Okay, let’s chat about mobile homes. These tiny houses on wheels are making a major comeback lately. I get the appeal – who doesn’t love the idea of downsizing and hitting the road in your own cozy, go-anywhere abode? Sign me up!

But before you start picking out curtains for your new mobile digs, we need to have a real talk. As much as I hate to be a buzzkill, the cold hard truth is that mobile homes make terrible investments in the long run. Yeah, I know, not what you wanted to hear. But stick with me here.

These homes have seriously leveled up from your grandparents’ vintage trailers. Modern mobile homes can look just as swanky as regular houses, with fancy finishes and amenities galore. Plusthose price tags are pretty darn attractive compared to traditional real estate. I totally understand why people get lured in by the affordability and portable appeal.

But Here’s the Catch (There’s Always a Catch)

As nice and reasonably priced as mobile homes seem upfront, they’re more like buying an expensive car than a house. Just like driving a new vehicle off the lot, the second you move into that brand new mobile home, the value starts plummeting faster than my motivation to hit the gym in January.

We’re talking losing tens of thousands within just a few years. Your shiny new $150K double-wide could shed over $50K before you know it – that’s a third of what you paid, gone in a flash. Yikes.

Look, you can deck it out with all the hipster accents you want – Edison bulbs, refurbished barn wood, a vintage record player spinning vinyls. It’ll certainly look uber-trendy. But alas, no amount of aesthetic wizardry can stop that sweet mobile home from depreciating into money pit territory.

Click here to learn more and subscribe to the newsletter

The Mobile/Manufactured/Modular Home Family Tree Explained

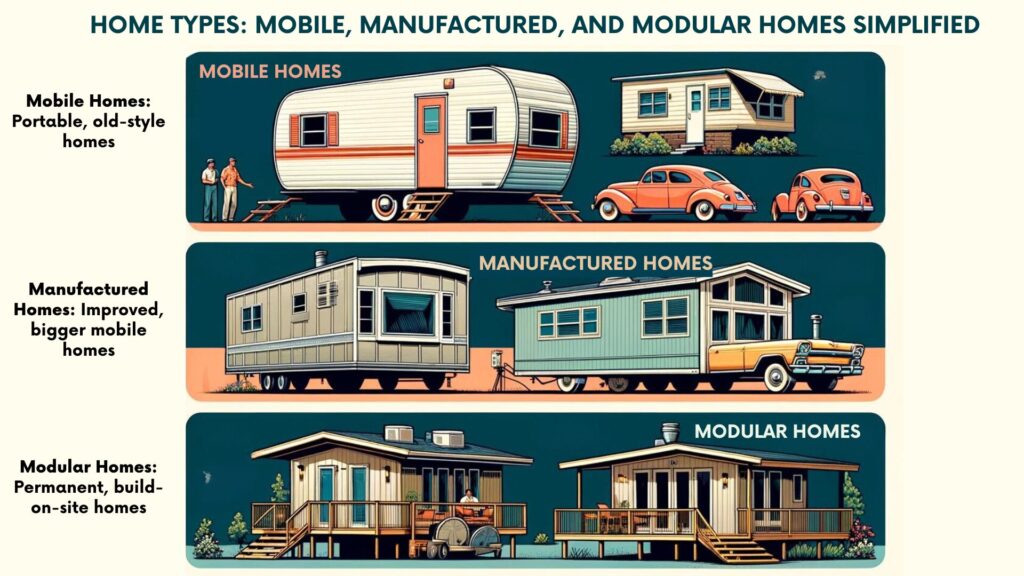

Before we go further, let’s get some terminology straight. In the mobile home realm, there are a few different branches on the family tree:

Mobile Homes

The OG trailer homes. We’re talking those classic shoebox shapes on wheels that were all the rage back when Elvis was shaking his pelvis on national TV. Mobile homes are built to be portable, made for towing behind trucks or hauling on a flatbed like a giant toy. Can’t you just picture a family rolling down the highway with their entire home in tow? Trailer park or bust!

Manufactured Homes

Basically mobile homes that went off to college, got a nice degree, and rebranded. After 1976, the government implemented stricter standards that mobile homes had to meet to earn the new “manufactured home” label. Still portable by design, but nowadays they make ’em in single, double, even triple-wide floor plans for those looking to super-size it.

Modular Homes

Now these are the chic, city-dwelling cousins who summer in the Hamptons. Built in factories like mobile/manufactured homes, but the pre-fab pieces get shipped and permanently assembled on-site, just like regular houses. They’re the respectable branch that can’t just up and hit the road whenever wanderlust strikes.

Let’s Talk Financials

According to the U.S. Census Bureau, a new mobile home runs about $130,000 on average these days. Not too shabby, right? But brace yourself, here comes the painful part: that “affordable” mobile home is going to start shedding value like crazy the millisecond you move in.

We’re talking a $150K double-wide potentially losing over 50 grand within half a decade. That’s like taking a massive chunk of your investment and flushing it down the house’s tiny toilet while you soulfully eat a frozen microwave meal as your dreams of tiny home independence swirl down the drain. Definitely not money well spent.

Get your free “2024 Real Estate Market Outlook” now!

Better Ways to Invest Your Hard-Earned Cash

Look, I get the romantic appeal of owning your own mobile kingdom and roaming freely wherever the wind takes you. Parking riverside one day, boondocking off-grid in the wilderness the next, all while living that minimalist tiny home fantasy. Sign me up!

Only thing is, when you crunch the cold hard numbers, investing in a mobile home makes about as much financial sense as setting a pile of cash on fire for s’mores while you’re camping off-grid. It just ain’t smart money, folks.

If you’re financially stable with no debts and a decent emergency fund in the bank (because life be life, y’all), your money is way better invested in a good old-fashioned home on a permanent foundation. Sure, it’s not as glamorous as the nomadic mobile lifestyle, but at least your investment won’t take a massive hit in value before you can even blink.

Another solid option? Mutual funds in a retirement account like a 401(k) or Roth IRA. But being able to comfortably retire one day without eating box-o-ramen every night? That’s the real dream right there.

Conclusion

Look, I get the whole mobile home fantasy – downsizing your life into a cute little house on wheels, then hitting the open road to chase adventure. There’s something wildly freeing about that idea. If that free-spirited lifestyle is calling to you, I ain’t here to judge.

But we need to keep it real for a sec. As much as I don’t want to be a buzzkill, the cold hard truth is that mobile homes make for straight-up terrible investments financially. Yeah, it hurts to say it so bluntly, but you gotta know what you’re getting into.

The second you move all your stuff into that brand spanking new mobile home, it starts losing value quicker than a car fresh off the lot. We’re talking potentially shedding tens of thousands within just a few short years. That super affordable $150K double-wide you thought was such a steal? It could lose over 50 grand before you know it. Ouch.

So while mobile homes can be a decent short-term living situation for some folks, you can’t really think of them as long-term investments for building wealth over time. Your hard-earned cash is way better off put into things that’ll actually gain value and grow your net worth.

If that’s your goal – growing a nice little nest egg for the future – you’re better off taking more traditional investment routes. Buckle down and save up for an honest-to-goodness home that’ll hold its value. Or dump money into retirement accounts and let it ride the market waves over decades. Not exactly insta-worthy #VanLife material, but hey, being able to retire someday without eating ramen every night? That’s the real dream.

The bottom line is, you gotta make choices that align with your current priorities and goals in life. If the wandering mobile lifestyle is legitimately calling you, then by all means, do you. Just be realistic that your mobile home is more like an overpriced used car than an investment that’ll pay off long-term.

For the rest of us mere mortals just trying to make smart money moves? Mobile homes should probably stay firmly in the “thanks, but no thanks” category when it comes to parking our hard-earned savings. Keep chasing your nomadic dreams if you want – but build up that real wealth first before blowing the budget on a mobile estate.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.