In this comprehensive article, we delve into Warren Buffett’s profound economic insights, revealing his predictions and analysis of the looming financial challenges. Drawing from his statements and interviews, we explore the subtle cues that hint at broader economic trends. Our analysis covers key industries and global economic implications, offering practical strategies for navigating these uncertain times. Join us as we decode the wisdom of one of the world’s most renowned financial minds.

The Unanticipated Statements of Warren Buffett

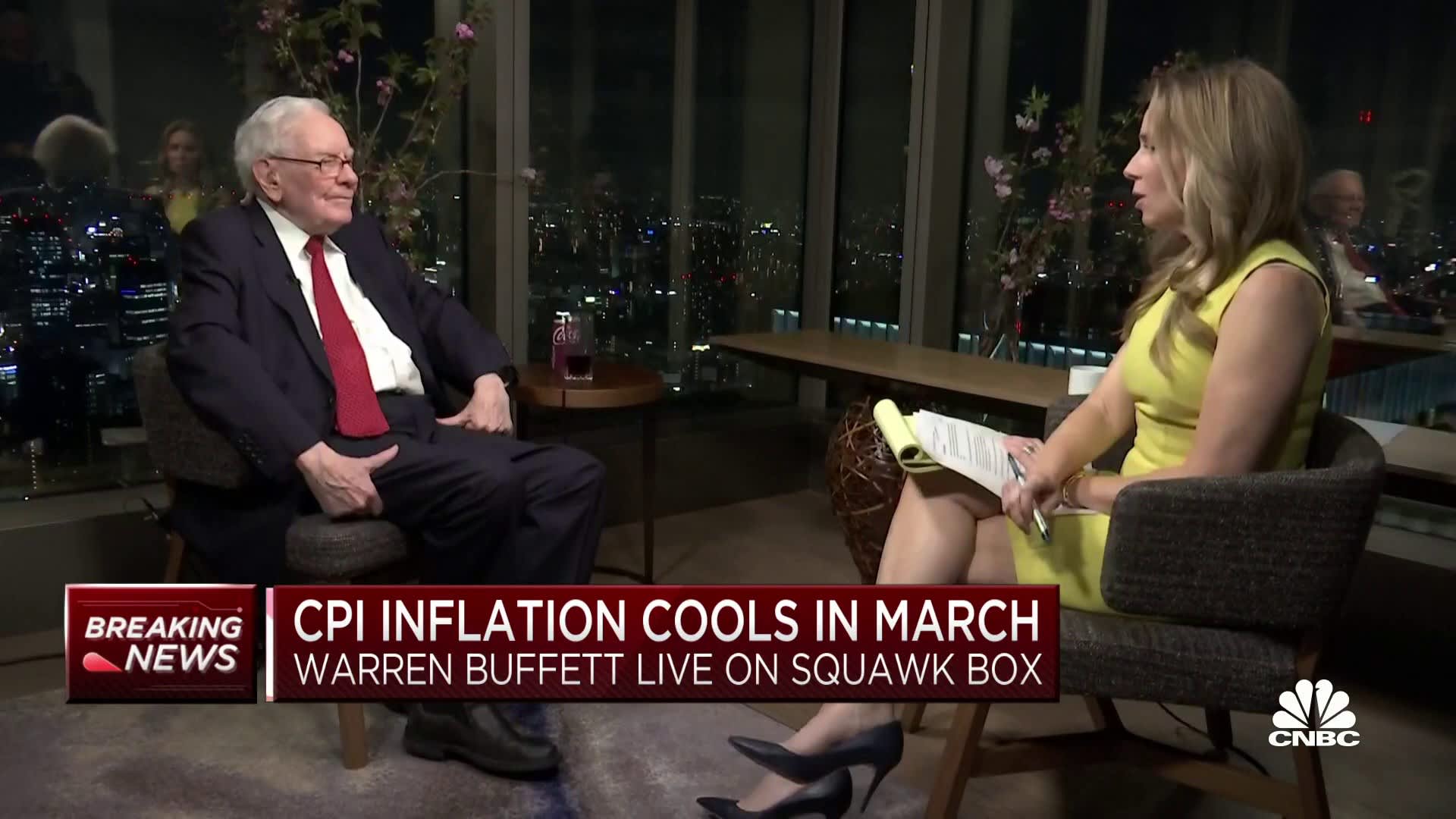

Warren Buffett, a titan in the world of finance, is renowned for his insightful yet often indirect statements on economic matters. In a notable interview in April, Buffett expressed views that took the global audience by surprise. Despite the economy’s seemingly stable condition at the time, Buffett’s words hinted at underlying issues of significant concern.

The Context of Buffett’s Observations

In early 2022, financial analysts and banking giants like Deutsche Bank were already sounding alarms about a potential recession in 2023. Predictions pointed towards a nearly 100% likelihood of economic downturn in the United States. Key indicators included a national drop in home prices (a first since 2008), record-level hikes in interest rates, and an inverted yield curve—a reliable harbinger of financial strife.

Disregarding Early Warnings: A Retrospective Analysis

As 2022 progressed, the initial cautionary signs were increasingly overlooked. The summer brought a halt to the decline in housing prices, and there was a growing sense of normalcy around the stock market and elevated interest rates. However, these fleeting signs of stability may have led to a collective neglect of early warnings, including those subtly indicated by Buffett.

Buffett’s Cryptic Caution

During the interview with Becky Quick, Buffett was questioned about his stance on the economy, specifically whether he leaned towards a bullish or bearish outlook. His response, though not straightforward, was laden with cautious undertones. He mentioned varied performances across his business portfolio, noting particularly worrying trends in sectors sensitive to economic fluctuations, like the railroad industry.

The Warning Signs in Key Industries: Buffett’s Concerns Validated

The Decline in the Railroad Industry: A Leading Economic Indicator

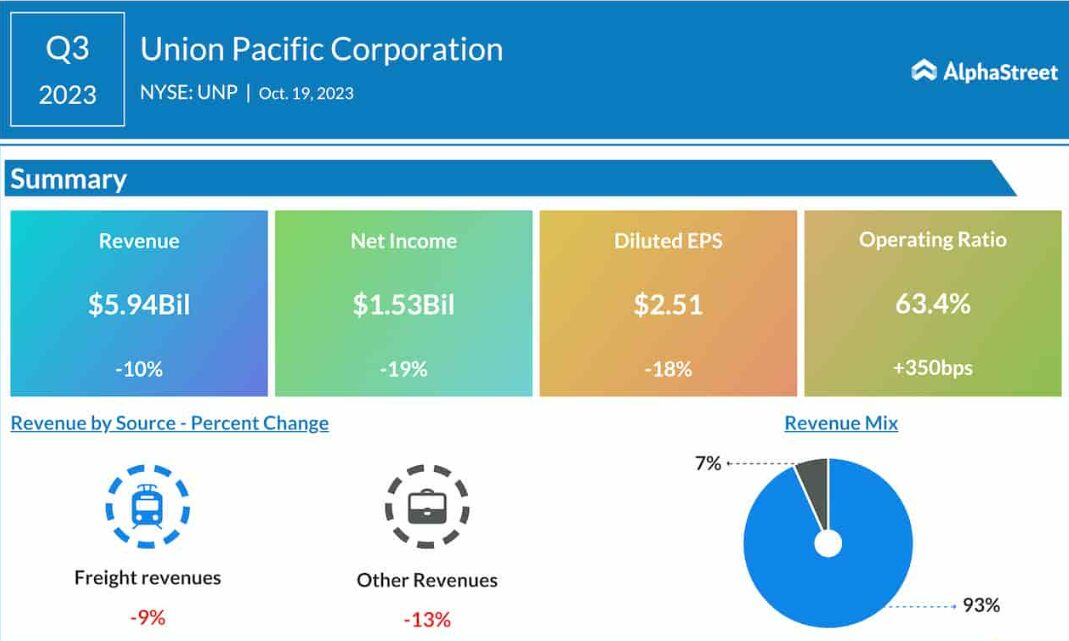

Warren Buffett’s apprehensions about the railroad industry were not unfounded. Railroads are often seen as a leading economic indicator due to their integral role in goods transportation. His concerns became evident when examining recent reports from major railroad companies like Union Pacific. These reports revealed significant downturns in income, profit, and freight volume, painting a stark picture of the economic slowdown.

A Closer Look at Union Pacific’s Struggles

Union Pacific, a prominent player in the railroad sector, reported a decrease in income by over 9%, with profits plunging by 20% and a 3% reduction in freight volume. These figures confirmed Buffett’s early predictions and signaled broader economic challenges.

Trucking Industry in Recession: Further Evidence of Economic Downturn

Moving beyond railroads, the trucking industry, another critical component of the freight sector, has also been experiencing a major recession. Factors contributing to this downturn include bankruptcies, plummeting rates, soaring fuel costs, and market oversaturation. The World Container Index, tracking container movement on major shipping routes, reported a staggering 75% decrease in traffic compared to the previous year, underscoring the severity of the economic situation.

Click here to learn more and subscribe to the newsletter

Analyzing Buffett’s Indirect Warnings: Reading Between the Lines

Deciphering Buffett’s Stance on the Likelihood of a Recession

In the interview, when asked directly about the chances of a recession, Buffett’s response, though indirect, suggested a bearish outlook. He highlighted that many business managers were surprised at the current state of their operations compared to their expectations six months ago. This sentiment, echoed across various sectors, not only in railroads but also in essential services like utilities, underscored the growing economic concerns.

The Subtle Indications of an Economic Slowdown

Buffett’s observations on declining revenues, sales, and profits across a range of businesses, coupled with the increasing cost of borrowing and tighter credit conditions, painted a troubling picture of the economic landscape. He noted the surprising resilience of tech stocks over the summer but emphasized the growing anxiety in more fundamentally solid businesses.

The Slow Unfolding of Economic Trends: A Gradual Descent into Recession

The Inevitable Economic Slowdown: A Cumulative Effect

The economy, as Buffett implied, moves at a gradual pace, whether ascending or descending. The onset of a recession is often a slow process, not an overnight collapse. He suggested that the economic downturn is like a slow-moving train wreck, becoming apparent only as the optimism surrounding a potential bubble begins to wane.

The Role of Interest Rates and Money Supply in the Economic Decline

The tightening of interest rates and a reduced money supply are contributing to the economy’s gradual deceleration. This tightening process is akin to a slowly constricting grip, which, over time, significantly impacts economic vitality, eventually leading to a state of panic and a full-blown recession.

Get your free “2024 Real Estate Market Outlook” now!

Broader Economic Implications of Buffett’s Forewarnings

Assessing the Impact on the Global Economy

The concerns raised by Warren Buffett are not limited to the United States. The ripple effects of the downturn in key industries like railroads and trucking have global implications. As these sectors are integral to international trade, their decline can signal broader economic challenges worldwide, affecting everything from global supply chains to international trade dynamics.

Global Supply Chain Disruptions: A Domino Effect

The decline in freight and shipping industries has led to disruptions in global supply chains. These disruptions are not just indicators of economic stress but also contributors to it, creating a domino effect that impacts industries and economies around the world.

The Interplay Between Domestic and International Markets

The interconnectedness of domestic and international markets means that economic trends in the United States can have far-reaching consequences. The slowdown in American industries can lead to reduced demand for international goods, affecting economies globally.

Navigating the Challenges: Strategies and Considerations

Preparing for Economic Uncertainty

In light of Buffett’s insights and the current economic indicators, businesses and investors must adopt strategies to navigate potential challenges. This involves diversifying portfolios, focusing on industries less sensitive to economic fluctuations, and maintaining liquidity to weather potential downturns.

The Importance of Flexibility and Adaptation

Flexibility and the ability to adapt to changing economic conditions are crucial. Businesses must be prepared to adjust their strategies, whether it’s shifting supply chains, exploring new markets, or adopting cost-saving measures.

The Role of Government and Policy Makers

Policy Responses to Economic Slowdown

Governments and policy makers play a critical role in responding to economic downturns. This includes adjusting monetary policies, such as interest rates and money supply, and implementing fiscal measures to stimulate growth and mitigate the impact of a recession.

Balancing Inflation and Growth

One of the key challenges for policy makers is balancing the need to control inflation with the need to support economic growth. Decisions around interest rates and government spending will be pivotal in shaping the economic landscape in the coming months.

Conclusion: Heeding Buffett’s Cautionary Advice

Reflecting on the Wisdom of a Financial Sage

Warren Buffett’s indirect warnings and observations serve as valuable insights for understanding the current economic situation. His ability to read subtle indicators and his long-term perspective on market trends make his opinions particularly noteworthy.

Looking Ahead with Caution and Preparedness

As we move forward, it is essential to approach the economic future with caution and preparedness. By understanding the underlying trends and being ready to adapt to changing circumstances, businesses, investors, and policy makers can better navigate the challenges that lie ahead.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.