Money. For some, it conjures feelings of excitement and possibility. For others, anxiety and stress. But how exactly does money impact our emotions, choices, and overall well-being? Welcome to the fascinating realm of the psychology of money.

In this blog, we’ll explore key concepts from behavioral economics to uncover insights into how our minds deal with money. Dissecting our financial behaviors and perceptions can help us make smarter money moves. We’ll also examine the complex link between money and happiness. Beyond the initial thrill of spending, how can aligning finances with values lead to more lasting contentment?

Additionally, we’ll dive into investor psychology and the mental game behind financial decision-making. With knowledge of common biases, we can identify areas for improvement in our financial planning. Developing intentional money management habits is another key focus, as is cultivating a growth-oriented mindset. With the right understanding and tools, we can build a solid financial future.

Let’s get started uncovering the secrets of the psychology of money!

Decoding Money Mindsets: Key Concepts from Behavioral Economics

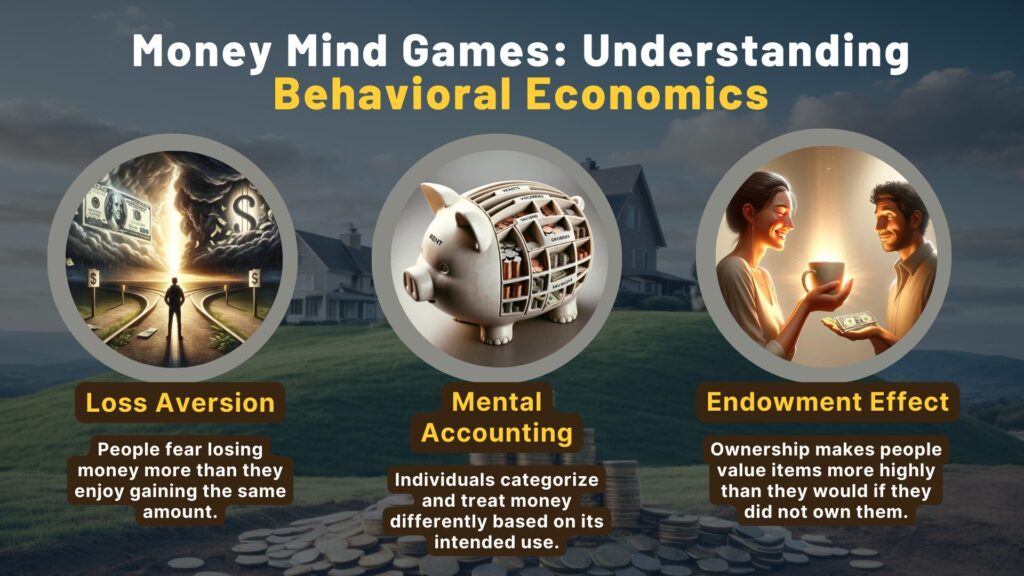

Have you ever felt joy when unexpectedly finding cash? Or attributed extra value to an item just because it’s yours? The field of behavioral economics sheds light on quirks like these in how we think about money. Let’s break down key concepts:

Loss Aversion

Imagine you find a $20 bill on the sidewalk. You likely feel a rush of excitement at this surprise gain. This is due to loss aversion – our tendency to strongly prefer avoiding losses over acquiring gains. Losses can evoke strong negative feelings than gains produce positive ones. Any unexpected upside, like finding cash, provides a little dopamine boost.

Mental Accounting

Ever have certain budgets for different expenses, like food, bills, travel? This is mental accounting at work. Your brain separates money into categories, almost like labeled compartments in a wallet. Each pot of money feels allocated for specific uses. This affects spending choices, sometimes in ways we don’t consciously realize.

Endowment Effect

You’re more likely to value an item higher if you own it. This is the endowment effect, where we attribute extra value to things simply because they’re ours. For example, you may see immense value in your old baseball card collection, whereas a buyer may view its worth very differently. Ownership status boosts an item’s perceived value.

Recognizing these mental money influences brings self-awareness. We can catch ourselves when biases like loss aversion or endowment effect creep in, leading to better financial habits.

The Money-Happiness Link: Key Insights

Can money buy happiness? The answer proves more complex than you may guess. Let’s break down key insights on the money-happiness link:

While buying something exciting brings an initial rush, that high fades. Our happiness hormones adapt to new purchases, and we return to a set point. This concept, known as the hedonic treadmill, shows how material goods provide fleeting happiness bursts. For lasting contentment, focus spending on values, not quantity.

Rather than buying for status or momentary thrills, align spending with personal values. For example, if family is important, budget for a special vacation. If you care about the environment, invest in green companies. Spending flowing from purpose brings deeper fulfillment.

Though material possessions provide quick hits of happiness, experiences like concerts, nature adventures, or classes create longer-lasting satisfaction. After material goods lose their initial novelty, experiences and memories persist as sources of joy.

The quality of spending impacts happiness more than the dollar amount. Thoughtfully direct finances towards your values and passions.

Click here to learn more and subscribe to the newsletter

Navigating Investor Psychology and Biases

Investing often involves as much psychology as strategy. Emotions and cognitive biases influence financial choices, sometimes with costly consequences. How can we navigate these mental money pits?

Overcoming Biases in Investing

Thinking you have more investing skill than you do can lead to overly risky portfolio choices. Temper overconfidence by objectively looking at past decisions and learning more about realistic returns.

When markets swing, it’s tempting to follow the crowd and sell or buy impulsively. But herd mentality leads to buying high and selling low. Stick to your long-term strategy over reactionary moves.

Adopting Healthy Investing Habits

We know losses hurt more than gains feel good. But cutting losses quickly and letting winners ride is key to investing success. Don’t hold onto sinking stocks just to avoid realizing a loss.

Anchoring means fixating on one piece of data when making a decision. For example, you bought a stock at $50, so you anchor to that price, ignoring fundamentals indicating it’s overvalued. Avoid anchoring by looking at the full picture.

No one avoids all psychological traps in investing. But simply recognizing common pitfalls makes us less likely to act on them.

Building Your Financial Foundation: Developing Healthy Money Habits and Mindsets

Establishing Positive Financial Routines

Budgeting Effectively. Distinguish between needs and wants to reduce excessive spending. Focus on allocating money to necessities like food, housing, and transportation first. Then budget for some fun purchases aligned with your values. Tracking spending increases awareness of habits around needs and wants, informing smarter future decisions.

Growing Savings. Pay yourself first by automatically funding savings and investments before spending on wants. Even small contributions compound over time into larger balances. Create an emergency fund buffer to avoid high-interest debt during unexpected expenses. Savings momentum builds on itself through consistency.

Cultivating a Financial Growth Mindset

See Setbacks as Learning Opportunities. When facing financial setbacks, view them as opportunities for growth rather than permanent failures. With a growth mindset, you believe money skills can be continually developed through effort. Focus on progress over judging absolute performance.

Embrace Adaptability. In personal finance, conditions constantly change. Expect to make frequent course corrections. Remain flexible and willing to adjust financial strategies as circumstances require. A growth mindset centers on mastering the habits, knowledge, and skills within your control.

Developing healthy financial habits and a growth-oriented mindset lays the foundation for achieving your money goals. Consistent routines create stability, while a learning focus enables flexibility. Together, they put you on the path to financial well-being.

Get your free “2024 Real Estate Market Outlook” now!

Conclusion

The psychology of money is endlessly fascinating, shedding light on the complex ways our relationship with finances impacts life. In this exploration, we uncovered key concepts from behavioral economics that reveal the quirks of money mindsets – loss aversion, mental accounting, and the endowment effect. Recognizing these influences provides valuable self-awareness to make smarter financial choices.

We also examined the nuanced link between money and happiness. While exciting purchases bring fleeting joy, aligning spending with purpose and values leads to deeper, lasting contentment. In investing, understanding common psychological traps like overconfidence and herd mentality helps us avoid poor decisions.

Establishing intentional money management habits provides a strong financial foundation. Budgeting effectively, growing savings consistently, and tracking spending builds stability. Adopting a growth mindset focused on continual learning enables adaptability in the ever-changing financial landscape.

The psychology of money offers endless fascination and valuable insights. Our financial behaviors and attitudes exert an enormous influence on life outcomes. With knowledge of money mindsets and mastery of healthy financial habits, we can make smart choices that optimize financial well-being. Understanding the mental and emotional dimensions of personal finance empowers us to achieve prosperity and purpose.

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.