Purchasing a home is a big commitment—and we understand it can be stressful! There are many important decisions, it’s a major investment, and it may be unclear what specifics to look for.

To help make you feel more at ease about the home-buying process, we’ve put together a list of 15 key questions to consider before purchasing a house. Getting answers to these questions will provide you confidence about homeownership and ensure you get a good deal.

1. What’s my total home budget?

The first vital question is: What is the maximum I can budget for a home? It’s crucial to determine a realistic total home budget so you don’t overspend. This helps avoid winding up with unaffordable monthly payments that financially strain you. The home shouldn’t own you—you should own it!

To budget properly, keep total monthly housing costs (including mortgage principal/interest, property taxes, insurance, HOA fees, and private mortgage insurance) to a maximum of 25% of take-home pay. This provides financial breathing room and leaves money for other important goals like retirement.

2. How much should I save for the down payment?

Next important question: How much do I need to save for the down payment? Ideally, 100% down payment (paying cash) is best.

But if taking out a mortgage, target at least 20% down. This leads to lower monthly payments, less overall debt, and reduced risk. Additionally, 20% down prevents paying private mortgage insurance (which protects the lender if you default).

For first-time buyers, 5-10% down is OK if total monthly housing costs are still under 25% of take-home pay. Just anticipate paying private mortgage insurance.

If taking out a mortgage, a 15-year fixed-rate loan is recommended. Avoid 30-years and adjustable-rate mortgages which incur higher interest costs.

Click here to learn more and subscribe to the newsletter

3. What sneaky closing costs await?

Homebuyers beware – closing costs can take a huge unexpected bite out of your wallet. Expect to shell out 3-4% of the purchase price just to close the deal. On a $300K home, that’s $9K-$12K gone!

Make sure you’ve stuffed your piggy bank with enough cash to cover closing costs after your down payment. Don’t let these budget-busting fees derail your plans.

4. Is moving worth the financial pain?

Moving isn’t just exhausting – it’s expensive! Unless your friends are willing to haul boxes for a few pizzas, you’ll pay big time. Local moves cost less than going the distance, but either way, you’ll feel the hurt.

Do the math ahead so you aren’t blindsided. If relocating for a new job, see if your employer will foot the bill. Nearly two-thirds of companies reimburse relocation costs to some degree.

5. Can you decorate on a dime?

Finding a turnkey home with furnishings included is like winning the lottery. For the rest of us, decorating challenges our budgets.

Moving existing furniture helps, but expect to need new pieces too. Only buy what you can afford in cash, whether new or used. Financing furniture on credit cards or through “buy now, pay later” schemes like Klarna and Afterpay piles debt on top of your mortgage. Yikes!

By decorating one room at a time, you can create a stylish home on a shoestring budget. It may take longer, but your bank account will thank you.

6. What’s the surrounding area really like?

Location, location, location. Get the inside scoop on the neighborhood before signing anything. Things to investigate:

Commute time to work. Longer drives aren’t dealbreakers, but know what you’re getting into. Distances are deceiving, especially in major metros.

Proximity to schools. Do you want to spend hours shuttling kids every morning? Didn’t think so.

Access to shopping. Scope out how far the nearest grocery and other errand running is. More options are better.

Distance to family and friends. Community connections are vital for quality of life. Make sure your support network is still accessible.

Property values. Buy on the low end for your area to maximize appreciation. Also avoid neighborhoods with declining prices – harder to sell later.

Getting the skinny on these details will reveal if the location really fits your lifestyle.

7. How are the local schools?

If you have or want kids, school quality is paramount. But even child-free, good schools equal higher resale value.

8. Is there risk of natural disasters?

If you’ve been spared hurricanes, tornadoes, floods, fires, quakes and blizzards so far, dangers can blindside you in a new home. Ask if disasters are common and ensure your insurance covers them. Extra protection may be needed. An ounce of preparation is worth a pound of recovery!

9. Does the home have any hidden issues?

Don’t rely on the seller’s word alone. Get an independent home inspection before signing to uncover problems. Sellers may accidentally or intentionally omit issues.

A good inspector will assess critical systems like the roof, foundation, electrical, HVAC, plumbing. If red flags appear, you can walk away, request repairs, or negotiate a lower price to fix issues later.

10. Is the roof past its prime?

Ask the roof’s age – asphalt ones typically last around 20 years. An expired roof could cost over $9K to replace. Avoid budget-busting surprises!

Get your free “2024 Real Estate Market Outlook” now!

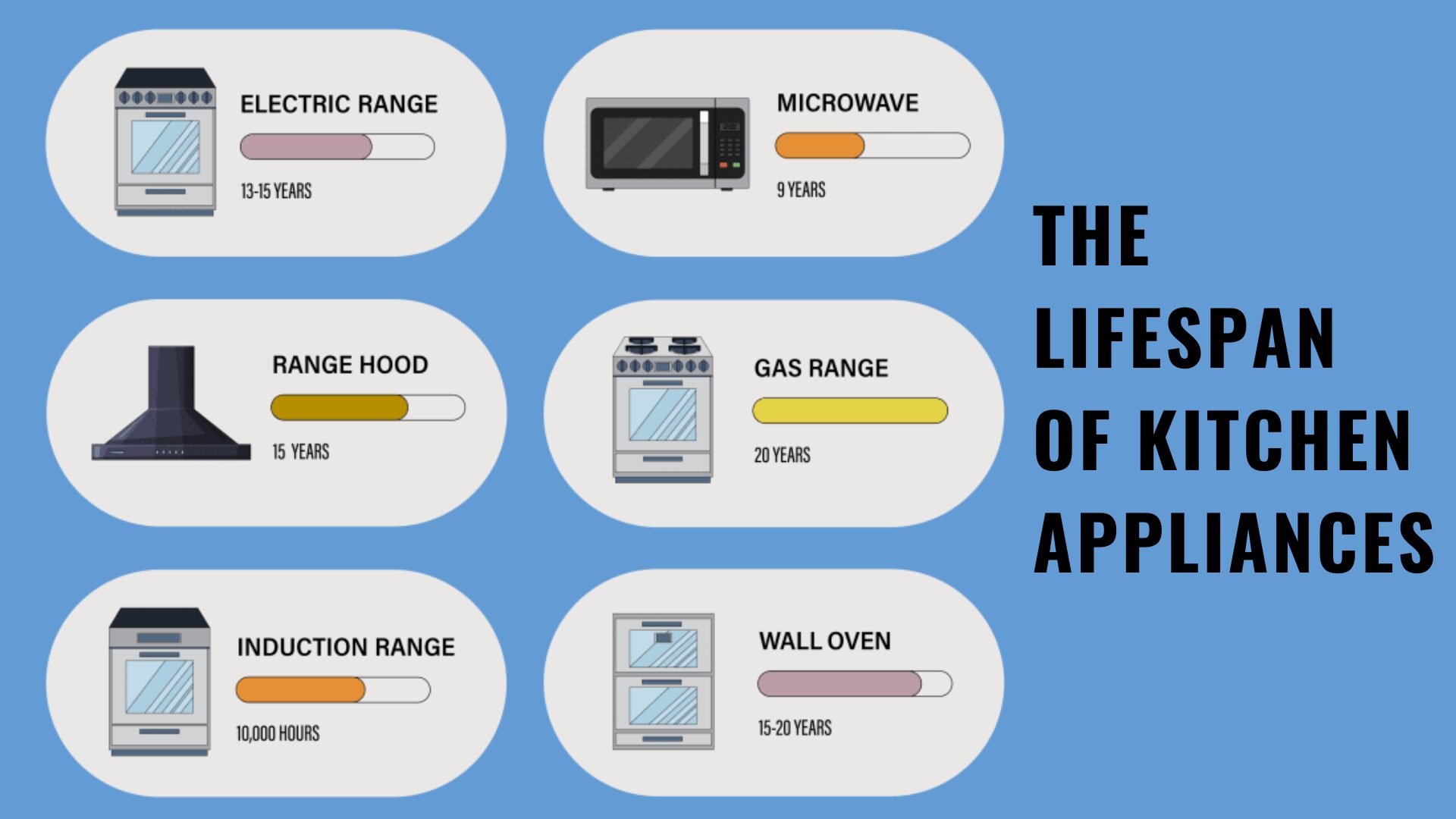

11. Are appliances ready to take a dirt nap?

Imagine moving in and appliances promptly conk out. Not ideal. Know which are near death before buying so you can negotiate accordingly.

Ask about life expectancy and replacement timeline for HVAC, water heater, washer/dryer, fridge, stove, dishwasher. Plan ahead.

12. What’s included with the house?

Don’t assume appliances, fixtures, window treatments are included in the sale. Laws vary. Avoid unpleasant surprises of massive empty spaces where the fridge and curtains used to be!

Explicitly ask what’s included. Don’t get blindsided by a space with nothing but dust bunnies.

13. How do sales prices stack up?

To determine if the price seems fair, compare it to recent sales of similar homes in the area. Your real estate agent can provide a competitive market analysis (CMA) leveraging their insider knowledge of local sales and home types.

Don’t go in blind on pricing – arm yourself with objective data!

14. What’s motivating the sale?

Try to uncover why the seller is moving on, if possible. Certain motivations like job relocations may make them more open to negotiating on price for a quick sale.

Asking this could also reveal red flags about the property condition if they can’t give a clear reason for moving. Proceed cautiously if anything seems off.

15. How long has the home been listed?

A home sitting unsold for an extended time suggests room to negotiate. But it could also signal issues serious enough to deter buyers.

If the home you’re interested in has stagnated on the market, investigate why with your agent before proceeding. Get the full story.

For context, the average U.S. home sold in 61 days in December 2023. Your local market timeline likely differs. Ask your agent for a typical time-on-market in your area.

Conclusion

Buying a home is a big decision. Ask these key questions to feel confident and informed. Get clarity on your budget, costs, location, risks, and value. Use this intel to find the right home at a fair price. With preparation and insight, you can navigate the process smoothly. Now go ask the right questions and start your journey to happy homeownership!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.