental income without having to actively work for it. Renters pay down your mortgage, generating equity over time. This frees up your time to focus on other income-producing activities.

Save aggressively to accumulate downpayments. Real estate requires large upfront investments. Plan to save 20-30% or more of your income solely for rental property downpayments. This sacrifices short-term spending but enables long-term wealth.

Rentals generate largely passive income. After finding good tenants, you step back as a hands-off investor. Use this free time to learn about new potential properties and optimize your current assets.

Rentals appreciate over time, generating equity. This helps free up capital to acquire additional properties to expand your portfolio. Avoid the temptation to constantly cash out equity when it builds.

Manage properties responsibly. Strong tenant screening, maintenance, and finances means reliable cash flow and profits. Consider hiring a property manager to oversee day-to-day landlord duties at scale.

10-15 optimally located and maintained rental properties can generate six figures in annual income. Enough passive cash flow to replace a full-time job income and achieve financial independence.

Use a Self-Directed IRA to invest in real estate tax-free and grow it into a sizable nest egg. Much more tax-advantaged growth potential than conventional employee retirement accounts.

The key is approaching real estate systematically like an asset-building business, not simply buying a home. Done right, rental properties set you financially free by generating continuous passive income.

Conclusion

Robert Kiyosaki’s Rich Dad Poor Dad philosophy clearly demonstrates that real estate, when approached properly, is one of the most powerful asset-building tools available.

Owning rental properties means generating largely passive income that can eventually replace your active job earnings. As an investor, you acquire assets that work for you, appreciate over time, and provide continuous cash flow.

But real estate wealth doesn’t happen overnight. You must live frugally, save aggressively for down payments, start small, and reinvest profits wisely. Patience and discipline will compound modest beginnings into an income-producing rental empire.

Don’t expect to adopt the Rich Dad mindset quickly or completely. But incrementally shift your money behaviors toward building real estate assets over liabilities. Optimize your properties, tenants, and finances. Scale up sensibly.

With a few rentals, you gain financial breathing room. With 10-15 optimized properties, you can achieve financial independence. With a passion for real estate and the Rich Dad principles, your possibilities are unlimited.

The journey starts with a single smart step. Commit to regular savings for your first down payment. Find a profitable starter property. Learn landlord skills. Your future rental fortune awaits.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.