Listen up, folks! I know being buried under a mountain of credit card bills, student loans, and other debts can feel suffocating. But before you do something rash like raiding your retirement savings, pump the brakes! That’s a terrible idea that’ll only make your money troubles way worse in the long run.

Should I Withdraw From My Retirement to Pay off Debt?

Let me be crystal clear on this one: Heck no, you shouldn’t touch that retirement money—not even to get those debt collectors off your back. I get the temptation, but dipping into your 401(k) or IRA means getting slapped with insane early withdrawal penalties and taxes. You’re essentially stealing from your future self!

The only time it’s even remotely okay to consider tapping into your retirement accounts early is if you’re staring bankruptcy or foreclosure straight in the face. Otherwise, keep those grubby paws away from your nest egg, capiche?

Rules and Penalties for Early Retirement Withdrawal

Now, let me break this down for you. Retirement investments like 401(k)s and IRAs are meant for one thing: funding your golden years when you’re finally ready to kick back and enjoy life. They’re not a personal piggy bank for you to crack open whenever you’re in a financial pickle.

If you withdraw cash from those accounts before you hit 59 1/2 years old, Uncle Sam is going to want a cut. We’re talking a 10% penalty, plus you’ll have to pay regular income tax on whatever you take out. Ouch!

Sure, there are a few exceptions where you can avoid those harsh early withdrawal penalties, like using the money for medical expenses, education costs, or a down payment on your first home. But even then, you’ll still owe taxes on the withdrawn amount.

The Danger of 401(k) Loans

Some of you might be thinking, “Hey, why don’t I just take out a loan from my 401(k) instead?” Well, let me tell you, that’s just asking for trouble!

With those loans, you’re basically borrowing from your future self and having to pay yourself back—with interest. It’s an easy way for that debt cycle to come back and bite you. Lose your job before paying it all back? Bam, you’re on the hook for penalties and taxes within 60 days.

My advice? Steer clear of 401(k) loans and other shady tactics to try borrowing your way out of debt. That path leads nowhere good, my friends.

Click here to learn more and subscribe to the newsletter

Why You Should Never Borrow From Your Retirement

Look, I get it. When you’re swimming in debt, that retirement money can seem awfully tempting. But let me put it this way: if you take a $50,000 chunk out of your IRA to pay off loans today, you could end up with only $30,000 after penalties and taxes. Ouch!

Worse yet, if you had left that $50,000 untouched and let it grow for another 20 years, it could’ve ballooned to over $445,000! I don’t know about you, but I’d much rather have over $400K waiting for me in retirement than a measly 30 grand.

The bottom line is, ransacking your retirement fund is just not worth the long-term cost. Sure, you might be able to make up for it by investing more later. But there are strict limits on how much you can contribute each year. Do you really want to have to work until you’re 90 because you blew through your savings when times got tough?

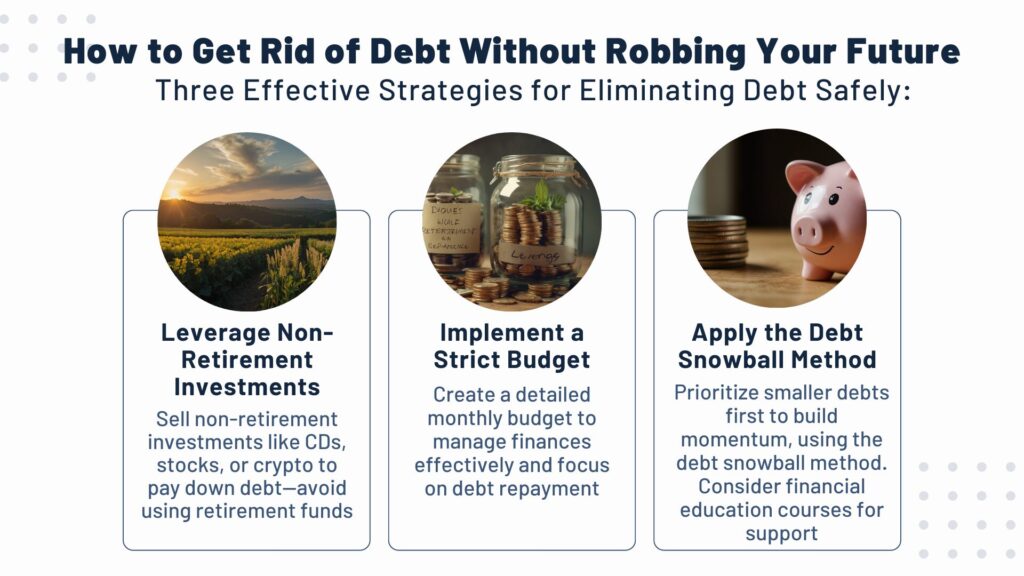

How to Get Rid of Debt Without Robbing Your Future

Okay, so if you can’t tap into your retirement stash, how are you supposed to get out of debt? Have no fear, my friends, because I’ve got some rock-solid tips for you:

Cash Out Non-Retirement Investments

First off, do you have any non-retirement investments lying around, like CDs, stocks, or crypto? Cash those babies out and use that money to start chipping away at your debts. It’s way smarter than touching your 401(k) or IRA. Those other investments aren’t doing you any favors just sitting there. By liquidating them, you can make a big dent in your debt right away without touching your retirement savings.

Get on a Budget

Next up, you need to get on a strict monthly budget. I’m talking a detailed, written plan for every dollar you earn. Budgeting might seem like a drag, but it’s honestly the best way to get a handle on your finances and make real progress toward becoming debt-free. Having a budget forces you to be intentional about how you spend your money. It will quickly highlight areas where you can cut back and prioritize debt payments.

Use the Debt Snowball Method

Finally, once you’ve got that budget locked down, use the debt snowball method to start knocking out those debts one by one. It’s a proven strategy that’ll help you build motivation and momentum. Learn all about it in a personal finance course like Financial Peace University—that class will give you all the tools and support you need to get out of debt for good in just a couple of years. The debt snowball keeps you laser-focused on your goal by having you pay off your smallest debts first while still making minimum payments on the larger ones.

Get your free “2024 Real Estate Market Outlook” now!

Conclusion

At the end of the day, your retirement savings are sacred. It’s the nest egg you’ve been diligently building to ensure you can live out your golden years in comfort and security. Raiding that retirement fund, whether through early withdrawals or shady loan schemes, is just plain self-sabotage.

I know being buried in debt feels impossibly heavy, but dipping into your 401(k) or IRA is not the answer. Not only will you get slapped with heavy penalties and taxes, but you’re also depriving your future self of the retirement you’ve worked so hard for.

Instead of making that short-sighted mistake, follow the smarter path. Cash out non-retirement investments, get on a written monthly budget, and use the debt snowball method to start knocking out those debts one by one. It’ll take discipline and patience, but isn’t avoiding the cat food diet in your old age worth it?

Your retirement dreams are precious, so protect them at all costs. When you finally do get to retire, you’ll be able to kick back, relax, and enjoy the financial freedom you’ve earned—without a mountain of debt dragging you down. Doesn’t that sound like the good life? You’ve got this!

Interested in multifamily real estate investing? Our experienced team is here to help. From market research to identifying the best opportunities, we guide you through the process. Subscribe to our YouTube channel for informative videos and expert discussions, and follow us on Instagram for exclusive content. Explore our comprehensive Udemy course for detailed insights and strategies. Ready to elevate your investment journey? Contact us now to schedule a consultation and achieve your financial goals in real estate.

*This content is for informational purposes only and is not intended as financial or legal advice. Please consult with a professional advisor before making any investment decisions.