Raise your hand if you want to be financially secure! I’m guessing every single one of you has your hand up right now. And why wouldn’t you? Financial security is the dream, isn’t it? Having total peace of mind when it comes to your money, knowing you can handle whatever life throws your way without stressing out.

But even though we all want that sense of security, the truth is, not many people actually experience it. More than a third of Americans say they are struggling or in crisis mode with their finances, according to the latest data. That’s a staggering number! And it shows there’s a huge gap between what we want and what we’re able to achieve when it comes to our money.

I’ve got good news for you though: Bridging that gap and achieving true financial security is possible. Even if you’re drowning in debt right now or you’ve made countless money mistakes throughout your life. Or if you haven’t saved a single penny for retirement yet. You can turn things around and get to that secure place we all dream about. It will take hard work, discipline and patience, but I’m going to show you the proven path to get there.

What Is Financial Security?

So what exactly is financial security? It’s reaching that point where you’re living completely debt-free, able to pay all your bills each month with money left over, consistently investing for retirement, and keeping a solid emergency fund in the bank.

With financial security, you have the confidence that you can survive financially no matter what chaos life throws at you. You know that even if you lose your job, get stuck with massive medical bills, or face some other financial storm, you and your family will be just fine. That sense of peace and confidence around your money is true financial security.

Click here to learn more and subscribe to the newsletter

Why Is Financial Security Important?

Let’s be honest, we live in an uncertain world where anything can happen at any time. Your car could break down tomorrow, needing thousands in repairs. Your company could lay you off without warning. A global pandemic could disrupt everything. With so much that’s unpredictable and out of our control, being financially prepared is crucial.

That’s why financial security is so vital. When you’ve put in the hard work to get there, you can handle those unexpected emergencies or life events without going into a panic. They become mere inconveniences instead of full-blown crises. True financial security means having the ability to roll with pretty much any punch life throws at you from a money perspective. And really, what could be more important than that?

5 Ways to Achieve Financial Security

If you want this level of financial peace and confidence, you have to be intentional about making it a goal and sticking to a proven plan to get there. It won’t happen by accident or overnight. Some of these steps may take you a year or two to complete. But trust me, after helping millions of people get their money headed in the right direction over the last few decades, I know the journey will be worth every bit of effort.

1. Start living on less than you make

The first step is keeping more of the money you bring in each month. Look, your paycheck is the key that will unlock your ability to build wealth and achieve financial security. It’s your most powerful wealth-building tool. So you have to get intentional about spending less than you make.

If you’re spending every last penny of your income month after month, you’ll never get ahead. You’ll stay stuck in the paycheck to paycheck cycle, scrambling to make ends meet, with no buffer to handle emergencies or ability to build up savings.

Living on less than you make, and banking the difference every month, is the first big key that will allow you to build up that emergency fund, pay off debt, and start investing consistently. Proverbs 21:20 says “The wise have wealth and luxury, but fools spend whatever they get.” That verse captures the essence of what you need to do here—be wise and wealthy by spending less than you earn.

2. Avoid Credit Cards

What’s one of the biggest roadblocks that keeps people from living on less than they make and being able to bank money? Credit cards. Oh, I know there are arguments out there in favor of keeping cards for the rewards and perks. But hear me out.

While those airline miles and cash back bonuses are enticing, they’re also a trap. In order to really rack up those juicy rewards, you have to spend huge amounts of money you probably wouldn’t spend if you were using cash. And people rarely stick to the plan of paying the balance off in full each month to avoid interest charges.

The fact is, the average credit card balance in America right now is over $6,300. All for some free travel and bonus bucks that you’ve paid thousands in interest to get. It’s just not worth it! Those cards and the debt they lead to put a huge dent in your ability to become financially secure.

3. Pay off your debt

This one is absolutely critical. Debt is a dream killer, plain and simple. Every single dollar you owe to someone else is money that can’t be used to build wealth and achieve your bigger goals. When you have debt, you’re making someone else rich instead of yourself! You have to get intentional about getting out of debt completely.

Start using the debt snowball method our team has taught for decades. List out all your debts from smallest to largest, paying minimums on the larger ones and as much as possible towards the smallest one. Once the smallest is paid off, you take that payment and add it towards the next debt on the list. Do this over and over until everything is paid for good.

Getting out of debt will likely mean making short-term sacrifices and going on a serious budgeting kick. You may need to cut restaurant spending, keep driving your current car for longer than planned, or pick up a side hustle to throw extra money at your debts. It will be tough in the moment, but just think about how freeing life will be when you finally shake all those payments!

Get your free “2024 Real Estate Market Outlook” now!

4. Build up an emergency fund

Once you work your way out of debt, one of your first orders of business has to be saving up an emergency fund. This is crucial for avoiding the trap of going back into debt when unpredictable expenses pop up, which is inevitable in life.

Without an emergency fund, a car repair or replacing a broken appliance means you’re stuck using credit cards and digging yourself into a hole again. But with cash reserves set aside for a rainy day, you can simply write a check and keep moving forward without any added stress or drama. Peace of mind like that is priceless.

So while working to get out of debt, start with a starter emergency fund of $1,000. Then once you’re debt free, make it a priority to build up 3-6 months of expenses in a separate emergency fund account.

5. Invest 15% for retirement

The last key step to solidifying your financial security for life is to invest for retirement. We’re talking about consistently putting away 15% of your income once out of debt and once that full emergency fund is in place.

If you start investing 15% of a $60,000 income at age 30 and keep it up until retirement, you’ll have around $3.5 million waiting for you at age 65 based on compound growth over time. That’s the dream! And even if you don’t start investing until later in life, getting that 15% in for as many years as possible will mean over $1 million waiting for you in retirement based on some basic math.

The key is putting it into good growth stock mutual funds inside of tax-advantaged accounts like 401(k)s and Roth IRAs. This lets your money grow and compound even faster over time, setting you up with wealth that lasts into your golden years. Hitting that 15% goal should be the top priority after you knock out debt and have your emergency fund stocked up.

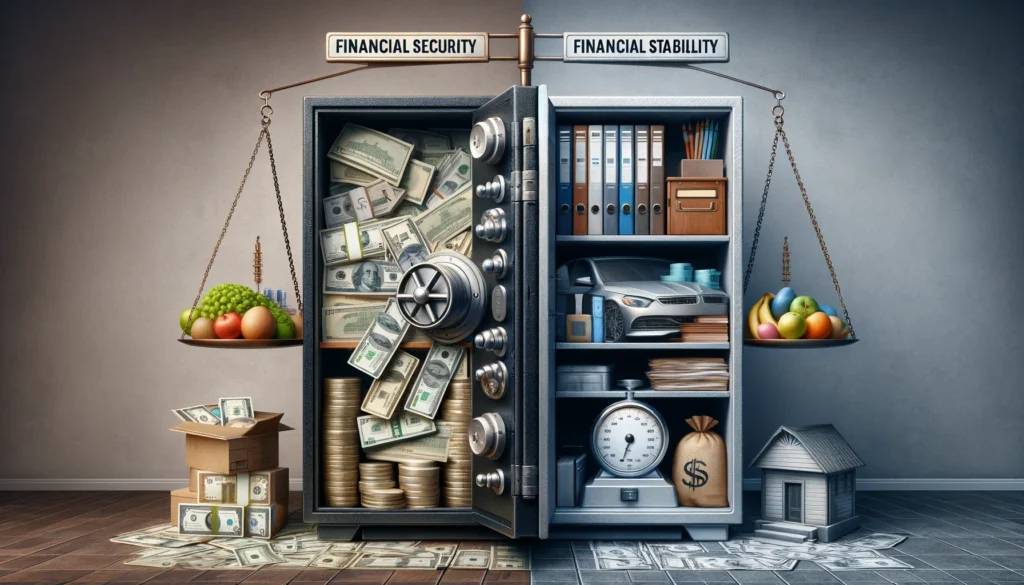

Financial Security vs. Financial Stability

One last thing I should clarify—the difference between being financially secure and financially stable. These terms are often used interchangeably, but they do have a bit of a distinction.

Financial stability is what you experience first, once you get out of debt and maybe even have a little money in the bank. You’re able to pay all your bills on time and handle moderate emergencies that pop up using cash on hand.

But true financial security takes that a step further. Not only are you able to cash flow your life and deal with short-term issues, you’re also proactively investing for retirement and keeping a fully-funded emergency fund. You’re building lasting wealth and preparing for the long-term future, not just staying afloat in the present. That’s the full security.

The Path Is Worth It

Look, I know for some of you just thinking about financial security feels overwhelming. Maybe you’re deep in debt, living paycheck to paycheck, and wondering how you’ll ever get ahead. Experiences like that can make the idea of long-term wealth and financial peace seem impossible.

But you have to believe that it is possible with discipline and smart decisions over time. Don’t let the day-to-day struggles cause you to lose sight of the bigger picture. Every debt you pay off, every dollar you save, and every investment you make is progress towards true financial freedom. Stick to the proven plan, and you’ll get there step-by-step. The path isn’t easy, but the security and peace of mind at the end of it is worth fighting for.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.