Alright, let’s get real here, folks. You’re about to take on a home renovation project, and if you’re not careful, it could quickly turn into a financial nightmare. I’ve seen too many well-meaning homeowners get caught up in the excitement of ripping out cabinets and picking out fancy new tiles, only to end up with a half-finished kitchen and a bank account drained dry.

We’ve all been there – you start with a simple plan to update the floors, but then those outdated cabinets are just screaming to be replaced too. And hey, while we’re at it, why not splurge on that beautiful kitchen island you’ve been drooling over? Next thing you know, your $2,000 budget has ballooned to $20,000, and you’re eating ramen noodles for the next year to make ends meet. No thanks!

Four Easy Steps to Keep Your Home Renovation Budget

Listen up, because I’m about to share the foolproof four-step process that’ll help you create a realistic home renovation budget and actually stick to it. Follow these steps, and you’ll be well on your way to a gorgeous new space without having to take out a second mortgage.

Step 1: Prioritize Your Projects

Unless you just won the lottery (and if so, hey, it’s me, your long-lost cousin!), chances are you can’t afford to tackle every single renovation on your wish list all at once. So the first step is to sit down, make a list of all the projects you’d love to do, and then prioritize the heck out of it.

Start with the essential stuff – if your bathroom is still rocking those avocado-green tiles straight out of the 70s, that’s probably priority number one. Or maybe your kitchen is so outdated that even your grandma would turn up her nose at it. Put that bad boy at the top of the list.

Once you’ve identified your must-dos, it’s time to get real about what else can actually fit into your budget and timeline. Sure, it would be amazing to have a brand new deck and a finished basement too, but if you try to bite off more than you can chew, you’ll end up with a bunch of half-done projects and a whole lot of regret.

Step 2: Get Your Research On

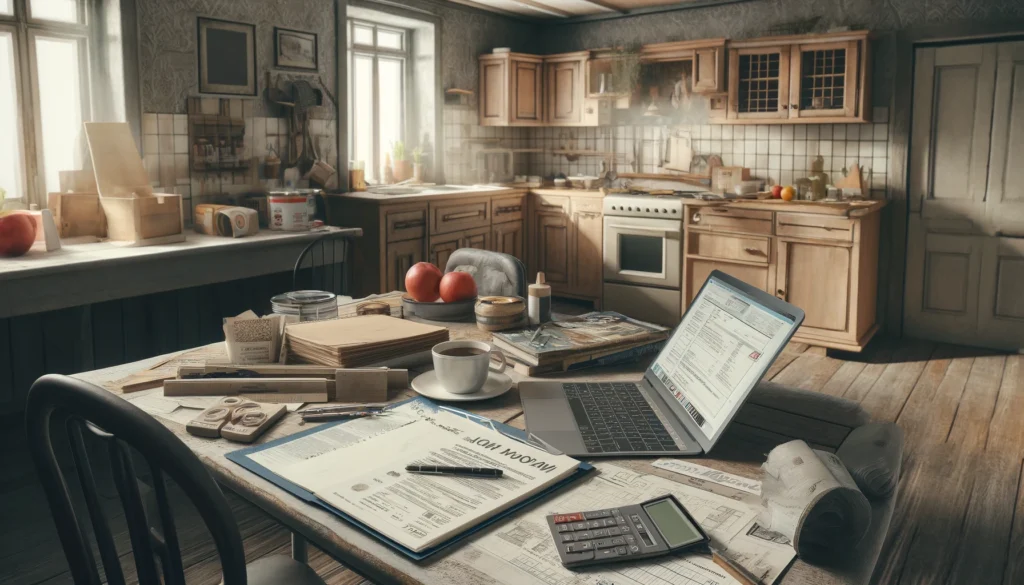

Now that you’ve zeroed in on your top renovation priorities, it’s time to roll up your sleeves and start crunching some numbers. Grab a notepad (or your laptop if you’re a tech-savvy millennial), and get ready to do some serious digging into pricing estimates.

For each project on your list, you’ll need to research the costs of materials, labor, permits – basically anything and everything that’ll go into making your dream a reality. And don’t just settle for the first number you find on Google, my friend. Call up local suppliers, ask around in neighborhood Facebook groups, and hit up any friends or family members who’ve recently gone through similar renovations for their insider intel.

Let’s say you’re tackling a full kitchen overhaul, for example. You’ll need to factor in costs for new cabinets (and all those fancy pulls and handles), appliances, countertops, flooring, lighting fixtures, and everything else that’ll turn your outdated cook space into a modern culinary oasis. Oh, and don’t forget about labor costs unless you’re a seasoned DIY warrior ready to take on the whole project yourself (in which case, I salute you).

Psst…Here’s a Money-Saving Tip

Speaking of DIY, if you’ve got the skills (and the patience of a saint), taking on some of the work yourself can be a great way to slash those labor costs and save some serious cash. Just be warned – DIY projects often come with a side of marital spats, bandaged fingers, and a newfound respect for the professionals who make it look so easy.

Click here to learn more and subscribe to the newsletter

Step 3: Set a Realistic Savings Goal (And Actually Stick to It)

Once you’ve got a rough estimate of how much your dream renovation will cost, it’s time to set a savings goal and actually commit to it. And let me be crystal clear about something: the only way you should be funding this project is with good ol’ cash money.

I know, I know – you’ve probably heard about those fancy financing options like home equity loans or HELOCs (Home Equity Lines of Credit). But let me ask you this: do you really want to risk going deeper into debt or, worse, losing your home altogether just because you couldn’t resist those high-end appliances or that gorgeous marble countertop? Didn’t think so.

So do yourself a favor and ditch any ideas about borrowing money for this reno. Instead, grab that calculator (or fire up the calculator app on your phone if you’re a youngster) and figure out how much you need to squirrel away each month to reach your savings goal by your target start date.

Let’s say your kitchen overhaul is going to run you about $30,000, and you want to get the ball rolling in 18 months. That means you’ll need to save around $1,667 per month to make it happen. It’s a hefty chunk of change, sure, but think about how amazing it’ll feel to pay cash for that beauty when it’s all said and done.

A Trick for Staying on Track

Saving up a huge sum of money is no easy feat, my friend. To help you stay motivated and on track, I highly recommend using a budgeting app like EveryDollar. This nifty tool lets you link up your bank accounts so you can easily monitor your spending, plus it’ll keep those savings goals front and center so you don’t lose sight of what you’re working towards. You could even get your family involved and turn it into a fun game – loser has to cook dinner for a week!

Get your free guide “Passive Real Estate Investing For Busy Professionals”

Step 4: Don’t Hire a Shady Contractor

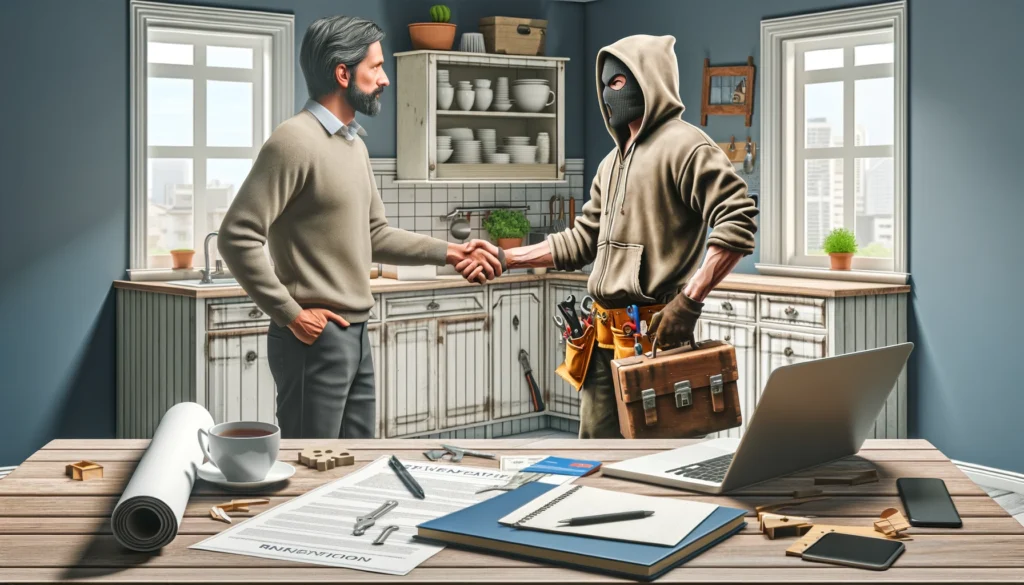

Give yourself a pat on the back, because you’ve officially hit your savings goal and are ready to make this renovation dream a reality! The next (and arguably most important) step is to hire a contractor you can actually trust to get the job done right.

I’m sure I don’t need to tell you that not all contractors are created equal. Some are true professionals who take pride in their work, while others are basically amateur scam artists looking to take your hard-earned cash for a sloppy, half-baked job. No thank you!

Your best bet is to start by asking friends, neighbors, or coworkers for referrals of contractors they’ve had great experiences with. Once you’ve got a few options, request bids and timelines from each one so you can compare pricing and schedules. But I’ll warn you – don’t just go with the cheapest bid! Lowballing prices is often a huge red flag that you’re about to get suckered by someone looking to cut a ton of corners.

Instead, take the time to actually vet each contractor you’re considering. Look into their licensing, insurance, and references from past clients. You could even set up interviews to get a feel for their communication skills and overall vibe. After all, this person (and their crew) will be spending a ton of time in your home, so you want to make sure you can actually stand to be around them for more than five minutes at a time.

Once you find a contractor that checks all the boxes, it’s time to make it official and sign on the dotted line. Just be prepared for some curveballs to be thrown your way as the project gets rolling. Maybe the crew discovers a nasty leak or structural damage that needs to be addressed stat. Or perhaps those fancy appliances you had your heart set on end up being backordered for months.

The key is to stay flexible and be willing to adjust your plans as needed. You might need to allocate some of your budgeted funds towards taking care of those unexpected issues, which could mean scaling back on some of the prettier (but non-essential) finishes and fixtures. It’s all about keeping your priorities in order and not letting yourself get carried away with the shiny objects.

At the end of the day, you did the hard work of planning, budgeting, and saving upfront, so try to keep your cool when the inevitable renovation hiccups pop up. Take a deep breath, keep your sense of humor handy, and get ready to enjoy that beautiful new space you worked your butt off for – no scary debt or financial strain required.

Conclusion

Renovating your home is incredibly exciting, but it can also be a huge source of stress and financial strain if you don’t plan carefully. That’s why it’s absolutely critical to create a realistic renovation budget and stick to it.

By prioritizing your projects, researching costs thoroughly, setting a cash-only savings goal, and vetting contractors, you’ll be in a much better position to stay in control emotionally and financially. At the end of the day, a successful renovation is about making your dreams a reality without going broke in the process.

So dream big and get ready to bring your renovation fantasies to life. Just be sure to keep one foot firmly planted in financial responsibility. With smart planning and mindful budgeting, you can transform your outdated space into something amazing while avoiding soul-crushing debt. Future you will be incredibly grateful you did.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.