Okay, let’s get real for a second. Over the last few years, we’ve seen a major spike in long-term stress, chronic health issues, and mental health diagnoses – especially among working adults. From 2019 to 2023, the percentage of 35-44 year olds dealing with long-term stress and chronic illness shot up from 48% to 58%. Mental health diagnoses in that same age group? A jump from 31% to 45%. But get this – adults ages 18-34 are dealing with the highest rates of reported mental illness at a whopping 50%.

Now here’s the kicker – the 18-44 age range makes up nearly half the entire U.S. workforce at 89 million employees. That’s a huge chunk of people in corporate America potentially struggling with crippling stress, health battles, and mental health challenges like anxiety or depression. I’m talking about your colleagues, your employees, maybe even you.

The Connection Between Financial Wellness and Mental Health

Listen up, because the numbers don’t lie. Over 80% of 18-34-year-olds and 77% of 35-44-year-olds list money as a top stressor. And let me tell you, financial health and mental health are tighter than two peas in a pod. The sooner your employees get their financial ducks in a row, the better their chances are for improving their mental well-being.

The 2022 SmartDollar Employee Benefits Study found some alarming stats that connect employee financial wellness to employee mental health. Brace yourselves:

Employee Financial Stress Symptoms

– 47% of employees said they lose sleep because of their personal finances. (Can you say “tossing and turning”?)

– 55% of employees worry about their personal finances daily. (Talk about a constant cloud hanging over their heads!)

– 36% of employees have missed work due to a financial problem. (Money troubles don’t take vacation days, folks.)

– 45% of employees have been distracted by financial problems while at work. (Hello, productivity killer!)

– 24% of employees are either struggling with their money or in a full-blown crisis. (Yikes!)

Do you see a pattern here? Lost sleep, worry, missed work, distraction, struggle, crisis – these issues don’t just stay at home. Employees can’t help but bring them to the office, and let me tell you, tired, worried, or distracted employees aren’t exactly the poster children for productivity and engagement.

Poor mental health is a disaster for your business, plain and simple. The stress employees feel shows up in all sorts of ways, from absenteeism and burnout to low motivation and physical illness. And trust me, you don’t want any of that on your watch.

The Financial Wellness Levels and Their Impact

The Financial Health Network breaks it down into three basic categories: financially healthy, financially coping, and financially vulnerable. The differences in reported mental well-being are staggering – 75% of the financially healthy group rate their mental health as excellent or very good. Compare that to just 44% for financially coping folks and a mere 21% for the financially vulnerable.

But here’s the catch – it’s not just about how much you make. High income doesn’t automatically equal financial wellness. Even some six-figure households are living paycheck-to-paycheck thanks to things like overspending, mountains of debt, and no savings. What matters is how you manage the money you have.

Research shows that debt loads in particular are strongly linked to depression, substance abuse, mental disorders, and even suicide risk. In fact, adults with significant debt are three times more likely to attempt suicide. That’s how toxic and psychologically taxing financial stress can become if left unaddressed.

Click here to learn more and subscribe to the newsletter

Financial Wellness Can Improve Employee Mental Health

Listen up, because this is important. The 2022 SmartDollar Employee Benefits Study shows that 56% of employees feel like they can’t get ahead with their finances, and 60% feel behind on retirement. But here’s the kicker: 33% of people in America have no savings at all. And let’s be real, some of those people are probably your employees.

They have no savings, no retirement, and no peace of mind. But here’s the good news: Financial wellness and mental health have a clear connection. As financial wellness improves, so does mental health. And if an employee isn’t financially well, their mental health may suffer as a result.

Luckily, employers aren’t left high and dry when it comes to helping their employees improve their financial situation. You’re in a prime position to help your employees resolve their money issues – and their money stress. And get this, over 70% of employees wish their employer offered more resources to help them manage their finances. So, what can you do? Offer them a financial wellness benefit, my friends.

Get your free “2024 Real Estate Market Outlook” now!

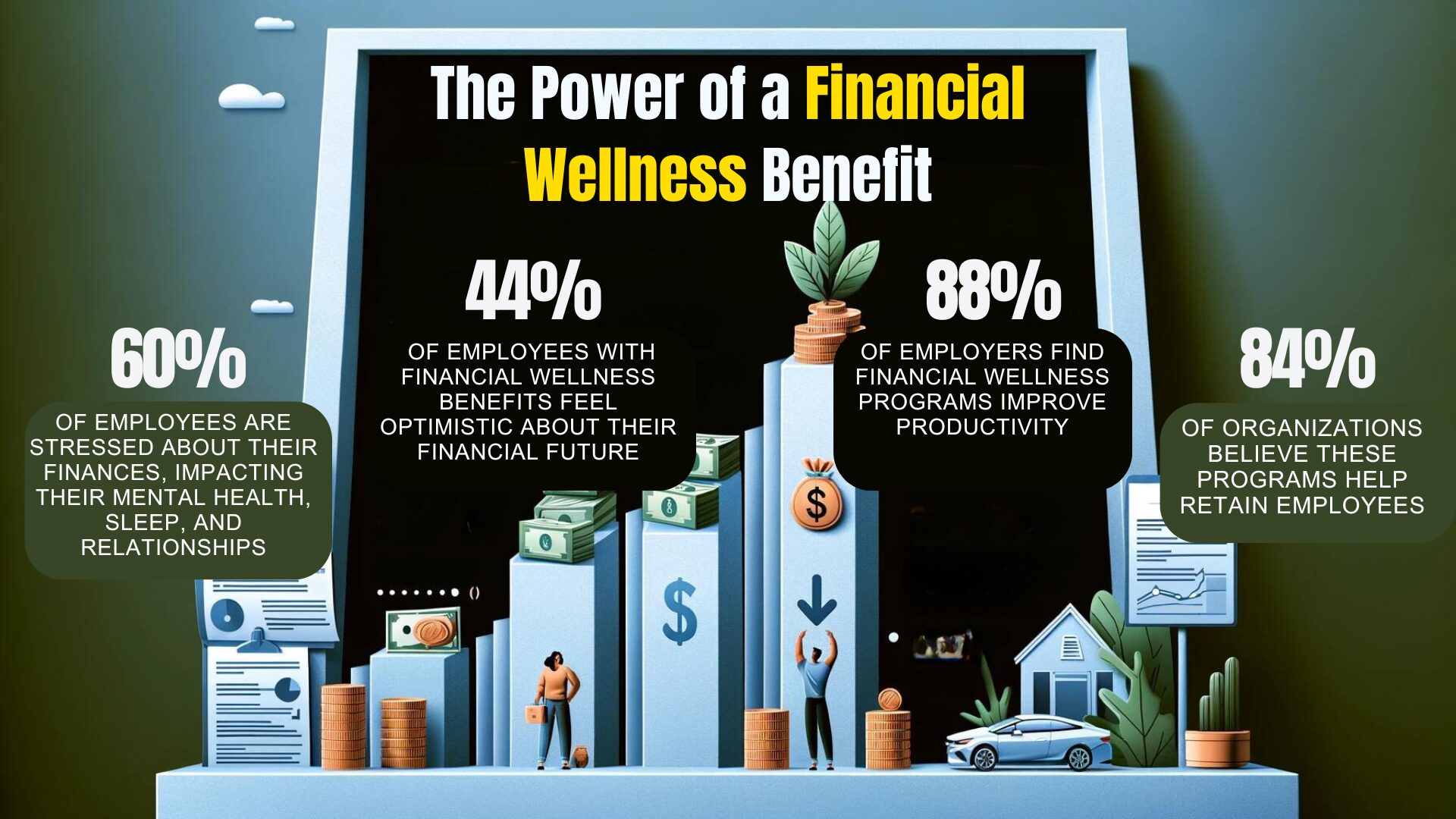

The Power of a Financial Wellness Benefit

A financial wellness benefit is any program that helps employees with money-related issues. And after implementing SmartDollar, a financial wellness benefit, employees reported some fantastic improvements, according to The 2022 SmartDollar Employee Benefits Study:

– 60% of employees say they’re better off compared to last year than the 30% who don’t have access to a financial wellness benefit. (Talk about progress!)

– 27% of employees report less stress about their personal finances. (Breathe a little easier, folks.)

– 29% of employees are saving for their retirement. (Planning for the future, smart move!)

– 25% of employees are building up their emergency fund. (Rainy day? Bring it on!)

– 24% of employees are learning how much they need for retirement. (Knowledge is power, baby!)

SmartDollar is a financial wellness benefit that teaches employees how to stick to a budget, get out of debt, save for the future, and retire with confidence. It’s the best resource to help your employees learn how to manage their finances and take action with tools like EveryDollar and Financial Peace University.

Employee Mental Health Affects Your Business

Listen up, because this is the bottom line: Employees who put one foot in front of the other with their finances and tackle their money goals are some of the strongest employees you can have. We’ve seen proof that financial issues have a negative effect on employee mental health, causing them to be stressed and anxious all day long. But when they turn the ship around, the business benefits too.

Here’s what we’ve noticed when looking at how employee mental health affects your business: When employees are financially stressed, their productivity takes a nosedive. They’re more likely to be distracted, make careless mistakes, and have trouble concentrating. It’s like their mind is just somewhere else entirely, you know?

On top of that, financially stressed employees tend to call out sick more often. Whether it’s from losing sleep over money worries or needing time off to deal with personal finance issues, absenteeism becomes a real problem. And let’s not forget about the impact on team morale. Money troubles can put people in a real funk, making them irritable, pessimistic, and just generally unpleasant to be around. Not exactly the kind of vibe you want in the office, am I right?

But when employees get a handle on their finances and start feeling more financially secure, it’s like a weight gets lifted off their shoulders. They’re able to focus better, stay motivated, and be fully present at work. And that positive attitude? It’s contagious! Suddenly, the whole team is operating at a higher level, collaborating more effectively, and just generally crushing it.

So, you see, investing in your employees’ financial wellness isn’t just the right thing to do – it’s a smart business move. Because when your team is mentally and financially healthy, your bottom line reaps the benefits too. It’s a win-win situation, folks!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.