Embarking on a journey to financial freedom and wealth is a transformative experience. It’s not just about accumulating wealth but mastering the art of wealth creation and management. This journey is akin to a marathon, not a sprint; it requires patience, discipline, and a well-thought-out strategy. The path to financial freedom is unique for each individual, yet there are universal principles that guide the way. This article delves into five pivotal steps inspired by financial experts like Brian Tracy, guiding you towards achieving your financial dreams.

These steps encompass not only smart investment tactics but also personal development and lifestyle changes. By understanding and implementing these principles, you can set a strong foundation for lasting wealth and security. Each step is designed to empower you, offering practical advice and insights that you can apply to your personal financial situation. As we explore these steps, remember that the journey to financial wealth is as much about the process as it is about the destination. Let this guide be your roadmap to not only achieving financial success but also enjoying the journey along the way.

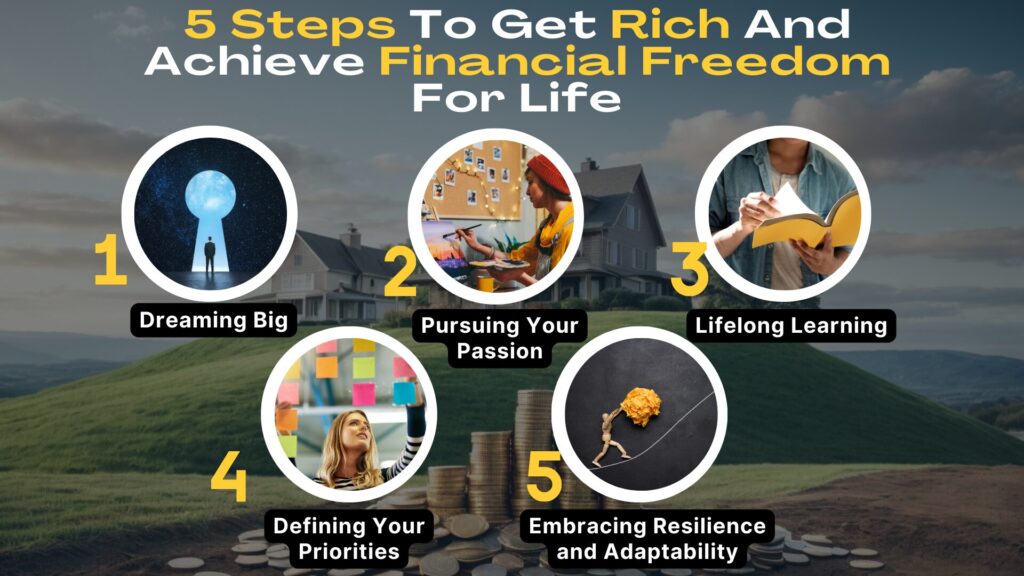

Step One: Dreaming Big

Significant achievements begin with audacious dreams. Dreaming big in financial success means setting seemingly unattainable goals that inspire and push you beyond your comfort zone. It’s about envisioning a future that transcends current limitations and daring to believe in the possibility of your vision. This process of dreaming big also involves breaking free from societal norms and conventional thinking, allowing creativity and ambition to take the forefront.

For instance, let’s take the inspiring story of Jeff Bezos and his journey with Amazon. He started in a modest garage, with the dream of creating an extensive online store. Despite facing numerous challenges, his vision and determination turned Amazon into a global powerhouse. His story exemplifies that no dream is too grand if pursued with determination. Bezos’ success stemmed not only from his visionary idea but also from his unwavering commitment to making it a reality. He consistently innovated and adapted, showcasing the importance of persistence and resilience. Bezos’ transformation from a garage startup to a global leader in retail illustrates that with belief and effort, even the most ambitious dreams can be realized.

Step Two: Pursuing Your Passion

Passion is a key driver of success. When you align what you love with your career or business, it leads not just to financial success but also personal fulfillment. This pursuit of passion ensures that your work is not just a means to an end but a journey that is intrinsically rewarding. It’s about finding that sweet spot where your interests and the opportunities in the market intersect.

Take, for instance, Elon Musk and his groundbreaking work with SpaceX and Tesla. His ventures are deeply rooted in his passion for technology and space exploration. These businesses are not merely sources of income; they represent the embodiment of his personal interests and ambitions. Musk’s journey underscores the importance of aligning your career with your passions. It’s a vivid example of how following your passions can lead not only to immense wealth but also to profound personal satisfaction and a sense of purpose. His story serves as a powerful reminder that when passion and profession align, the potential for success and fulfillment increases exponentially.

Step Three: Lifelong Learning

In the dynamic and ever-evolving world of finance and investment, embracing constant learning is crucial. This principle of lifelong education extends beyond finance, proving vital in every field and aspect of personal and professional development. It’s about staying curious, seeking new knowledge, and being adaptable to change. Lifelong learning not only keeps you relevant but also continuously enriches your understanding and skills.

One exemplary figure who embodies this principle is Warren Buffett, known for his unmatched investment expertise. Buffett attributes a large part of his success to his insatiable appetite for knowledge. He dedicates a significant portion of each day to reading various materials, ranging from financial reports to broader economic literature. This practice of relentless learning and staying informed has been a cornerstone of his strategy in making informed investment decisions. Emulating Buffett’s approach to continuous learning can have a profound impact on your financial success. It’s not just about staying informed but also about developing the ability to see the bigger picture and make connections between different pieces of information. Buffett’s example demonstrates that continuous learning is a key ingredient in the recipe for long-term success and financial wisdom.

Click here to learn more and subscribe to the newsletter

Step Four: Defining Your Priorities

Achieving success in finance and investment heavily relies on the ability to identify and concentrate on your most important goals. The financial landscape is filled with myriad opportunities, but it’s impractical and often counterproductive to chase them all. Instead, the key lies in focusing your energies and resources on a select few areas where you can truly excel. This strategic approach not only enhances your chances of success but also ensures a more manageable and less stressful journey.

Consider the hypothetical scenario of ‘Emily,’ who began her investment journey by spreading her resources across various sectors. She soon realized that this approach led to overwhelming complexity and diluted efforts. However, when Emily reassessed her strategy and chose to focus on her genuine interests in real estate and tech stocks, she experienced a significant turnaround. Her success rates improved, and her stress levels diminished considerably. Emily’s story highlights the critical importance of narrowing down your focus to a few key areas. By doing so, you can dedicate more time and effort to understanding these sectors, thereby making more informed and effective decisions. This principle of focused effort is a crucial aspect of any successful financial strategy, demonstrating that sometimes, less is more.

Step Five: Embracing Resilience and Adaptability

In the dynamic and often unpredictable world of finance, the ability to adapt and remain resilient is crucial. This means being flexible in your strategies and approaches while maintaining a firm commitment to your core principles. It’s about understanding that the financial landscape is in constant flux and being prepared to adjust your sails accordingly. Resilience in finance isn’t just about bouncing back from setbacks; it’s about learning from them, refining your strategies, and using those lessons to guide future decisions.

Embracing adaptability and resilience also involves recognizing and responding to changing market conditions, technological advancements, and evolving economic landscapes. It’s a continuous process of staying informed, being proactive, and not being afraid to make adjustments as needed. This approach ensures that you remain agile and responsive in the face of new challenges and opportunities.

Final Thoughts

Achieving financial freedom is indeed a multifaceted journey that intertwines strategic planning with personal growth. It’s a path that demands not only intellectual acumen but also emotional intelligence. The journey to financial independence is as much about managing your finances as it is about managing yourself – your ambitions, your fears, your resilience, and your adaptability. These qualities, when honed and combined with sound financial strategies, pave the way for a fulfilling and prosperous life. The journey may have its share of challenges, but the rewards of financial freedom and personal growth are immeasurable and truly worth striving for.

Building a Support Network

Success is seldom a solo endeavor. Building a network of mentors, peers, and professionals provides invaluable guidance and support. Engage with communities and forums where you can share experiences, gain insights, and receive encouragement. A robust support network can help you navigate through uncertainties and offer diverse perspectives on your financial journey.

Balancing Risk and Security

Understanding and balancing risk is crucial in financial planning. While taking calculated risks can lead to substantial rewards, ensuring a safety net is equally important. Diversify your investments to mitigate risks and have a solid financial plan that includes savings for emergencies. Balancing risk and security ensures a more stable and sustainable path towards financial independence.

Get your free “2024 Real Estate Market Outlook” now!

Conclusion

The path to financial success is more than a series of strategic steps; it’s a holistic journey that combines learning, resilience, networking, and risk management. These key principles are essential for not only building financial wealth but also leading a fulfilling and purposeful life. Along this journey, one discovers that financial success is intertwined with personal development, each aspect feeding into and enriching the other. The process of achieving financial freedom teaches valuable life skills such as discipline, foresight, and the ability to adapt to changing circumstances. It’s important to remember that the journey towards financial freedom is as enriching and rewarding as the destination itself. By embracing each aspect of this journey, you not only work towards financial stability but also cultivate a richer, more well-rounded life. This approach ensures that the path to financial success is not just profitable but also deeply satisfying and transformative.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.